Unfortunately, getting scammed in any type of precious metals investment is nothing new. Criminals have always existed and will continue to exist. If there is an opportunity for fraudulent activity, it will be there.

The demand for precious metals has greatly increased over recent years in part due to COVID-19, bank failures, inflation, etc. Many people are looking for a way to hedge themselves against inflation and are flocking towards precious metals. With the rise in popularity of gold and silver, criminal activity has also risen. Many unsuspecting investors are being caught in dead-end traps and potentially losing everything they have.

Rightfully so, many people are worried about falling prey to these criminals and are looking for guidance.

In this blog, we are covering the 5 most common precious metal scams and how to avoid them.

Who is Most Prone to Being Scammed?

Anyone and everyone can be prone to falling for a scheme. It can be easy to think, “Who would ever fall for this?”, but scam artists are only getting smarter, and technology is playing a big hand in it. Not to mention, the world is drastically different from even 40 years ago. Imagine telling someone in 1990 (pre-internet) that it will become common for people to invest their entire savings on an investment app, without ever having to see or talk to another human being. That would sound ridiculous, but it’s considered normal now. Imagine the levels of fraud as AI becomes more powerful and common in everyday life. For example, AI is already capable of mimicking the sound of people’s voices and stringing together coherent sentences. Robocalls are about to see a serious upgrade. That’s a topic for a different day.

Most common targeted groups for precious metals fraud:

People over the age of 70

New and inexperienced gold and silver investors

Young and eager individuals

Just about everyone

It had become stereotypical to imagine only old folks to be caught in precious metals fraud, but it’s beginning to swing the other way. The internet has fueled the fire for younger generations to be caught in these scams.

Let’s not forget to mention, that there being multiple ways to invest in precious metals (ETFs, stocks, physical metal, 401k, etc.) also opens the door for more criminal opportunities. When considering investing in precious metals, it’s important to know the risks and what to look out for.

Don’t let the swindlers win, be aware of these scams:

1. “Last Chance!” – Pushy and Fabricated Sales Pitches

Many people are looking for a leg up when it comes to their investments. The words “easy” and “money” rarely if ever can be used honestly in a sentence, unless some scheme is involved. That’s exactly what these pushy salespeople lead with.

In the world of precious metals, a deal that sounds too good to be true is 99.99% of the time not true. With precious metals being a commodity, the price is the price everywhere. Its price will fluctuate based on the market, but there is no deal hunting outside of slight pricing differences from various dealers. If gold or silver is being sold below the spot price, there is no money being made by the dealer and that’s beyond fishy! That’s bad business.

What is the Spot Price?

The spot price is quoting the current trading market price for 1 troy ounce of .9999 fine gold, 1 troy ounce of .999 fine silver, or .9995 fine platinum.

It’s the price at which a precious metal may be exchanged and delivered right now. (In other words, the price at which gold, silver, platinum, and other precious metals are currently trading in the paper market.) Spot prices are often referenced in the gold and silver markets, but they also impact crude oil and other commodities. Price is in a never-ending flux of market discovery, and is monitored by banks, financial institutions, dealers, and retail investors.

View the live spot price here.

What to Look Out For

Be on the lookout for sales pitches, from either salespeople and/or ads that promise spectacular deals that can only be secured if acted upon now. This is an old advertising tactic that relies on creating urgency: “You cannot afford to miss this” or “You could lose everything overnight”.

Celebrity Endorsements

Ads for Get-Rich-Quick-Schemes will promise ludicrous results and deals. These may even feature testimonials from celebrities or “everyday people, just like you”. No matter how promising and trustworthy it looks, there is still a chance it is not.

Take a look at FTX, once the third-largest cryptocurrency exchange, which collapsed in late 2022. Long story short, a liquidity crisis arose due to solvency issues and a bank-style run ensued. The exchange did not have the funds to meet customer demands, and the floodgates opened. Sam Bankman-Fried (Ex-CEO) was released on a 250 million dollar bond and is facing multiple charges. FTX co-founder Gary Wang, and former director of engineering Nishad Singh, have both pleaded guilty to fraud and other charges. Without naming names (quick Google search) FTX had many big-named celebrity endorsements. There’s a high likelihood that they hadn’t done their due diligence. Heck, FTX had their logo plastered on the same arena that the Miami Heat played in. The operation seemed legit, but it was a complete facade. Take this as a prime example of an almost perfectly executed fraud – except there’s no perfect fraud, the house of cards will fall at some point.

