This guest contribution is provided by Vince Lanci.

China Gold Buying Broadens in Unprecedented Public Push

Shanghai Buying Gold From All Angles Amidst US Tensions

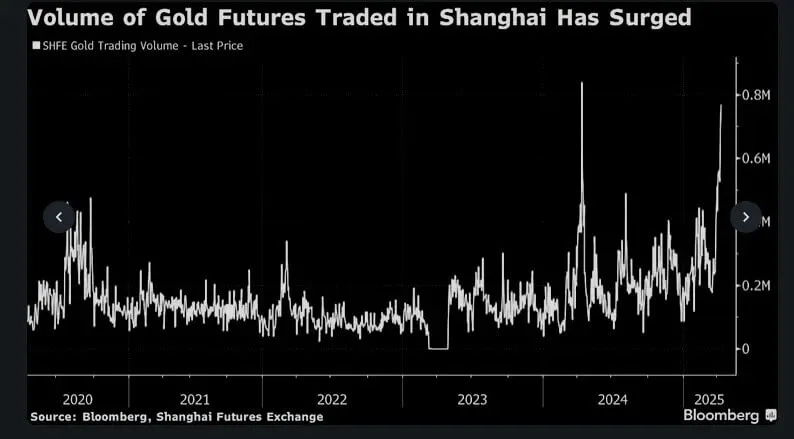

Last week, Bloomberg’s Yihui Xie reported the Shanghai Futures Exchange recorded its highest gold trading volumes in a year. This wasn’t retail speculation—it was coordinated hedging by China’s industrial base: refineries, retailers, and trading houses reacting to renewed volatility in global trade policy.

Trade friction between the U.S. and China is once again spilling into asset markets. But this time, gold isn’t just reacting. It’s repricing.

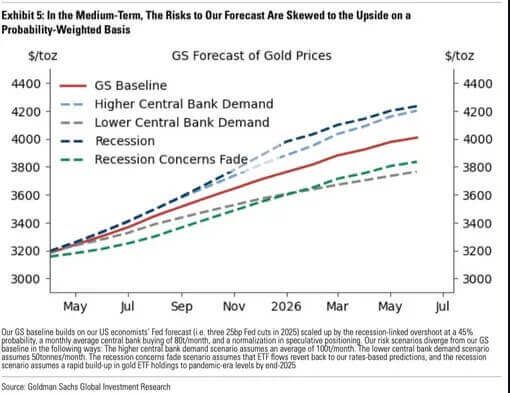

A $4,000/oz Forecast: Goldman Leapfrogs Bullish Camp

Goldman Sachs has now placed a 2026 price target of $4,000/oz on gold—an increase of 25% from current levels. Their rationale is built on three pillars:

Accelerating central bank gold purchases

Heightened global recession risk

Increased demand for real assets amid policy instability

The market’s tone has shifted from opportunistic to defensive. Gold is being treated not as a tactical play—but a structural hedge.

China’s Market Sets Global Tone Now

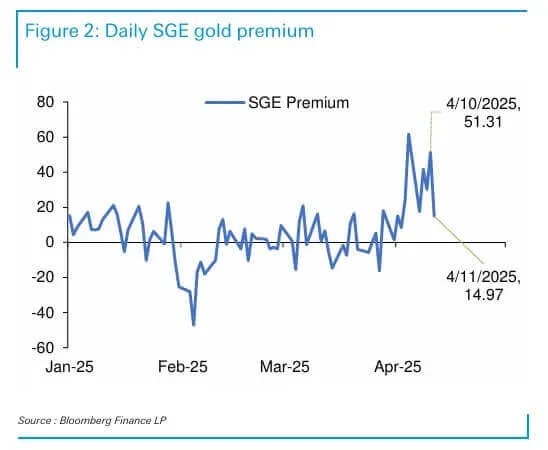

One of the clearest signs of conviction is the domestic premium. For most of the past year, Chinese gold prices lagged international benchmarks. But in recent weeks, they’ve flipped—trading almost $60/oz higher than global spot befoer settling back to approxiamtely $20 over— but only after Gold itself rallied $200 cooling demand.

China Demand Driving Global Price Now

That’s not an accident. It’s a signal of sustained local demand outstripping global supply.

