Tariff Transition and Growth Stabilization

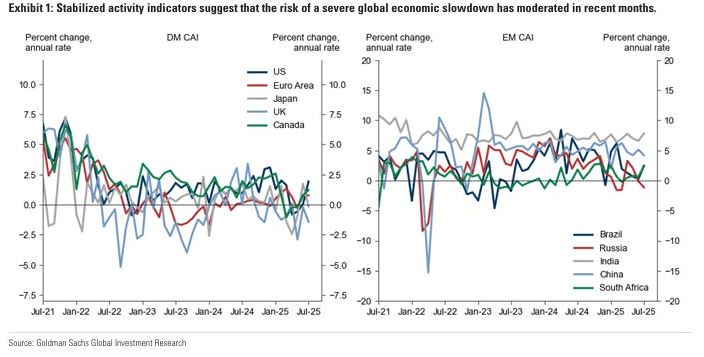

The report notes that since the spring, markets have shifted from tariff uncertainty into tariff reality. This transition has helped stabilize economic activity indicators and reduced both consensus and internal recession probabilities for the United States, though the risk remains above the historical average. The authors argue that risks persist, reinforcing the diversification benefits of commodities in portfolios.

“Important risks remain that reinforce the diversification benefits of commodities in portfolios.”

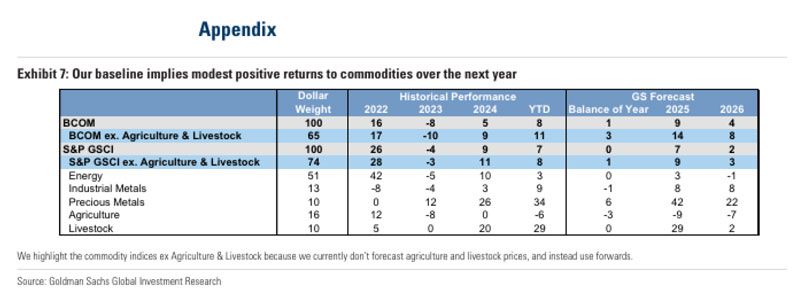

Baseline Commodity Outlook

Goldman Sachs outlines a base case scenario of modest positive returns for commodity indices over the next year. While retaining bullish views on gold, copper, and U.S. natural gas, the bank projects an intensifying oversupply in oil. Non-OPEC ex-U.S. oil supply growth is expected to create a 1.8 mb/d surplus in 2026, pushing Brent prices toward the low $50s per barrel.

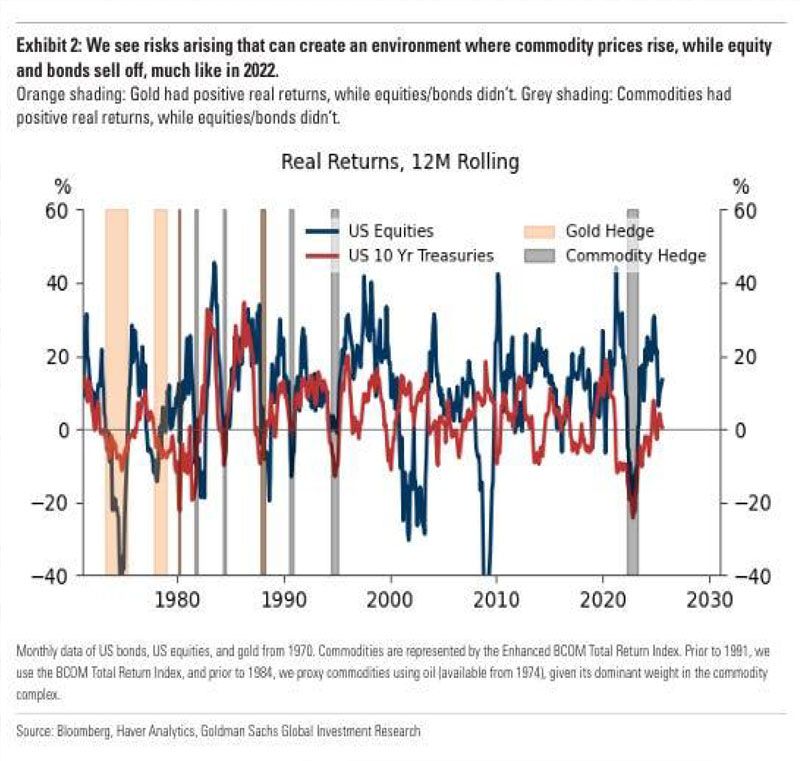

The report highlights commodities as a hedge against tail risks, citing both U.S. institutional credibility challenges and concentrated supply sources.

“The role of commodities as a hedge against inflation risks is increasingly relevant in the current environment.”

Fed Independence, Institutional Risk, and Gold

A scenario of weakened Federal Reserve independence would likely raise inflation, increase long-end yields, pressure equities, and weaken the U.S. Dollar’s reserve status. Gold is positioned as the primary hedge in such a scenario, given its role as a store of value outside institutional trust.

“A scenario where Fed independence is damaged would likely lead to higher inflation, lower stock and bond prices, and erosion of the Dollar’s reserve currency status.”