Take the time to conduct real research. When it comes down to making a big investment, don’t trust a talking head on TV or high-pressure sales tactics from a boiler room. Education is your strongest asset, use it!

2. Not So Rare “Rare Coins” and Counterfeits

When it comes to investing in precious metals, this is one of the oldest tricks in the book.

One thing is for certain, precious metals are rarely, if ever, cheap. “GOLD 50% OFF” will never be a legitimate advertisement for a legitimate business. Even if a local coin shop is going out of business, there won’t be a clearance sale. It’s not a furniture store, precious metals have a set value no matter where they come from – that’s the idea behind a commodity. No one will sell under the spot price.

Rare Coin Schemes

Many of these operations teeter around legality by using nice words that sound like the real deal. It is a fine line, and there are plenty of operations thriving off of it. It’s common to see these advertisements on Facebook, Reddit, Instagram, and everywhere else on the internet. The language being used is not incriminating, but it is highly deceiving. Watch out for terms such as “nickel silver” (18% nickel, 62% copper, 20% zinc), it’s not a lie but the intentions may lead unsuspecting people to believe it’s silver. It looks like silver, has the word silver, and so it must be! In many cases, certificates of authenticity are included with the purchase. The same company making the coin is also making the certificate – it’s meaningless.

It’s common to see copies of silver coins online, such as Buffalo or Silver Eagle replicas. For the seasoned coin collectors, it’s an obvious red flag, but there’s a reason these “replicas” exist… people are buying them. Also, in many instances, these coins are being sold as if the precious metal content and rarity are there.

False Claims on Coins

Here are some warning signs to look out for when buying rare coins:

Coin prices below spot and/or collectibles below average retail rate. A special deal is a bad sign.

Promises of great returns and zero risks

Websites with no track record

The business has no location listing

How to Avoid Counterfeits

Conduct thorough research about the company, and completely avoid buying from a cold call, unsolicited email, social media post, or infomercial. If something seems suspect about the phone call, then leave the conversation. Websites that are bare bones with poorly written English are also a sign of trouble.

When buying rare numismatics, stick to authenticated pieces graded by companies such as NGC (Numismatic Guaranty Company) and PCGS (Professional Coin Grading Service). Rare coins that are self-graded are a warning sign. A majority of coin collectors with a rare coin will have it graded by a trusted third party – it makes the most sense. When it comes to bullion, stick to trusted companies with built-in authenticating services, such as Scottsdale Mint with our 100% guarantee for purity, weight, and precious metal content.

3. Fraudulent IRAs

This has only become a more common occurrence as more people are starting to move away from traditional IRAs – especially with retirees. Even the Commodity Futures Trading Commission (CFTC) has warned against IRA schemes that are meant to drain people’s retirement savings.

In many cases, these self-proclaimed “IRA Experts” have no trading or investment credentials to legally provide advice or service. They are just precious metal dealers working on commission. There is no obligation to provide sound advice, but rather, their goal is to sell products with the highest markup to increase their profits. Also, these dishonest companies will charge exorbitant handling, storage, and/or insurance fees. Part of their luring process is to promise gold prices below standard retail rates. That may be true, but the price is offset by their added fees. It’s a classic bait-and-switch.

It’s not uncommon for such scams to provide a false sense of security while convincing potential victims to drain their retirement accounts. This isn’t the worst of it, there have been cases of complete Ponzi schemes being run on predominately retirees. Scammers will convince investors that there is little, or no risk involved, and also that their retirement money will continue to multiply. That’s a lie for any investment. Once the market is volatile, investors start looking to withdraw and the entire operation melts down. Unfortunately, most of the victims lose everything and never fully recover.

How to Avoid an IRA Precious Metals Fraud

It will be mentioned more than once, but cold calling and unsolicited emails are the breeding grounds for fraud. No reputable firm is spamming for more clients. Investment fraud is life-altering, and so it only makes sense to approach it from an almost journalistic approach. Find out everything about the company and conduct a personal deep dive into their dealings.

