This guest contribution is provided by Vince Lanci.

Executive Summary: Gold’s Permanent Repricing

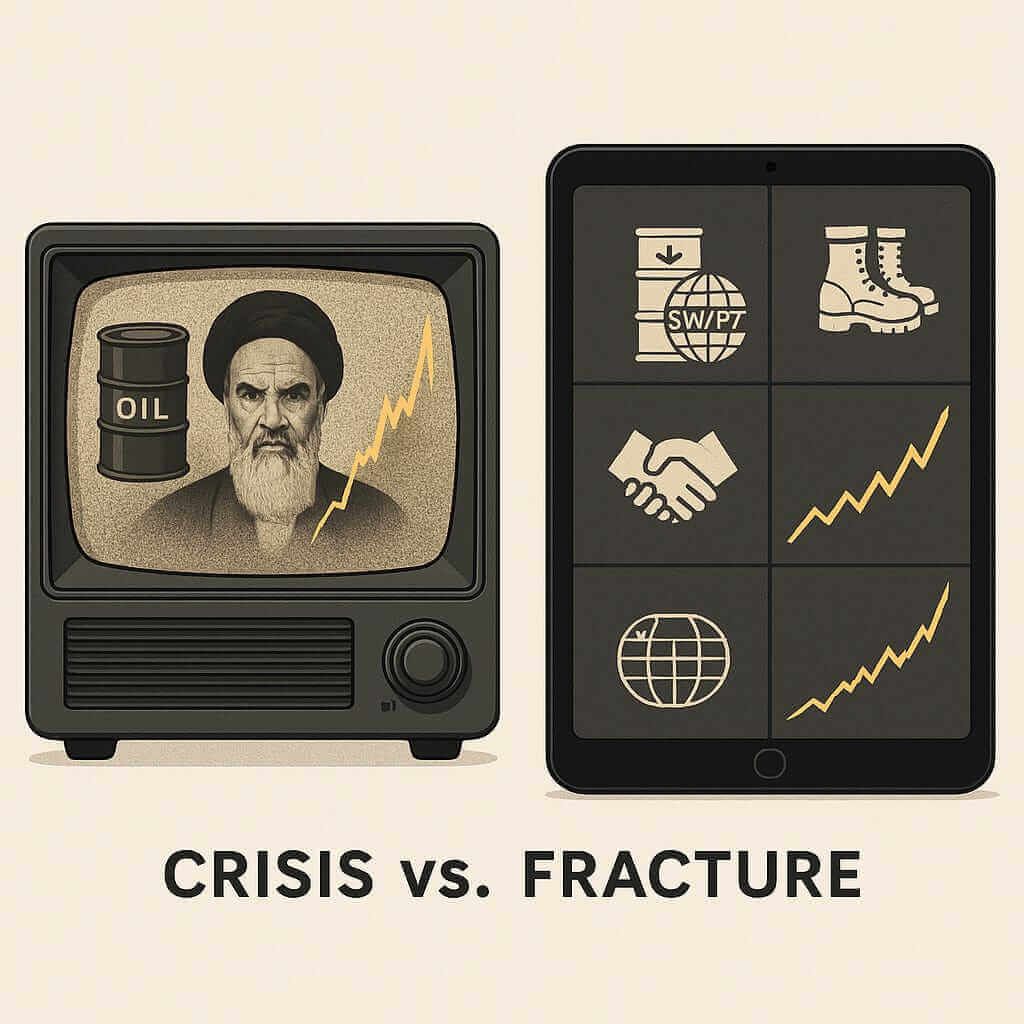

Gold is trading $3,300 this morning and into record territory marks a break from the speculative spikes of the past, unlike the 1980 rally, which is now being talked about as a comparable situation. That faded with geopolitical resolution. This move is rooted in a broader structural shift. The core difference is global trust has eroded without a functioning mechanism for recovery of it.

