Gold and Silver Surge on Geopolitics and Central Bank Shifts

Market Action

Gold and silver soared in today’s U.S. holiday trade. By early afternoon, gold was trading at $3,474, up nearly $28 on the session, a gain of about 80 basis points. Silver outpaced gold, reaching $40.70 per ounce, up a full dollar or roughly 2.5 percent. This puts gold within striking distance of its all-time high and positions silver at its highest level in more than 11 years.

The moves cap off what has already been a historic stretch for both metals. Last week gold closed the month at its highest monthly price ever, while silver posted its second-highest monthly close on record. The trading flows reveal heavy buying in physical metals, an important confirmation after miners had already appreciated significantly over the last month, outpacing most other sectors in equities.

Two Immediate Catalysts

Two concurrent developments help explain today’s surge. First, the Shanghai Cooperation Organization held its 2025 summit in Tianjin, China. President Xi Jinping and President Vladimir Putin hosted, joined by India’s Prime Minister Modi. The interactions were visibly friendly. The SCO functions as a more geographically narrow extension of BRICS, primarily coordinating among Pacific Rim states. Their focus remains trade logistics, and this cooperative momentum provides a backdrop for stronger regional ties and potentially greater reliance on non-dollar settlement mechanisms.

Second, India formally announced on September 1 that it had increased gold reserves while reducing exposure to U.S. Treasury bills. The Reserve Bank of India confirmed a strategic diversification of its foreign exchange reserves away from the dollar. This aligns with a global pattern of central banks recalibrating reserve portfolios in response to geopolitical tensions and Treasury market volatility.

India’s move is particularly notable given ongoing tariff debates with the United States. Despite the political tension, India did not frame the reserve shift as a reaction to American rhetoric. It instead presented it as prudent reserve management. India remains a top holder of U.S. Treasuries, ranking sixth globally, behind France but ahead of Brazil.

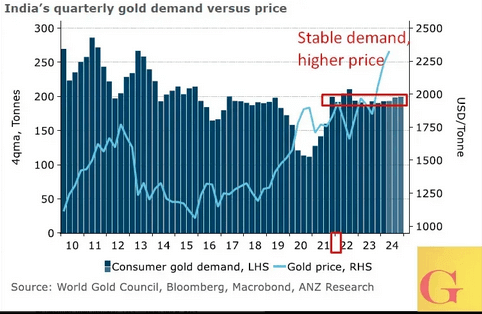

At GoldFix, we have tracked India’s steady accumulation of gold since 2022. The key feature has been the price inelasticity of its demand. Between 2021 and 2025, India’s gold purchases remained steady in tonnage terms, regardless of price fluctuations from $1,740 to nearly $3,500.

Their objective was measured in ounces, not dollars. This behavior has also been evident among other central banks, further reinforcing the narrative that official-sector gold demand is structurally different from that of financial investors. Josh Phair, CEO of Scottsdale Mint, recently underscored this point:

Imagine creating paper/digital money out of thin air and then using some to auto buy Gold. There are many central banks doing this monthly/quarterly as they raise % backing of Gold.

Indeed, as depicted above, India’s demand for both Gold and Silver has been consistent in ounces bought for years now.

Market Context

Labor Day’s rally comes after several significant milestones. Gold reached all-time highs in April 2025 before consolidating in a sideways, volatile range for four months. Today’s breakout places it just below the $3,500 level, which has acted as resistance.

Spot market highs sit at $3,499, making today’s $3,489 print a clear test of that ceiling. Silver, in contrast, has been steadily appreciating, catching up with gold after lagging earlier in the year. Friday’s monthly close for silver marked a 14-year high, not seen since July 2011.

Historically, September through November has often been a seasonally weak period for precious metals. Prices tend to dip as physical buying from jewelers slows after the summer.

Yet the present context is unusual. Wars are under negotiation without resolution, trade tensions are escalating, and key economies such as France and the United Kingdom are seeking IMF assistance. The backdrop supports metals strength despite seasonal expectations.

The Role of Large Capital

Price behavior in both gold and silver is also drawing attention from discretionary macro hedge funds. These funds are known for deploying large capital when they see multi-month breakouts after consolidation.

The last time such flows were evident was March 1, 2024, when gold broke higher after two months of sideways trading. From that point gold advanced from just over $2,040 to $2,736 within six months, and after a brief pause extended gains further to today’s levels.

Evidence suggests the same class of funds has been positioning in silver since early summer. Their activity is not short-term oriented. If correct, today’s strength represents continuation buying rather than speculative froth.

Monetary Policy as a Catalyst

“This [Jobs] slowdown is much larger than assessed just a month ago, as the earlier figures for May and June were revised down substantially. -Jerome Powell August 22

On the macroeconomic front, the Federal Reserve remains the dominant catalyst. Chair Jerome Powell signaled after the last employment release that a rate cut is very likely at the September meeting.

This dovish tone contrasts sharply with some of the underlying data. Equity markets are near all-time highs, unemployment is only gradually ticking down thus far, and inflation is still not fully contained nowhere near the stated target of 2% said years ago.

The juxtaposition of easing policy into a backdrop of strong equities and persistent inflation has unsettled markets. Traders are questioning the wisdom of a cut at this stage. They are expressing it by buying

Precious metals, and selling US Bonds. Between now and the September 17 decision, volatility is expected to remain elevated. The path forward will hinge on whether Powell confirms the market’s expectation of easing or resists political and market pressure.

Geopolitical Undercurrents

Beyond immediate market drivers, the geopolitical context continues to favor metals accumulation. The U.S. tariff threats toward China, the ongoing tariff dialogue with India, and Europe’s economic fragility all contribute to an environment where diversification away from the dollar becomes more rational for official players. Central banks appear determined to build bullion stockpiles regardless of price.

In parallel, the Shanghai Cooperation Organization and BRICS+ provide platforms for non-dollar trade experimentation. Each summit reinforces the idea that alternative trade structures are moving forward incrementally. The fact that India’s reserve shift was announced on the same day as the SCO summit illustrates how monetary and geopolitical strategies are aligning.

Conclusion

The surge in gold and silver on this U.S. holiday session is not a random anomaly. It reflects a convergence of immediate catalysts (the SCO summit and India’s reserve shift) layered onto a broader framework of structural demand, monetary uncertainty, and geopolitical reordering.

Gold is once again pressing against all-time highs after four months of consolidation. Silver is breaking to levels not seen in over a decade. Hedge funds are participating, central banks are undeterred by price, and retail physical demand is strong.

The next two weeks leading into the September 17 FOMC decision will likely be volatile. Yet the weight of flows and the persistence of official demand point to continued support for precious metals.