The Federal Reserve is one of the most important financial institutions, but many are unaware of its daily impact on their lives. Generally, the news reports on the Fed regarding interest rates, but their role is much larger than that.

What does the Federal Reserve do, why do they matter, and one of the most asked questions, “Who owns the Federal Reserve?”

There is no “ownership” in the Fed. The Federal Reserve was founded in 1913 with the passing of the Federal Reserve Act, under the presidency of Woodrow Wilson. It currently operates as the Central Banking system of the U.S. It was created in response to the panic of 1907.

Historically, there had been runs on the banks before, but this one tipped the scale as far as a worldwide financial meltdown. The idea is that the creation of the Fed would alleviate possible financial disruptions in the future and provide financial stability.

The Fed performs 5 key functions for the U.S. economy (source: The Fed):

-

-

Promote stability of the financial system

-

-

-

Establishes the safety and soundness of individual financial institutions

-

-

-

Creates a safe, efficient, and accessible system for U.S. dollar transactions.

-

-

-

Fosters community development and protection

-

Is the Federal Reserve a Central Bank?

Yes, it is a central bank.

It’s responsible for governing the national currency. Part of their duties include managing the nation’s money supply and determining interest rates.

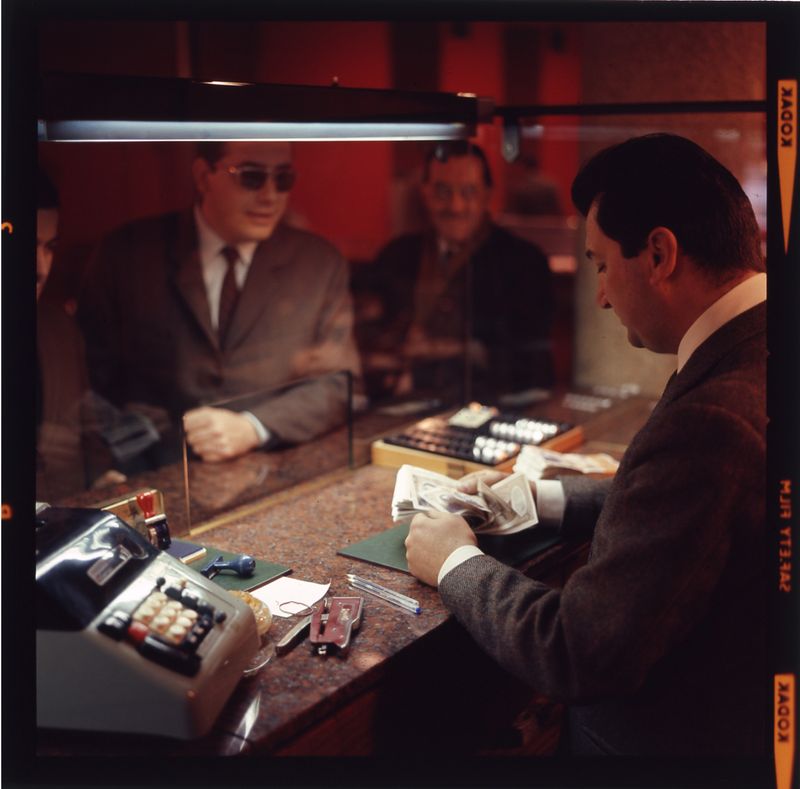

The Federal Reserve functions as a banker’s bank and the government’s bank. As for banks, the Fed ensures that they have money and that transactions are efficient. This means the Fed distributes coin and paper currencies among smaller banks and other financial institutions. Also, they handle large transactions for banks, such as swapping loans and funds between them.

As the government’s bank, the U.S. Treasury holds an account with the Fed through which deposits and payments are processed.

Does the Fed Print Money?

This is a common misconception, but no, the Federal Reserve does not print any currency. Coins come from the U.S. Mint and paper currency comes from the U.S. Treasury’s Bureau of Engraving and Printing. But the Fed does distribute the money supply once printed.

Though the Fed doesn’t print money, they are in control of the supply.

Here is how it works: the Federal Reserve adds or takes away from the money supply by purchasing or selling U.S. Treasury Securities and other financial instruments. This is done through Open Market Operations. To pay for these securities, the Fed adds credits to the reserves that banks are required to hold – this is either cash for their vaults or deposits in a Reserve Bank.