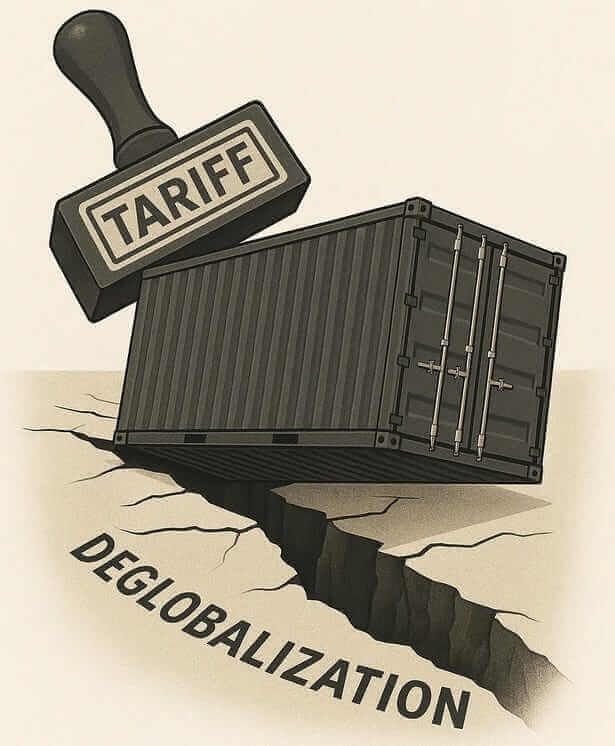

Trade war escalation, waning confidence in US security guarantees, sanctions, weaponization, of the dollar and a retreat from coordinated global responses are embedding gold as a strategic reserve asset across both state and institutional portfolios. Back then, referring to 1980, the world was beginning to globalize and tear walls down. The world currently, however, is in the process of raising walls and deglobalizing along mercantile protectionist lines.

Gold is not spiking on crisis right now. It is repricing on fracture.

Why The panic?

Structural vs. Cyclical: Why This Time Is Truly Different

“The breakdown in international cooperation in the last few years has led to gold staying permanently high… There is a bigger geopolitical bid in the market.” — HSBC’s James Steel

Gold’s ascent—up 16% year-to-date after a 27% rally in 2024—has naturally drawn comparisons to the 1980 peak triggered by the Iranian Revolution and the oil shock. But as HSBC’s James Steel notes, that previous crisis was followed by swift coordination. Today, there is no expectation of resolution. In fact, the market is pricing in its opposite: deeper division.

The gold price is now reflecting the end of global trust, not just another crisis cycle. That shift has created a different kind of market—less reactive, more anticipatory. Traders are not just hedging risk; sovereigns are insulating against systemic reordering.

Trump Tariffs are an Accelerant, Not a Cause

“Unlike other recent crises that triggered coordinated global responses, this time there’s no real prospect of policy alignment.” — AMT Futures’ George Griffiths

Gold’s most recent leg higher has coincided with President Trump’s announcement of the most aggressive U.S. tariff package in over a century. While the metal is inversely correlated with global trade volumes, it’s not tariffs alone that are moving price. Rather, it’s the recognition that trade fragmentation is part of a longer arc of deglobalization—a structural transformation with no reversal in sight.

That lack of alignment is a risk premium in and of itself. Markets no longer assume there is a global backstop. Each country, central bank, and investor must now hedge not just volatility, but fragmentation.

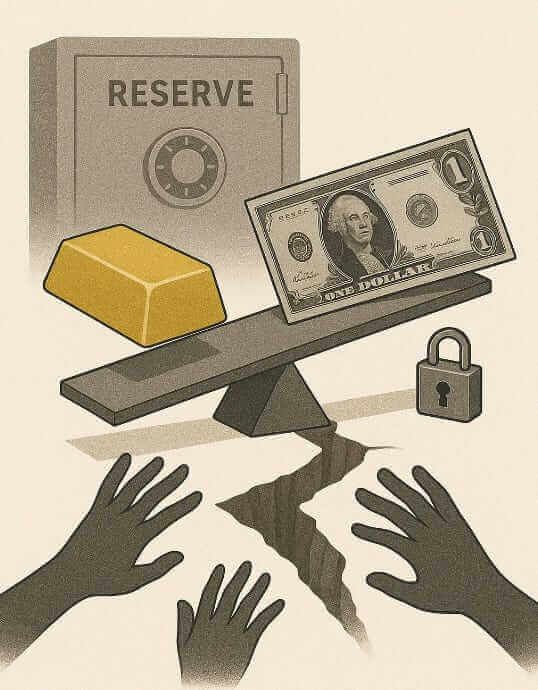

The Weaponization of Reserves and the Dollar Shift

The Ukraine sanctions did not create a flight to gold—they created a flight into gold by institutions that now fear the dollar itself may be selectively inaccessible. — Vincent Lanci, Echobay Partners, GoldFix Editor