Taking steps such as calling your state’s division of corporations to check if it’s a legitimate business can help weed out scams. Also, look for a Google business profile that includes a number, address, and customer reviews.

4. “Hot Tips” and Leveraged Accounts

In these types of cases, there’s a similar thread they all share. Someone calls a potential investor with news of the greatest precious metals investment of a lifetime. The dealer claims to have received an inside tip that metals are about to skyrocket. Also, this is going to happen overnight, so this person needs to act NOW. These companies may ask for only 20%-25% down, and they’ll finance the rest. That’s where things get sticky.

Unless the company is registered as an exchange with the Commodity Futures Trading Commission (CFTC) or delivers the precious metals within 28 days, this company may violate federal regulations and be guilty of securities fraud.

Many times, these leveraged accounts include high interest rates. The idea is that these companies will finance the client’s investment. Common sense in hand, that sounds like a bad idea to play with someone else’s money. Here’s what can and often happens: like any commodity, there are ebbs and flows, and if the investment takes a downturn, the customer could be required to pay a margin call. Or worse, if their balance falls below a certain threshold, the account can be closed and all of their funds vanish. Meanwhile, these customers are paying interest fees, insurance, storage, etc. To top it off, it’s possible that no precious metal investments were made and the entire setup was fabricated.

What is a Margin Call?

Like many things in the financial world, margin calls are legit but they are ripe to be used by fraudsters. To understand a margin call, it’s vital to know what a margin account is and how it can be used by scam artists. A margin account is a brokerage account (could be pseudo) in which the broker lends money to the client for, in this case, precious metal investments. A margin call is when the broker demands that the client deposit more money into the account to meet the minimum value needed to hold the account. It’s perfectly legal when it is legally done.

Plenty of people fall for these precious metal “hot tips”, and end up wiring money to a random offshore bank account, but have nothing to show for it.

5. Fake Mining Companies

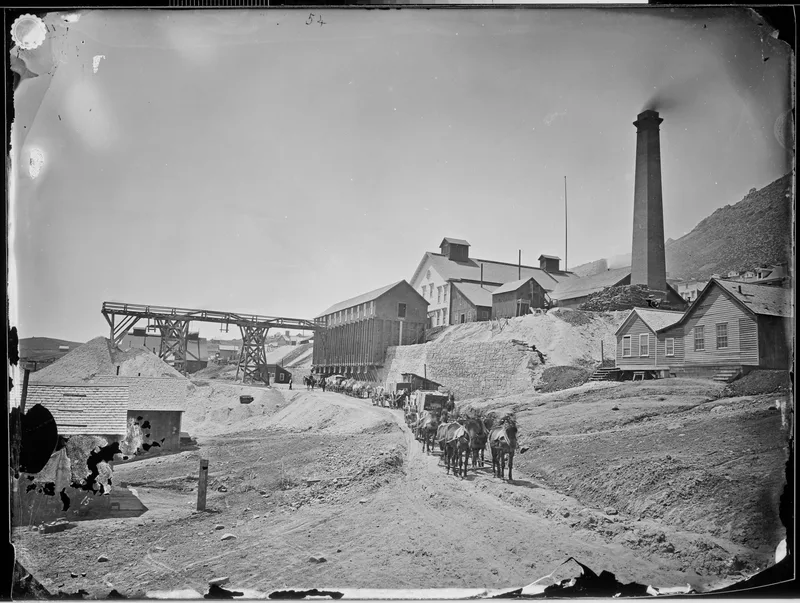

To make a point from one of the largest cases of fraud in the mining industry, the collapse of Bre-X Minerals Ltd. is a good place to start. Bre-X was a Canadian gold mining company that defrauded investors of billions of dollars. Investors were led to believe that the Indonesian mining operation was home to over 70 million ounces of gold. This wasn’t some precious metals fraud occurring discreetly in some basement, far from it, Bre-X was traded on major stock exchanges. Their stock initially traded for under $1 per share and peaked close to $300 per share.

