Gold’s Rising Share in Global Reserves

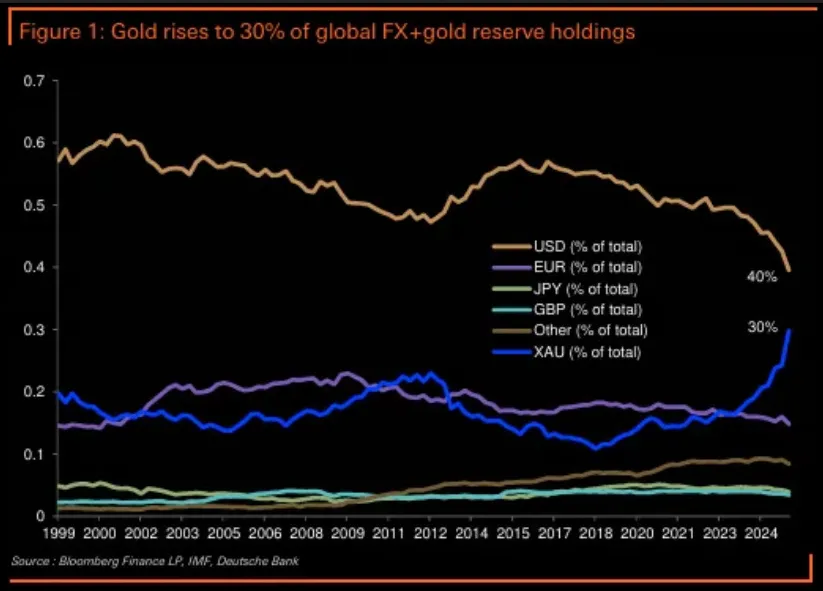

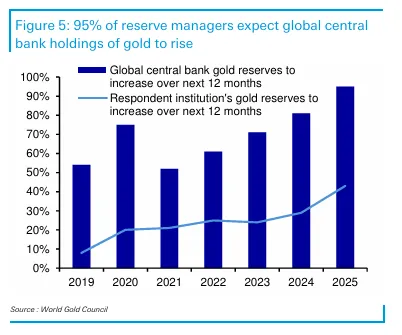

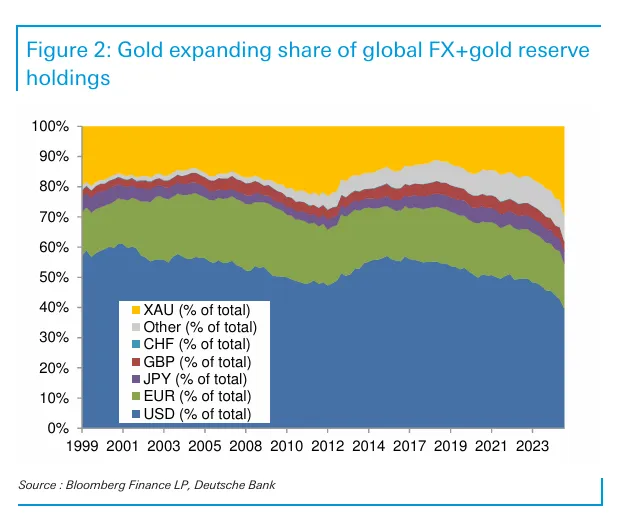

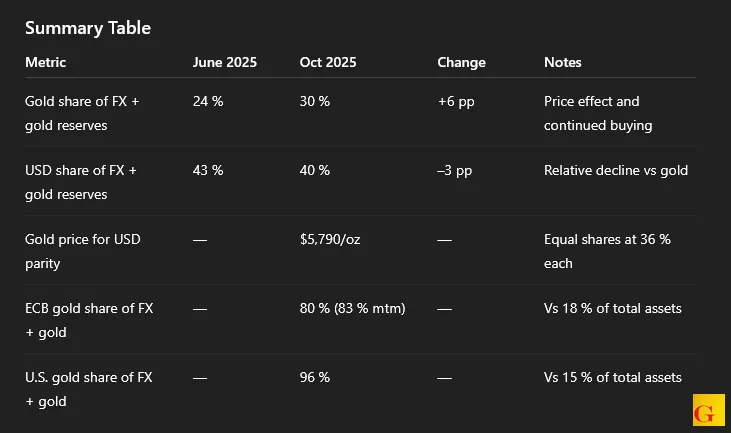

Deutsche Bank’s latest Precious Blog (October 17, 2025) by analyst Michael Hsueh reports that gold’s share of official reserve assets has reached 30 % of global FX + gold holdings, up sharply from 24 % at end-June. The data incorporate spot-price adjustments and mark a historic rebalancing within central-bank reserves.

“Gold’s share of FX + gold reserve holdings has risen from 24 % at end-June to 30 % currently.” — Deutsche Bank Research (2025)

This surge occurs as the U.S. dollar’s share of reserves slipped from 43 % to 40 % over the same period. Deutsche Bank attributes the shift to both valuation effects and persistent central-bank accumulation, confirming that official demand continues to underpin gold’s price performance rather than restrain it.

WGC Survey Shows More Buying Ahead

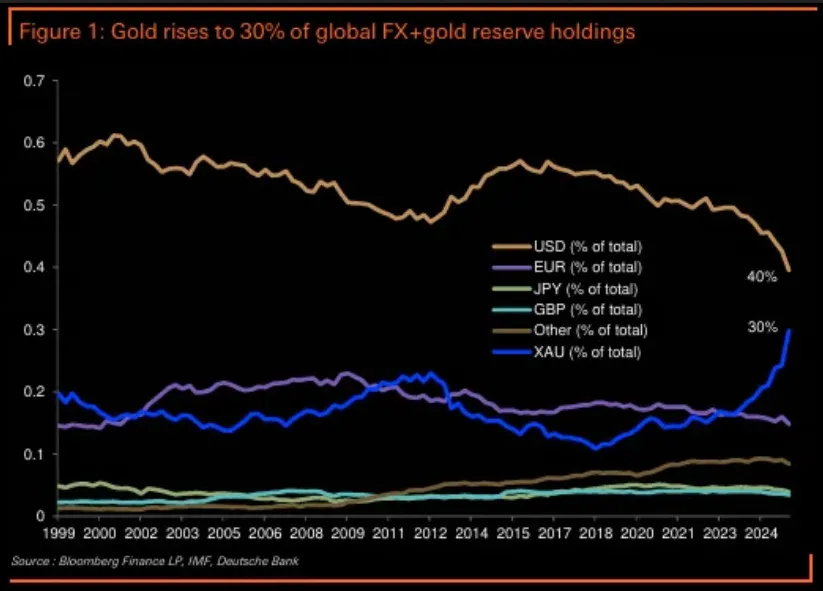

The report cites the World Gold Council’s 2025 Central Bank Survey, which found that 43 % of respondents plan to raise their own gold holdings, up from 29 % a year earlier. Even more telling, 95 % of reserve managers expect global central-bank gold holdings to rise in the coming year — a record high since the survey’s inception.

“Ninety-five percent of reserve managers expected global central-bank holdings would rise over the next 12 months.” — World Gold Council Survey (2025)

This sentiment illustrates a structural commitment rather than a cyclical trade. Central banks are not only holding onto their gold; they are explicitly planning to own more.

Where Does Gold Hit Parity with the Dollar?

Deutsche Bank calculates that a gold price of USD 5,790 per ounce would equalize gold’s share of global reserves with that of the U.S. dollar, assuming quantities remain constant. At that level, both gold and the dollar would represent 36 % each of total FX + gold reserves.

“Gold at USD 5,790 per ounce would equalise reserve holdings with USD.” — Deutsche Bank Research (2025)

Such parity underscores the degree of financial-system adjustment under way. Even without new buying, valuation alone could bring gold to a co-equal role with the dollar in official portfolios.