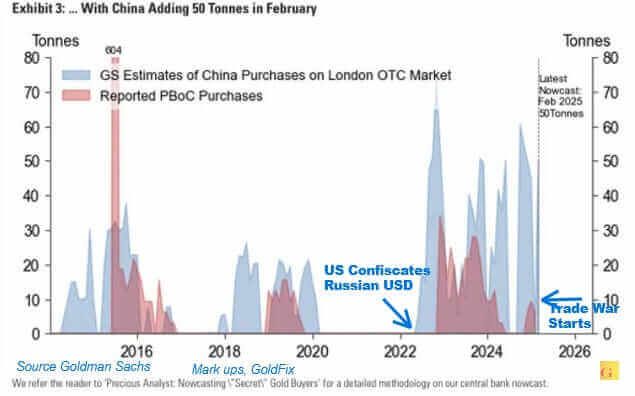

The turning point was not tariffs alone—it was the precedent set by freezing Russia’s reserves in 2022. That single act realigned how non-Western central banks view the dollar. Gold, unencumbered by jurisdiction or intermediary risk, became the default reserve diversification asset. From that moment on, the marginal global buyer of gold shifted from ETF speculators to central banks.

This dynamic continues to anchor flows. The buy-side is no longer exclusively Western or ETF-driven. It is now balance sheet driven—by public-sector actors with multigenerational horizons.

Not Nominal, But Real: The 1980 Benchmark Revisited

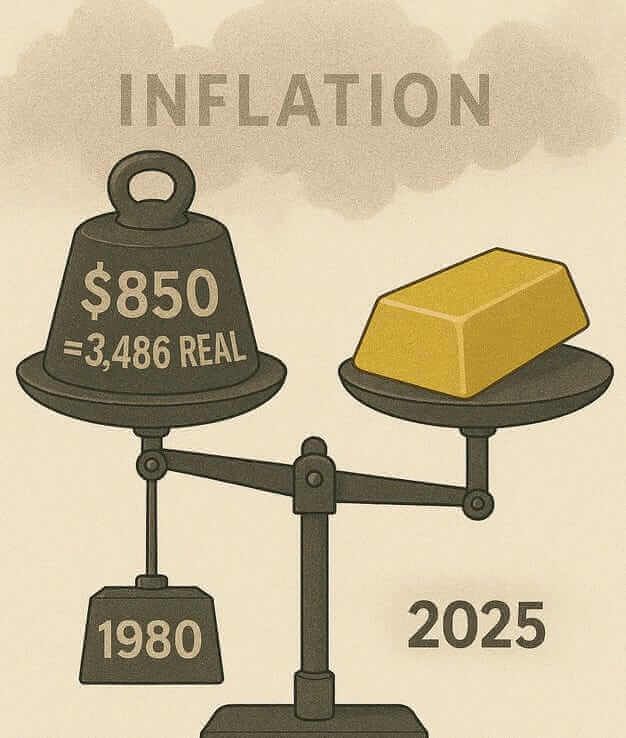

‘One more milestone remains, the peak in real terms of $850 hit January of 1980.’ —StoneX analyst Rhona O’Connell

Rhona O’Connell of StoneX highlights that while gold has hit new nominal highs, inflation-adjusted levels still lag the 1980 peak ($850 then = ~$3,486 today). HSBC’s Steel echoes that point—but adds an important nuance: that real-term high may yet come, and more sustainably.

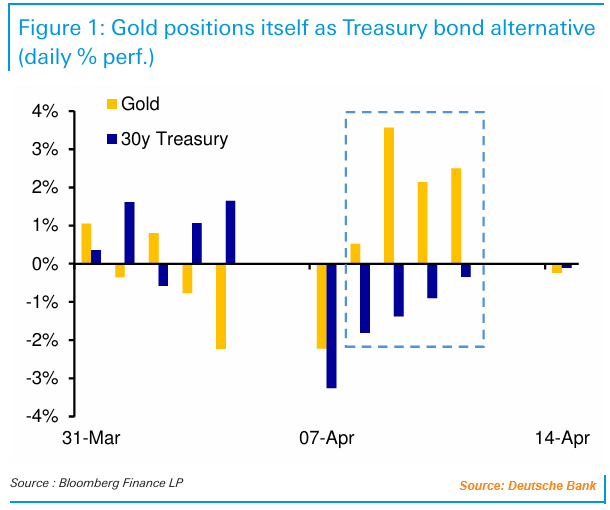

By implication, and as shown in market data, the price signal is only part of the story. The composition of buying, the drivers of the bid, and the lack of coordinated fiscal/monetary policy globally all suggest the top is not in. As Deutsche Bank’s analysis shows, China is selling US Treasuries and buying Gold in quid pro quo fashion now.