This addition of reserves is basically “printing” money.

Does The Fed Control the Government?

Many hold the opinion that the Federal Reserve is some kind of big behemoth up on the hill that has too much power… that is not wrong. The Federal Reserve consists of multiple layers – together these 3 parts serve as a central bank.

(1) The Board of Governors

(2) The Reserve Banks

(3) The Federal Open Market Committee (FOMC)

Let’s start from the top.

The Board of Governors

It is an independent government agency based in Washington D.C. – meaning they do not receive their budget from Congress, nor do they change members during a swap in presidents. Think about the Board of Governors as a manager over the 12 Reserve Banks throughout the U.S.

The Board of Governors is made up of seven Board members. This includes the Chair (formerly Chairman) and the Vice-Chair, who are both nominated by the President of the U.S. and selected by a vote from the Senate.

Twelve Federal Reserve Banks

Second in power in the Federal Reserve System, are the 12 Reserve Banks. These are decentralized banks that function over their regions while regulating and overseeing privately owned commercial banks. Each regional federal reserve bank resides over its area: (1) Boston, (2) New York, (3) Philadelphia, (4) Cleveland, (5) Richmond, (6) Atlanta, (7) Chicago, (8) St. Louis, (9) Minneapolis, (10) Kansas City, (11) Dallas, (12) San Francisco.

The Federal Open Market Committee (FOMC)

Most often, people hear about the Fed through the news. Usually, it has to do with raising interest rates and the value of the dollar.

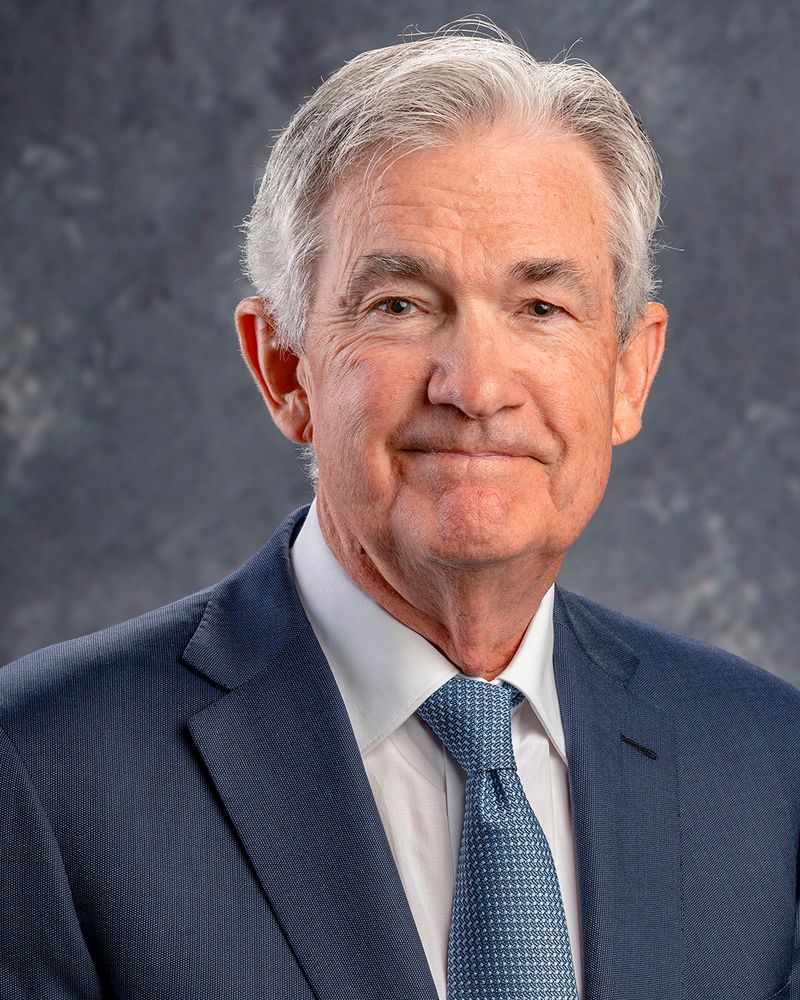

The FOMC is the part of the Federal Reserve that sets monetary policy – this includes stabilizing prices, maximizing employment, and setting interest rates. These are the people, most notably Jerome Powell, whose faces get plastered all over the news once there’s a hike in inflation. It’s made up of all seven Board Members, the President of the Federal Reserve Bank of New York, and 4 of the 11 Reserve Bank presidents. These 4 out of 11 Reserve Bank presidents serve as voting members and they are rotated every year.