The People’s Bank of China Is Still Buying

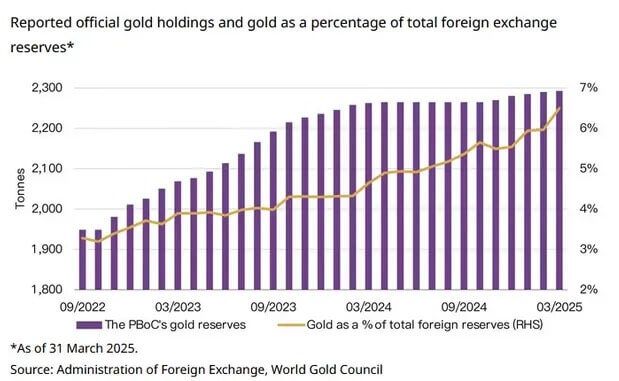

In March, China’s central bank added another 2.8 tons of gold to its reserves—the fifth consecutive monthly increase. This builds on precedent: in 2019, amid deteriorating U.S.-China relations, the PBOC added over 100 tons in a single year.

China’s Official Gold Reserves Expand Five Months Running

As global tensions rise, the pattern is returning. Monetary hedging is back—and this time it’s institutional.

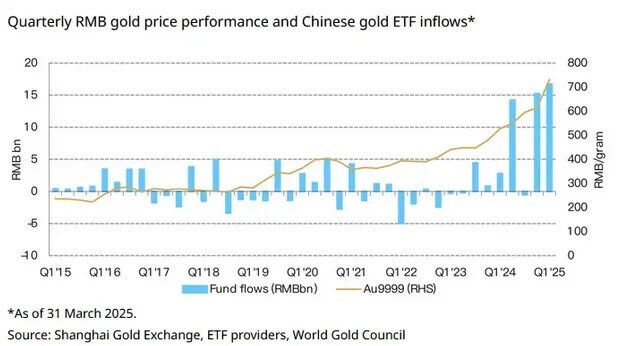

ETF Inflows Break Records

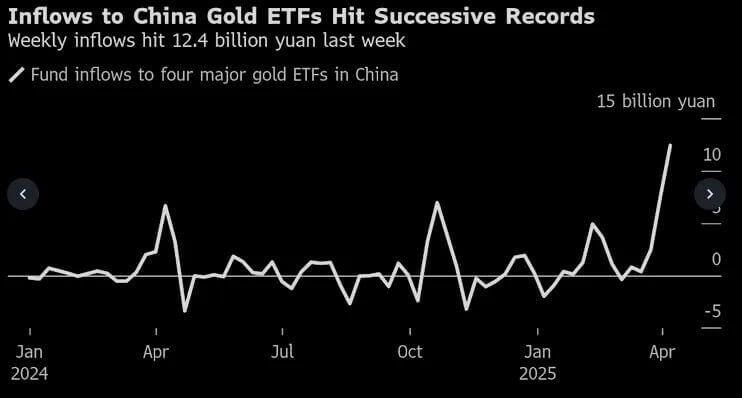

Parallel to official accumulation, gold ETFs in China are seeing unprecedented inflows. Last week alone brought in 12.4 billion yuan ($1.7 billion), almost double the prior week’s high.

According to Aron Chan at State Street Global Advisors:

“This multi-layered demand base helps support and stabilize gold prices even amid external volatility. This demand is less speculative and more strategic or culturally embedded.”

In short: gold ownership is broadening, deepening, and persisting—even as other markets wobble.

Unseen Price Strength Attracts Monster Q1 Inflows

Structured Gold Accumulation: Retail Buys In

Zijie Wu at Jinrui Futures highlights an important dimension: structured gold savings plans are fueling demand. These products—offered by banks—allow individuals to accumulate gold over time, dollar-cost-averaging into the metal like a long-term asset.

China Savings Accounts Link Directly to Gold Program

“Investors continue to favor gold as a safe-haven asset and long-term portfolio diversifier, as domestic bonds and equities come under pressure,” Wu notes.

Add ETF flows, bar purchases, and central bank stockpiles—and the base looks sticky, not speculative.

Bottom Line: Official Government Policy Becomes Public Mandate

Gold is now behaving less like a commodity and more like a form of collateralized insurance. The demand base—from China’s central bank to its citizens—is building a new price floor under the metal.

The trade war may have triggered the rotation. But what’s emerging is a multi-tiered, regime-level portfolio shift—away from fiat exposure and into hard assets.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.