Context of Reserve Composition

The report emphasizes that these figures refer to FX + gold reserves, not to total central-bank assets. Gold’s share within total balance sheets remains smaller because domestic-currency assets dominate. For example, the European Central Bank’s gold share of FX + gold reserves stood at 80 % in September (83 % mark-to-market at USD 4,350/oz), while its gold share of total assets was only 18 %.

“Reserve managers may assess their gold holdings in relation to gold + FX reserves, given these are the only holdings denominated in foreign currency.” — Deutsche Bank Research (2025)

A similar pattern appears in the United States, where gold represents 96 % of FX + gold reserves but only 15 % of total assets, highlighting the distinction between international liquidity buffers and domestic-currency positions.

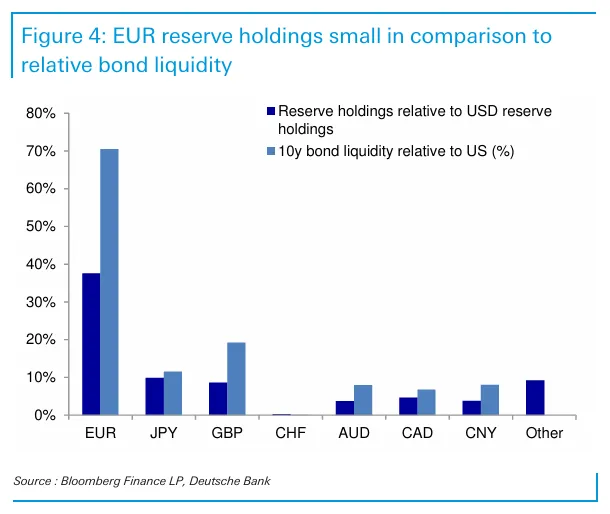

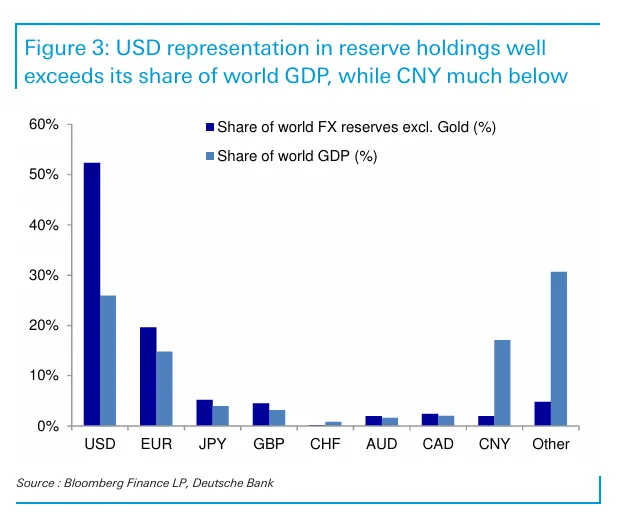

Dollar too Strong Yuan Too Weak

Deutsche Bank also notes that the USD still represents a far greater share of world reserves than its share of global GDP, whereas China’s CNY share remains well below its economic weight. This imbalance, paired with rising gold ratios, signals a diversifying reserve architecture in which non-fiat assets are playing a growing role.

Interpretation

The Deutsche Bank analysis presents gold’s rise to 30 % as a valuation and confidence phenomenon rather than a temporary spike. With survey data showing overwhelming expectations for further accumulation and theoretical price targets that align gold and the dollar in reserve importance, the report implies an emerging monetary co-existence between fiat and metal.

Bottom Line

Gold’s advance to a 30 % share of global FX + gold reserves marks a decisive moment in the re-monetization of the metal within the official sector. Deutsche Bank frames the trend as both a valuation outcome and a policy signal: central banks continue to view gold as a strategic asset for currency defense and portfolio stability. The implied equilibrium of USD 5,790 per ounce serves less as a forecast than as an indicator of how far gold’s monetary role has already moved toward parity with the dollar.