Who Holds the Federal Reserve Accountable?

Well, the Board of Governors is responsible for reporting to Congress. Congress sets the goals for the monetary policy, but the Fed is not required to get approval for any decisions from the President or any legislative branches.

To answer the question of who holds the Fed accountable, the answer is no one… technically.

It’d be similar to a boss setting expectations with an employee handbook, but the employee can do what they want and can’t be fired for it. No one said it has to make sense.

Who Sits on the Board of Governors in 2025?

Chair: Jerome H. Powell

Vice Chair: Philip N. Jefferson

Vice Chair for Supervision: Michael S. Barr

Member: Michelle W. Bowman

Member: Lisa D. Cook

Member: Adriana D. Kugler

Member: Christopher J. Waller

Is My Personal Bank Part of the Federal Reserve?

Member banks and depository institutions are part of the Federal Reserve System. Under the Federal Reserve Act, all nationally chartered banks are required to be members of the system and state banks can be members so long they meet certain requirements.

More than one-third of U.S. commercial banks are members of the Federal Reserve System. Community banks, credit unions, and/or local banks are more than likely not part of the system. Depending on your standpoint, it may be worth looking into how your bank classifies itself. Any commercial bank with major advertising spots is most likely part of the Fed’s system.

Why is the Federal Reserve Separate from the government?

The main reason for allowing the Federal Reserve to operate independently is its ability to protect its interests and future from political tensions and economic instability.

If the Fed’s powers were to be influenced by a political leader, adjustments may be made to current economic conditions for the sake of securing a mid-term. An example would be lowering unemployment for the sake of winning the hearts of a population. Economic growth may follow in the short-term, but then lead to inflation and financial panic over the long-term.

Issues with Independence

As with those who support the Federal Reserve system, there are just as many (if not more) against it.

A polarizing debate is over the issue of currency. If the government were to follow the constitution, it’s self-evident that Congress should be printing and issuing currency.

Article I, Section 8, Clause 5:

[The Congress shall have Power . . .] To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; . . .

Through the Federal Reserve Act, Congress delegated this power and now it’s in the hands of a somewhat private company. Some say it’s a bit odd how unelected officials, who aren’t held accountable, have so much power over the monetary system.

Being that the Fed is not a federal agency (and not receiving funding through Congress) they’d have to turn a profit, right?

How the Federal Reserve Turns a Profit

Since the Fed is not funded by the federal government, it makes a profit on the interest of government securities bought on the open market.

