Gold as the Market’s Search for Safe Collateral

Introduction: A Signal of Systemic Anxiety

Gold has recouped all it’s losses Friday in a historic 3 day period. The sell-off was so short lived and the buying so vociferous today with no new news, one has ot ask “What is going on?”

The answer may be that Gold is the last collateral standing adn that price may be completely secondary to having atoms of the precious metal in your possession.

The historic rise in gold signals that the market is searching for safe collateral as investors confront an expanding spectrum of financial risks. Gold’s ascent is not merely speculative; it is symptomatic of a system under stress.

“When gold speaks loudly, as it is doing today, it’s wise to pay attention.”

The Misunderstood Asset

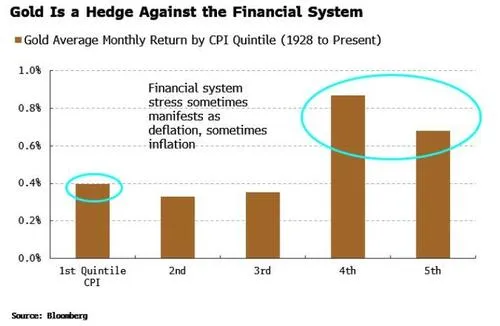

Gold remains one of the most misinterpreted assets in modern finance. Many investors still regard it as Keynes once did, a “barbarous relic.” Yet, as Simon White of Bloomberg1 argues, gold’s recent behavior suggests it is fulfilling a more complex role than simply hedging inflation.

The common narrative frames gold as an inflation or currency-debasement hedge. But owned in its unleveraged, physical form, it represents something different: an asset free of counterparty risk, a store of unimpeachable collateral when debt and derivatives become unreliable.

“Owned in a non-financialized form, gold is no one’s liability.”

From Sanctions to Safe Havens

The post-Ukraine world triggered a shift in global reserve behavior. When the United States used the dollar as a sanctioning tool, emerging central banks recognized its vulnerability. The result has been a structural hunt for reserve assets outside the Western financial system. That instinct has now spread to private markets, where counterparty risk is quietly repriced.

The critical message of gold’s rally will be missed if viewed only through the lens of inflation. Gold performs well in both inflationary and deflationary environments because both reflect instability. Its value lies not in direction of price levels but in protection against the system itself.

Historical Precedent: Deflation and Confiscation

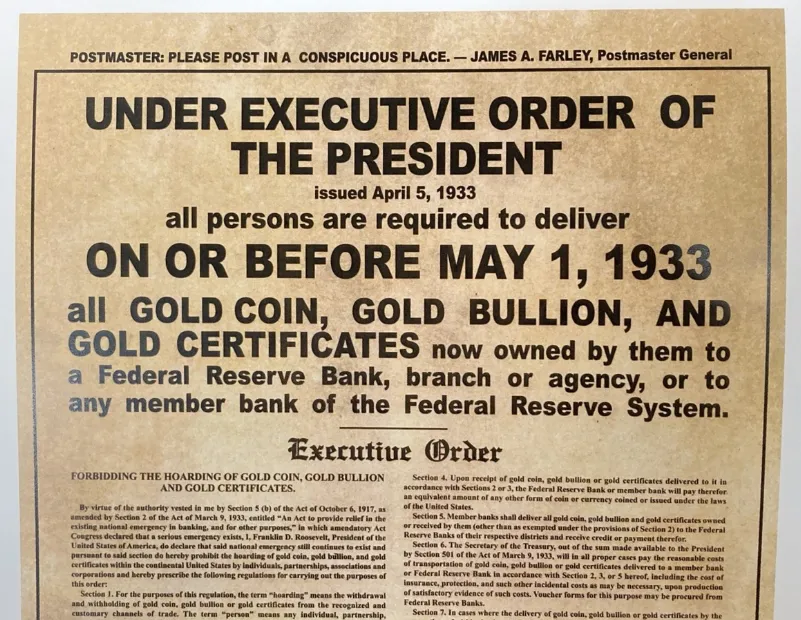

Gold’s behavior in the early 1930s reinforces its role as a deflation hedge. The U.S. government’s forced sale and subsequent revaluation curtailed private participation in its rally, but the episode proved how the public’s hoarding of gold coincided with financial collapse.

