Bubbles are Temporary, Gold is Forever

Gold and Silver Take Their Proper Place in the Pantheon of Assets

Introduction

A decision has been made. The precise timing and place are unclear, but the outcome is evident: gold has been allowed to rise toward a valuation more consistent with monetary reality. This shift reflects both the expansion of money supply and the visible debasement of fiat currencies. What may sound improbable at first begins to make sense once the sequence of asset bubbles and policy choices is examined.

The Bubble Machine

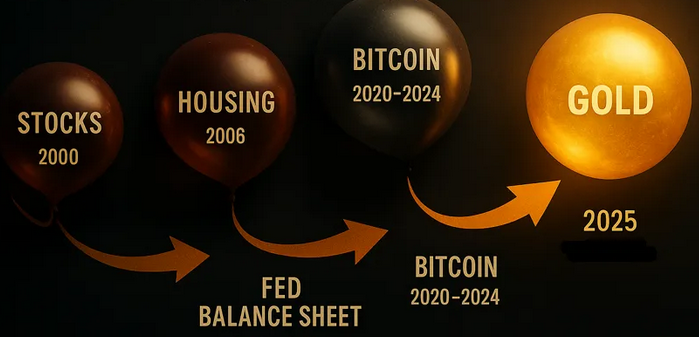

Since the start of quantitative easing, the United States government and the Federal Reserve have operated what can best be described as a bubble machine. Liquidity has been directed into preferred assets—bonds, stocks, mortgages—while alternative channels were suppressed. Market structures were throttled, taxes and regulations discouraged ownership, and investors were punished for holding assets deemed undesirable.

“By a bubble machine, I mean they print the money they need to keep the assets they want inflated.”

This cycle has repeated for decades, most intensely since QE began. When the stock bubble collapsed in 2000, liquidity was pushed into housing. When housing collapsed in 2008, the next outlet became the Federal Reserve’s own balance sheet. That balance sheet is now effectively permanent.

From Real Estate to Digital Assets

After COVID, commercial real estate faltered, and the government moved quickly to stabilize the system. The Bank Term Funding Program was introduced, while the data center boom was accelerated through policy incentives. Government does not invent new ideas; it expedites those already in motion.

Bitcoin then emerged as the perfect sponge for excess liquidity. Marketed as “gold 2.0” and framed as an inflation hedge, it drew flows that could not be absorbed elsewhere. The deregulation of Bitcoin ETFs gave policymakers a degree of centralized control over what was once presented as decentralized.

Gold as the New Sponge

The unmistakable development now is that gold has been chosen as the next receptor for liquidity. Banks that once dismissed it have shifted tone. J.P. Morgan has published a $6,000 target, while Jefferies has gone further with $6,500. These calls are not accidents. They resemble the public promotion once undertaken by Bitcoin advocates.

“The government has lifted the lid off of gold to make it the permitted asset to hedge inflation.”

Why Now?

The decision reflects structural realities. The Federal Reserve’s balance sheet cannot be unwound. Stablecoins are not sufficient to absorb liquidity. Bitcoin is inadequate. Meanwhile, China and the BRICS have already moved to institutionalize gold within their monetary systems.

By lifting the ceiling on gold, the United States acknowledges both its constraints and its competition. What follows is revaluation. Whether this is a race with China or simply an attempt to set terms, the result is the same: gold is being steered upward by design.

The Bubble We Need

Skepticism is natural. Some will argue that this is merely another bubble. In truth, it is a sage off ramp for those concerned. it is a way for capital to keep from fleeing the US if inflation upticks. It is required by the system at this stage. Liquidity must find a home, and gold has been re-designated as that home to do what it does best

“You want to call it a bubble? Its a safety valve because bubbles aren’t working”

Eventually, gold will correct. But not now. Now is the time to measure its potential against M2, against the monetary float, against capital that cannot be directed into Treasuries or equities. Those measures imply a valuation far beyond current levels, well above $10,000 per ounce.

Silver’s Signal

The case for revaluation is reinforced by silver. At $47, silver now trades above the official balance sheet valuation of gold at $42.22. This inversion is unprecedented and symbolic. It underscores the reality that official gold pricing no longer reflects market truth.

“Silver is trading at a higher level than Gold’s price on the US Government’s balance sheet.” – Jordan Roy-Byrne

Conclusion

The bubble machine must continue to operate, and liquidity must continue to flow. Stocks, housing, Bitcoin, and balance sheets have each served as outlets in turn. Now gold and silver have been selected. The lid is lifted, the ceiling raised, and the stage is set.

The system is steering capital into gold. That is the decision. And the game is on.