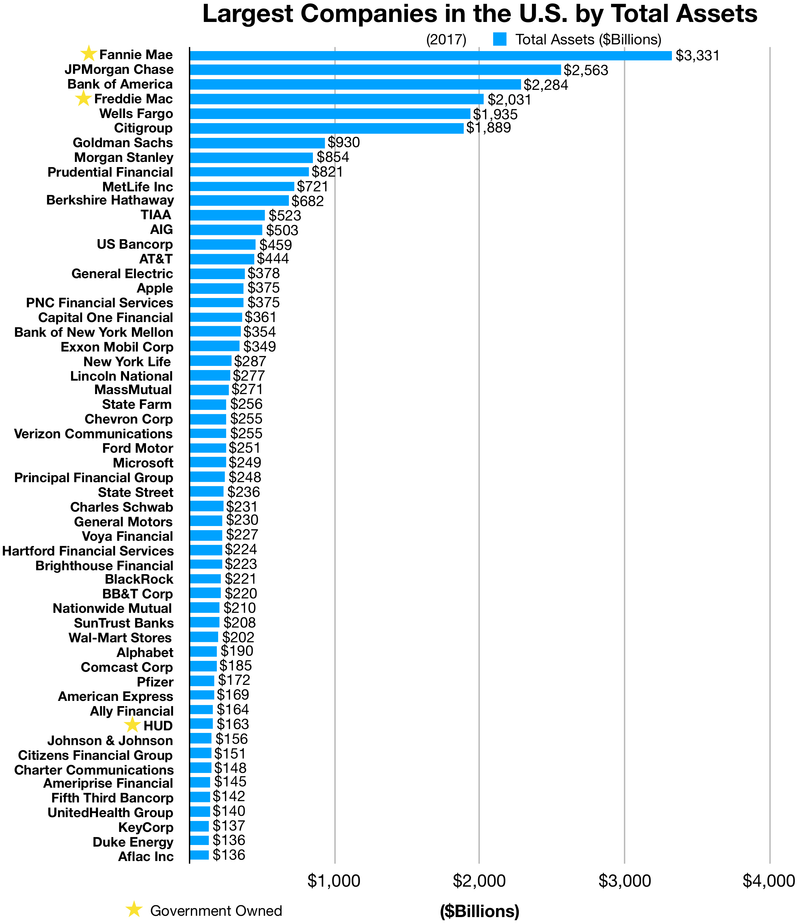

For the most part, these include U.S. Treasury securities, mortgage-backed securities, and government-sponsored enterprise securities (GSE). Examples of a GSE include Freddie Mac and Fannie Mae. These are both private corporations that operate under a congressional charter.

Securities make up 75%-90% of the Fed’s assets, and the Fed has a lot of assets. At the moment, the Fed’s total assets are teetering close to $8.5 trillion… you read that right, trillion.

Some may think, “$8.5 trillion is a lot, but the Fed has been around for close to 100 years, so it could make sense why their assets are so high.”

Well, the Federal Reserve has grown exponentially since the financial crisis of 2008 and in response to the COVID pandemic (which also doubled as a financial crisis and a whole slew of other things). Before 2008, the Fed’s balance sheet was sitting at just under $1 trillion, and at the start of 2020 was at $4 trillion. Talk about a massive jump.

Here’s something pretty wild: in the year 2022 alone, the federal government made over $400 billion in interest payments to the Fed. That’s over $3,000 per household.

The federal government spends more on interest than on Social Security, food and nutrition services, or housing.

Looking back on school lunches, that doesn’t seem too surprising.

With the Federal Reserve being a nonprofit, it technically doesn’t “make money”. After the Fed covers its expenses, any leftover profits are paid to the U.S. Department of Treasury. The Treasury then uses that money for government spending.

What is the Bank of International Settlements?

Headquartered in Basel, Switzerland, the Bank of International Settlements (BIS) is the Bank of Central Banks. It’s owned by the central banks of member countries you can view the list here. Up until March of 2022, the Bank of Russia was also a member. Together, these member banks account for up to 95% of the world’s GDP.

It was established in 1930 (after World War I) to facilitate reparations put on Germany in response to the Treaty of Versailles.

The BIS functions as a for-profit organization and does not do business with consumers or private corporations, only national banks.

The BIS holds three monthly meetings, which include: the Global Economy Meeting (Chaired by Jerome Powell), the Economic Consultive Committee, and the All-Governors’ Meeting.

Hmmm… the U.S. and other central banks who together hold 95% of the world’s GDP, sit at a round table every other month to talk about monetary policy. It’s no surprise there are critics.

Jekyll Island and the Federal Reserve

Before putting on the tinfoil hats, let’s define a conspiracy: the action of plotting or conspiring.