Wall Street’s New Gold Forecasts

Major Banks Racing to Update Price Targets

“Calling for $3,000 was easier than calling for $3,500… but what’s the other risk here?” —Michael Widmer, Bank of America

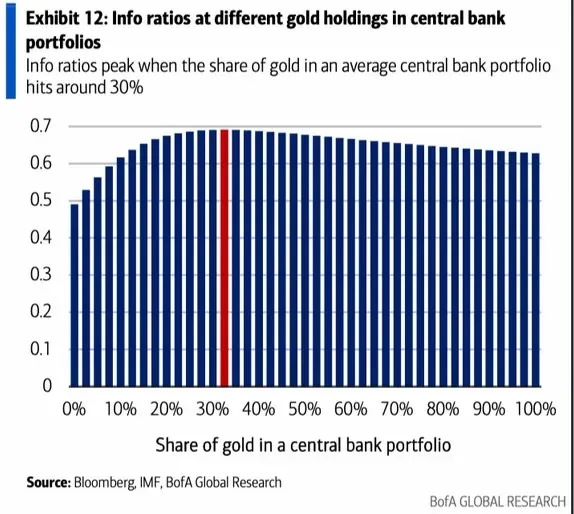

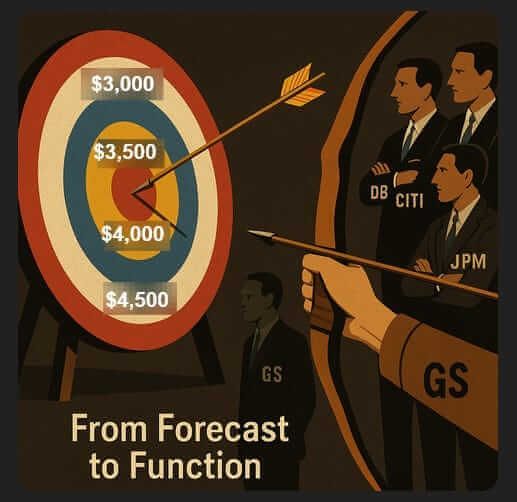

Bank of America commodity strategist Michael Widmer has updated his price targets to $3,063 for 2025 and $3,350 for 2026—raising his previous forecasts by over $600. He now sees $3,500 within two years.

His framing is instructive: the risk to gold is no longer geopolitical—it’s re-coordination. If global stability miraculously returns, if trade wars vanish, if the Fed hikes and normalcy returns, then yes, the trade may unwind. But as Widmer concedes, that’s unlikely. The market agrees. Meanwhile other banks have followed suit.

Not to be outdone, Goldman Sachs, days after Bank of America’s target change, sees even more risk to the upside.

Final Thoughts: Gold’s Structural Revaluation

This rally is not a hedge. It is a revaluation.

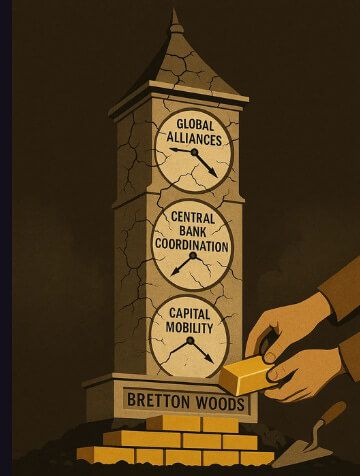

Gold is not rising because of any single event. It is rising because the institutions that previously managed risk—global alliances, central bank policy coordination, and unimpeded capital flow—are no longer reliable. Each event (tariffs, Ukraine, dollar weaponization) is part of a larger realignment.

This rally is not a hedge. It is a revaluation.

Gold is not in a bubble—it’s in a repricing regime.

There is no marginal seller of trust for now. Only buyers.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.