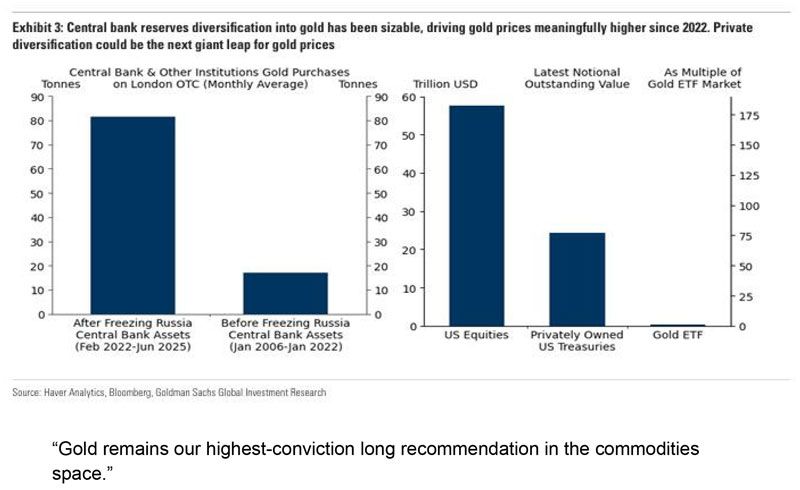

The report presents a tail risk case where gold prices rise above $4,500 per ounce, compared to a baseline of $4,000 by mid-2026. A shift of only 1 percent of the U.S. Treasury market into gold could push the price near $5,000.

“If 1% of the privately owned U.S. Treasury market were to flow into gold, the price would rise to nearly $5,000 per ounce.”

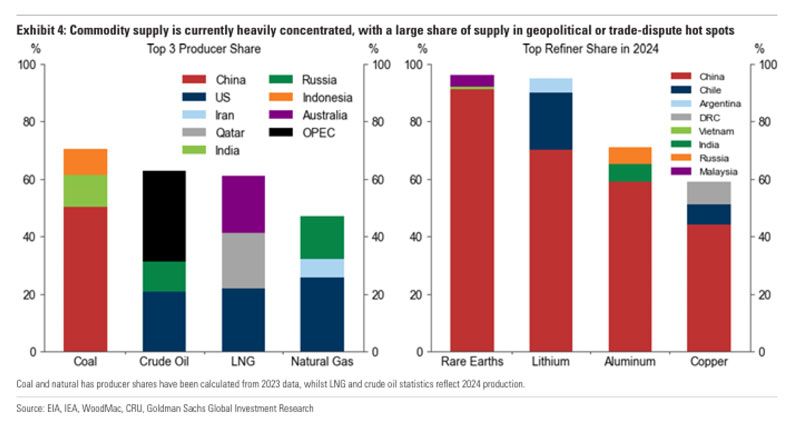

Supply Concentration and Geopolitical Risk

The authors emphasize growing supply concentration across commodities. China controls over 90 percent of rare earth refining, while energy production remains dominated by a small number of regions, many in geopolitical hot spots. Export restrictions and chokepoint disruptions raise volatility and inflation risks.

Examples include Russia’s gas curtailments to Europe in 2021 and China’s temporary restriction of rare earth exports to the U.S. More recent issues in the Panama Canal and Red Sea trade routes are also cited. Moderating OPEC+ spare capacity amplifies risks of oil price spikes.

“Commodities might be increasingly used as leverage, raising disruption risk, price volatility, and inflation risk.”

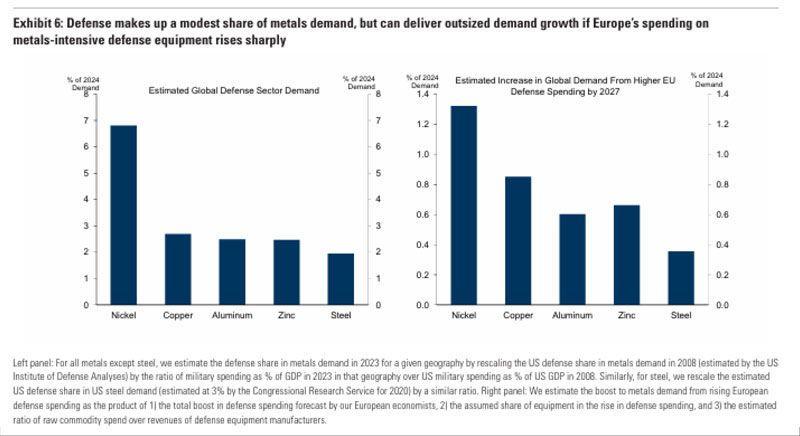

Defense Spending and Metals Demand

Rising defense expenditures are expected to drive additional demand for metals. Goldman projects Euro area military spending to rise from 1.9 percent of GDP in 2024 to 2.7 percent by 2027. This translates into cumulative demand boosts of 6 percent for European industrial metals, and global increases of 0.4 percent for steel, 0.9 percent for copper, and 1.3 percent for nickel.

The defense boost could lift copper demand growth from 2 percent annually in 2025–2027 to 2.4 percent, implying upside risk to copper price forecasts of $10,000 to $10,750 per ton. This is balanced against recent inventory growth that could temper price pressures.

“Defense spending will support demand for industrial metals.”

Central Banks, Dollar Diversification, and Gold

The freezing of Russian dollar assets in 2022 set a precedent that triggered a fivefold increase in central bank gold purchases. These flows explain much of the 94 percent rally in gold since 2022. The bank forecasts gold at $3,700 by end-2025 and $4,000 by mid-2026, assuming strong central bank demand continues.

Asian central banks are expected to sustain rapid purchases for another three to six years, until reserve targets are met. Private investor flows into gold are not included in the baseline scenario, leaving additional upside open.

A weaker dollar, reflecting slower U.S. growth, would also support broader demand for commodities denominated in dollars.

“Once the precedent of freezing Russian dollar assets was set, central bank gold purchases increased fivefold.”