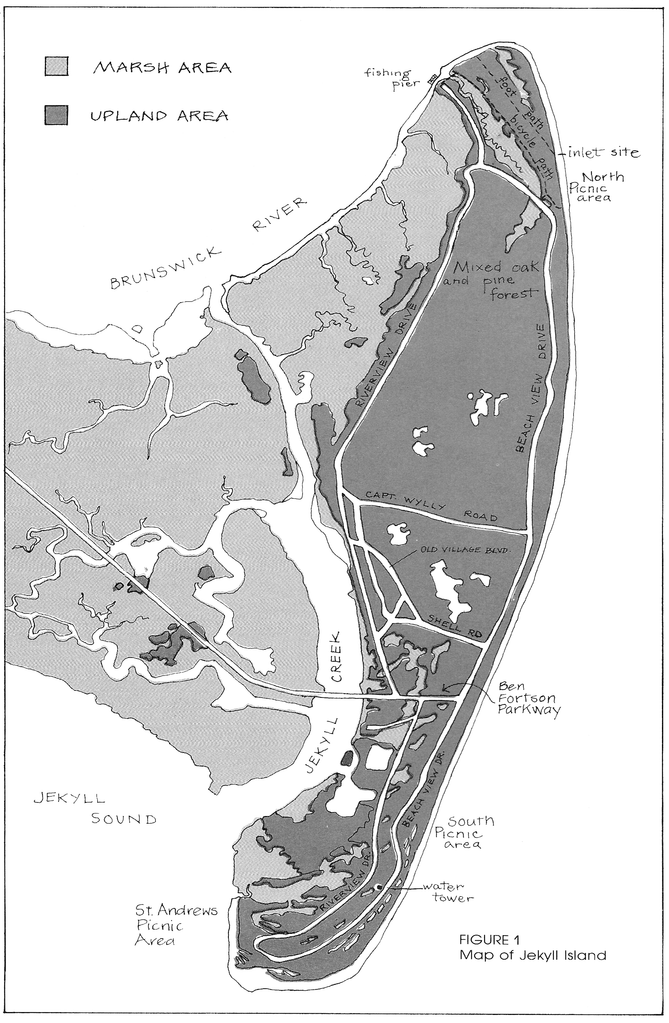

In the case of Jekyll Island and directly from the mouth of the Fed, Jekyll Island was a conspiracy to start a new banking system and national monetary policy.

Over 100 years ago, in 1910, there was a secret gathering on Jekyll Island that would lay the foundation for the Federal Reserve system. Some of the most powerful men met up and devised a plan to rebuild the nation’s banking system. These 6 men include Nelson Aldrich (Republican Senator), A. Piatt Andrew (Assistant Secretary of the Treasury), Henry Davison (Senior Partner at JP Morgan), Frank Vanderlip (President of the National City Bank of New York, now Citibank), Benjamin Strong (Vice-President of Bankers Trust), and Paul Warburg (a board member of Wells Fargo & Company).

The meeting was so closely guarded that the true intentions were not admitted until the 1930s. Hmm, seems like there could be some conflicts of interest going on here.

Criticism of the Fed

Here’s a rabbit hole to go down: the time the Federal Reserve bailed out AIG (in 2008 for a whopping $182 billion) and unconstitutionally took 80% equity and voting control of the company. It’s in the court documents. What was the penalty? Absolutely nothing.

How about we let Alan Greenspan (former Chair of the Fed from 1987 to 2006) point out a major issue with the Federal Reserve System: “The Federal Reserve is an independent agency, and that means that there is no other agency of government which can overrule actions that we take.” Talk about being an independent central bank.

Funny enough, former members of the Fed make for the best critics.

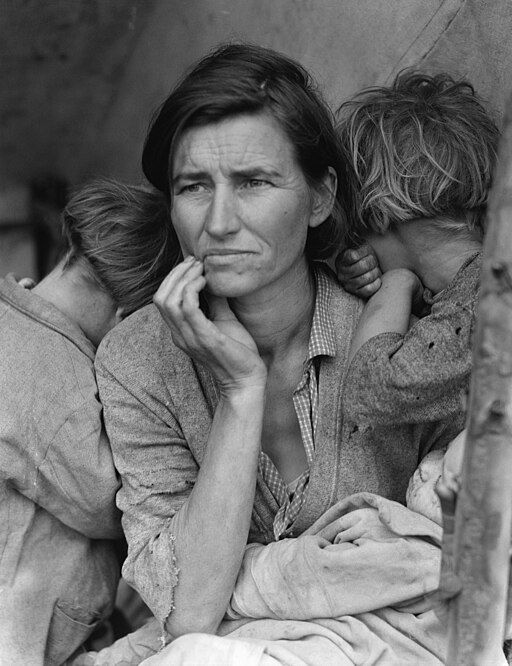

The Federal Reserve Caused the Great Depression

Ben Bernanke (former Chair of the Fed from 2006-2014) has said, “Regarding the Great Depression. You’re right, we did it. We’re very sorry. But thanks to you, we won’t do it again.”

