This guest contribution is provided by Vince Lanci.

Silver on the Edge: BOA Says Silver to $40 in 2025

Silver Surges 4% on Ukraine Tensions and Trade War Fears

Yesterday Silver rallied over 4% in a move surprising many on the Wall Street side of the trading ledger. The proximate drivers were an escalation in the Ukraine war and the dashed hopes of China-US trade war reconciliation. In combination, they make Silver the perfect vehicle for hedging the multi-pronged risks associated with those two events: specifically, safe haven needs arising from war, and tariff resumption causing commodity price spikes.

With yesterday’s price action in mind, we present Bank of America’s case for Silver to outperform gold going forward due to its dual nature.

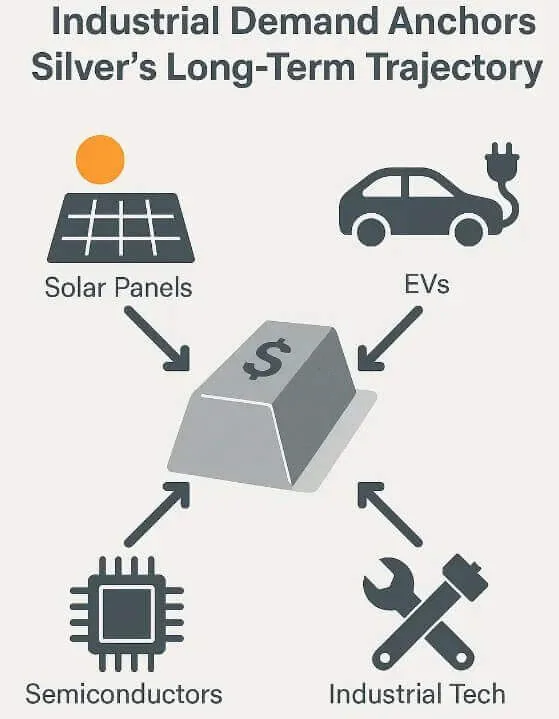

Why Bank of America Sees Silver Hitting $40: Industrial Demand Meets Safe Haven Appeal

Bank of America has raised its metals forecasts, calling for $40 silver and $4,000 gold by late 2025 or early 2026. While gold continues to dominate headlines, analysts at BoA are increasingly focused on silver—not just for its monetary appeal, but for its irreplaceable role in industrial production.

Francisco Blanch, head of global commodities and derivatives research at BoA, told CNBC that silver is “one of the better investments” available right now. He emphasized silver’s hybrid nature—half monetary, half industrial—as a reason to expect renewed momentum, particularly once the current lull in manufacturing activity reverses.

“We still expect enormous investment in solar panels and in the electrification of everything… Silver plays a critical role. It’s the best electricity conductor in the world, so it’s going to play a very important role going forward.” — Francisco Blanch

How Tariffs and Trade Wars Are Setting Up Silver’s Next Rally

Analysts noted that tariffs and trade disputes are reshaping global supply chains and investor behavior. The initial burst of silver buying in late 2024 and early 2025 was, according to BoA, driven by anticipation of tariffs. Now that trade barriers have materialized, the market is likely entering a transitional cooling-off period. But it won’t last.

BoA expects this soft patch to persist for a quarter or two, followed by a new phase of industrial growth—especially in sectors where silver is indispensable, like solar, battery tech, and green infrastructure.

“Right now, industrial activity is going to be weaker, so that’s one of the reasons silver has lagged… But we think the squeeze on demand will be short-lived.” — Bank of America

Silver demand from industrial applications set a record in 2024, marking the fourth consecutive year of structural deficit. While 2025 may see modest friction from tariffs and slower growth, the underlying trajectory remains intact.

Gold’s Path to $4,000: Why U.S. Investors Need to Join the Rally

While silver’s industrial story stands out, gold’s monetary narrative remains intact. Bank of America reiterated its earlier forecast—made in October—that gold would reach $3,000 in 2025, and now sees a possible overshoot to $4,000 per ounce by late 2025 or early 2026. But unlike prior cycles, gold’s path higher may require a stronger showing from U.S. investors, who so far have largely sat out the latest rally.

“To provide some context: investment would need to increase by 18% year-over-year for gold to hit $4,000/oz… Purchases exceeded that tally in 2016 and 2020—twice in the past decade—highlighting that it’s possible.” — Bank of America Commodity Research

Most of the lift so far has come from Asian demand, with U.S. participants still hesitant. Jewelry demand is expected to stabilize, but the next leg higher likely hinges on a reallocation away from Treasuries amid rising fiscal concerns.

U.S. Credit Downgrades Drive Precious Metals Higher

Moody’s recent downgrade of the U.S. credit rating drove a spike in Treasury yields, serving as a stark reminder that U.S. debt may no longer be the default “safe asset.” BoA analysts argue that in this environment, gold and silver may emerge as more stable alternatives.

“We still believe that gold could end up being a less risky investment than Treasuries.” — Bank of America

In particular, the fiscal trajectory of the U.S. government, combined with trade instability, continues to feed demand for hard assets. The dollar has shown weakness alongside this uncertainty, reinforcing the case for precious metals—especially those with monetary and industrial crossover appeal, like silver.

Technical Analysis: Silver and Gold Consolidation Before Next Breakout

Blanch acknowledged that gold is in a correction phase, but maintained that the broader trend remains bullish. The same applies to silver, which has lagged gold recently due to weaker short-term industrial activity.

This consolidation is expected to last a few months, after which both metals could resume their upward march. But silver’s trajectory may be more dramatic, given its tight physical market, underinvestment by Western buyers, and its growing role in global electrification.

The underlying message is clear: While gold remains the benchmark, silver may represent the higher beta play, especially in a world grappling with inflation, trade realignment, and decarbonization.

BoA’s dual forecast of $40 silver and $4,000 gold is a reflection of two diverging, yet overlapping demand profiles. Gold for safety. Silver for utility. Both for value preservation.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.