To pull off such a large scheme, Bre-X added flecks of gold to the core samples – this is a process known as “salting”. As anyone can guess, the core samples came back positive for gold and investors came running with dollars in hand. Surprisingly, Bre-X was able to keep auditors off of their tails and push their stock soaring with “high quality” samples. The Indonesian government wasn’t letting this one slide. A majority of the mine was taken from Bre-X, and Freeport-McMoRan began to explore the area.

A little backstory, Freeport-McMoran is a real mining company (which currently operates the world’s largest gold mine). Their company was able to quickly dig up the fraud… pun intended. Freeport was unable to find this plethora of gold that Bre-X was mining in the same area. Here comes the collapse. The exploration manager (and fraud mastermind) Michael de Guzman mysteriously fell to his death from a helicopter over the Indonesian jungle. The cat was out of the bag, there was no gold. The stock collapsed, was delisted from the stock exchange, and billions of dollars disappeared overnight. This scandal was much worse than getting duped by an email.

Mining Regulations

After the Bre-X scandal, the Standards of Disclosure for Mineral Projects within Canada created the National Instrument 43-101. The instrument is a set of rules and guidelines for mineral properties, which are reported to the stock exchanges within Canada. This also includes foreign mining companies who trade on stock exchanges overseen by the Canadian Securities Administrators.

Common Mining Scams and How to Avoid Them

As with anything financial, a little common sense goes a long way. The likelihood of a Bre-X level precious metals scam occurring on the stock exchange is less likely to happen with tighter regulations. However, it doesn’t mean it’s out of the picture (take note from FTX).

Here are some common characteristics of gold mining scams:

Claims of high gold content, but no data to back it up

Emails, calls, and social media posts that push speculative claims about the future of a precious metals investment of said company

A plan to recover ancient gold from a sunken ship, or an investment only for “qualified” candidates

Companies with no track record of success

If it doesn’t feel right, it probably isn’t. This doesn’t mean to throw the baby out with the bathwater, as there are secure ways to invest in mining, it just takes some research. Be aware, that once someone begins to research mining companies, it’s not unlikely to begin receiving advertisements, some of which may be illegitimate.

To Recap: The Easiest Way to Avoid Scams

With the ever-increasing number of people making precious metal investments, the number of criminals is also increasing. In times of high demand, something as simple as a good deal or promises of future riches will capture desperate people.

High-pressure sales tactics may work at a department store, but if it’s coming from a precious metals dealer, it’s probably a scam.

If a dealer offers a loan to purchase precious metals, it’s probably a scam.

If a profit is guaranteed and there are “no risks involved”, it’s likely a scam.

If any precious metals sellers insist that you wire money and/or send money to a foreign country, there’s a chance it’s a scam.

If any precious metals transactions are carried through email, run, it’s a scam.

If recruitment is required, it may be a pyramid scheme, it’s a scam

Easy Tips to Help Avoid Precious Metals Investment Fraud

If it all possible, research the reputation of the dealer and/or company, and double-check documents before completing a transaction. With the advancements in AI, it’s incredibly easy for someone to make a very professional document to appear legitimate.

Verify what you are buying before pulling the trigger on anything precious metals. This can get tricky when it comes to numismatics, which is why it’s even more important to buy from reputable dealers and get a second opinion.

Look for online reviews and keep note of word-of-mouth recommendations.

If conducting business over the phone, have a set of questions ready to ask. Going into the call prepared will set you up with confidence and give you the edge over any criminal. Ask, ask, and keep asking. Any precious metals investment is a big investment, there’s no such thing as too many questions. In most cases, they aren’t looking to do business with someone who knows what to ask. Creating personal authority is a quick way to cut through their common “investment opportunity” language. Legitimate precious metals sellers don’t need to convince someone to buy.

Real deals do exist when buying precious metals, but they are not a dime a dozen. Make sure it’s coming from a reputable dealer, and there’s no misleading language such as “silver clad” when the intention is to purchase precious metals.

Who to Contact for Precious Metals Fraud?

There are plenty of victims who have lost money to precious metal investments gone wrong, and many of them didn’t do their due diligence before deciding to invest.

Before making a precious metals investment it is advised to contact the CFTC or the National Futures Association to check the company’s registration status, business background, and disciplinary history.

Need to report a violation?

Contact the CFTC here.