Since the inception of the Federal Reserve, Inflation Has Only Worsened

“100 years ago, in 1913, the Fed was created, and we’ve marked it with a vertical line there. Consumer prices now are about 30 times higher than they were when the Fed was created in 1913.” – Bloomberg (watch the video here)

Federal Reserve Board Members Benefitted from the 2008 Crisis

More than $4 trillion of basically zero-interest Federal Reserve loans went to banks and businesses of at least 18 current (at the time) and former Federal Reserve directors. Keep in mind, that this was during a complete meltdown of the middle and lower class. Housing was upside down, and small businesses were closing left and right.

Some notable loans include:

Jeffrey R. Immelt, CEO of General Electric, and Jamie Dimon, CEO of JPMorgan, both sat on the board of the New York Fed. During the crisis, these businesses received over $400 billion in lending.

Stephen Friedman, former Chair of the New York’s board of directors, dabbled in a bit of insider trading – of course with no consequence. In 2008, the Fed gave Goldman Sachs approval to become a holding company, which would give it access to cheap loans. During this period, Friedman sat on the board of Goldman and owned stocks. Even after receiving a slap on the wrist (waiver from the Fed), Friedman continued to make trades.

Who were the most Famous Federal Reserve Board Members?

Alan Greenspan stands as perhaps the most infamous Fed Chair, serving from 1987 to 2006 – a period dubbed “The Great Moderation” until it wasn’t so moderate anymore. Known for his cryptic “Fedspeak” and free-market ideology, he later admitted he “found a flaw” in his worldview after the 2008 crisis.

Paul Volcker, the tall guy with the ever-present cigar, made his mark by crushing 1970s inflation through sky-high interest rates that peaked at 20% – a move that triggered a recession but cemented his reputation as the Fed Chair willing to make unpopular decisions.

Ben Bernanke, the quiet academic who literally wrote the book on the Great Depression, found himself steering the ship during the 2008 financial crisis. His unconventional policies like quantitative easing and near-zero interest rates fundamentally changed how the Fed operates, though critics argue these moves just kicked the can down the road and inflated asset bubbles.

Janet Yellen became the first woman to chair the Fed in 2014, inheriting Bernanke’s experimental policies and the delicate task of trying to “normalize” monetary policy without crashing the markets.

Jerome “Jay” Powell stepped into the Fed’s top spot in February 2018, nominated by President Trump – making him a bit of an oddity as the first Fed Chair in 40 years without a Ph.D. in economics (he’s a lawyer by training). Unlike his academic predecessors, Powell comes from an investment banking background, having worked at The Carlyle Group and other Wall Street firms. His tenure has been a wild ride marked by unprecedented challenges: a global pandemic that saw him unleash trillions in monetary stimulus, the highest inflation in 40 years, and the fastest rate hiking cycle since the 1980s.

Under his watch, the Fed’s balance sheet ballooned to nearly $9 trillion – making previous Fed interventions look like pocket change. Initially praised for his decisive pandemic response, Powell later took heat for maintaining that inflation was “transitory” well into 2021, before making a dramatic pivot to aggressive rate hikes. Despite the criticism and market turbulence, he was reappointed for a second term as Chair running until 2026, making him one of the most consequential Fed Chairs in recent history.

Conclusion

Are there supporters of the Federal Reserve? Aside from the direct beneficiaries, they are few and far between.

Many aren’t aware of the current and past issues of the Fed. Looking back on the booms and busts over the past century and seeing the redistribution of wealth to the very top… the overall financial future doesn’t look too bright.

With the incoming Central Bank Digital Currencies (CBDCs) – it’ll be even easier for the Fed to create money. There will be no need for the mint. Sounds a bit crazy, but the Bank of International Settlements (the Bank of Central Banks) keeps pushing CBDCs forward. The ultimate fiat.

Here’s something to think about:

Agustin Carstens, general manager of the Bank of International Settlements, had this to say at an IMF (International Monetary Fund) summit, “We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000-peso bill today. The key difference with the CBDC is the central bank will have absolute control [over] the rules and regulations that will determine the use of that expression of central bank liability, and also, we will have the technology to enforce that.” Powell also has good things to say about CDBCs (ease of transactions, modernizing payments, and reaching the “underprivileged”)

The nice thing about gold and silver is it’s real.