“The U.S. seized gold as people had begun to hoard it in the Great Depression, worsening the deflationary crisis.”

Today, markets again hedge against a loss of real wealth. Whether the trigger is a credit crunch, fiscal overreach, or geopolitical escalation, gold’s rise signals the same concern: deteriorating confidence in paper collateral.

The New Risks

The modern list of threats is long. Investors face the possibility of a major credit downturn, bond-market volatility shock, deficit monetization, or a funding-market event. Add to these the risk of an AI-driven equity bubble, recession, or tariff escalation, and the rationale for non-financialized stores of value becomes clear.

“Owning gold starts to make sense if you are beginning to run out of viable, safe options.”

Collateral Strain and Credit Signals

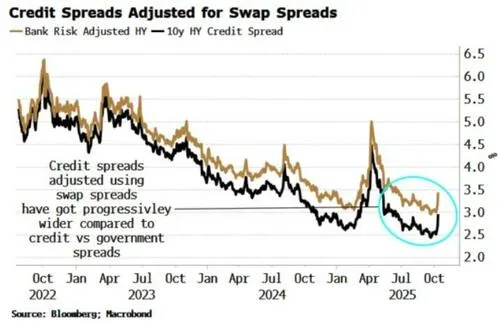

White cites Russell Napier of Orlock Advisors, who attributes gold’s rise primarily to an impending credit crisis. Credit spreads have tightened, but that compression conceals risk rather than reducing it. As government deficits expand, the assumption of “risk-free” status for sovereign bonds weakens. When spreads are adjusted using swap differentials, funding costs for private risk rise, and the need for superior collateral grows.

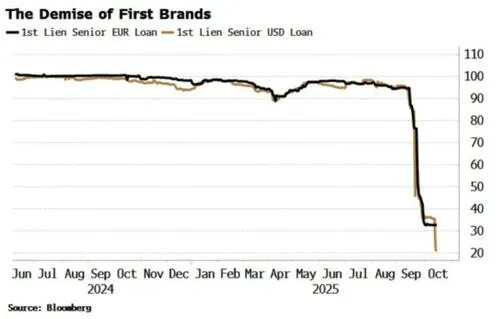

Even investment-grade bonds are beginning to lose their comparative safety. Recent events—renewed U.S.–China trade tensions and the collapse of First Brands—show how quickly perceived stability can reverse. As JPMorgan’s Jamie Dimon warned, “when you see one cockroach, you’re likely to see others.”

Gold’s behavior mirrors that warning. In a deflationary credit event where cash flows falter, owning an asset that carries no liability becomes one of the few remaining hedges.

Government Risk and Monetization

Governments pose a different problem. Unlike corporations, they can print money. But excessive issuance combined with fiscal profligacy eventually undermines confidence in the currency itself. That possibility is now shaping investor behavior.

“The risk that the largest fiscal deficits seen outside of war or recession are eventually monetized would eviscerate the real value of fiat money.”

White notes that renewed quantitative easing may reappear sooner than expected, even as quantitative tightening formally concludes. Fed Chair Jerome Powell recently hinted as much, suggesting policymakers may again resort to balance-sheet expansion to stabilize markets.

The Treasury Market’s Inflection Point

The rise in term premiums shows waning faith in government collateral. Volatility in Treasury yields remains low, implying a significant move ahead—whether higher or lower. Either direction favors gold. In inflation, it hedges debasement. In deflation, it anchors collateral scarcity.

In a severe credit downturn, non-government debt would be hit first. Yet persistent deficits and a renewed need for debt monetization would eventually erode the real value of sovereign bonds as well. Gold, unless again confiscated, would remain “money good.”

“Government debt’s nominal value would be underwritten, but its real value would be shredded.”

Conclusion: The Last Collateral Standing

Gold’s historic rise is a message about the structure of modern finance, not simply a price event. As confidence erodes in every other form of collateral…corporate, sovereign, or synthetic—gold reasserts its ancient function as the ultimate reserve.

In Simon White’s view, the market’s scramble for safety is a sign that the system’s foundations are shifting once again. When the dust settles, the metal’s real message will be clear: the world is running out of trust, and gold is the last asset left that does not need any.