Goldman Sachs: Upgrading the Gold Forecast on Persistent Inflows

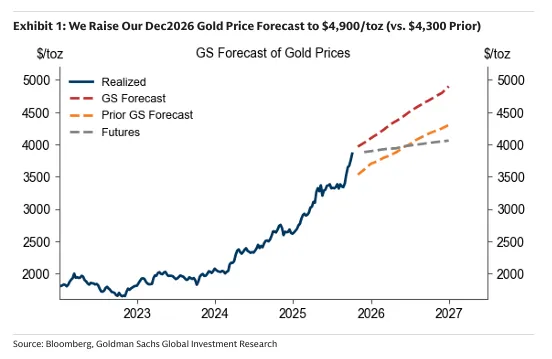

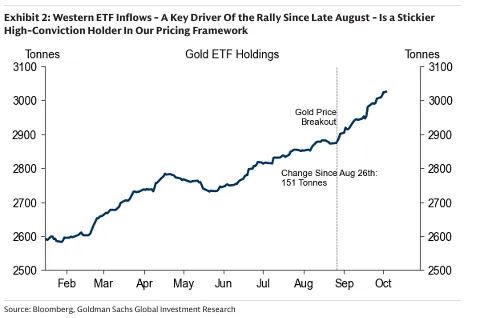

Goldman Sachs has raised its December 2026 gold price forecast to $4,900 per ounce from $4,300, citing structural inflows from Western ETFs and continued official-sector accumulation as the primary drivers behind the metal’s 17 percent rally since late August. The bank also updates clients on the their three main “high conviction Gold buyers” from the encyclopedic report broken down in “The Ultimate Gold Primer” recently.

“We raise our Dec 2026 gold price forecast to $4,900/toz (vs. $4,300 prior) because the inflows driving the 17% rally since August 26 – Western ETF inflows and likely central-bank buying – are sticky in our pricing framework.”

The report, authored by Lina Thomas and Daan Struyven of Goldman Sachs Global Investment Research, emphasizes that these inflows are “sticky” within their pricing framework, effectively lifting the baseline from which future price gains are projected .

Roof Raise: Upward Slope Ratchets Higher

Goldman notes that speculative positioning has remained largely stable even as ETF demand caught up with the bank’s U.S.-rate-implied model.

The analysis suggests that the surge in ETF holdings during September was not excessive but rather consistent with macro drivers such as rate expectations and central-bank demand recovery.

“The level of Western ETF holdings has now fully caught up with our U.S. rates-implied estimate, suggesting the recent ETF strength is not an overshoot.”

We would add that during this rally we have seen fund profit taking as Bullion banks have been covering shorts once again. Longs can sell with seemingly little risk of causing a washout as long as there is no accompanying news item

High Conviction Buyers re-Commit

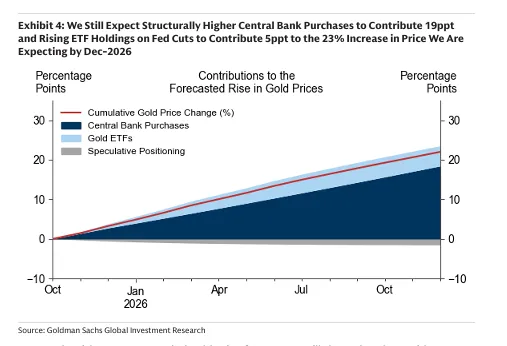

Despite the higher base, Goldman’s model still anticipates a 23 percent total increase by end-2026, distributed across three structural components:

Central-bank purchases: averaging 80 tonnes in 2025 and 70 tonnes in 2026, contributing 19 percentage points of the overall price gain.

The report ties this to “the structural diversification of reserves into gold following the freezing of Russian reserves in 2022.”

Western ETF holdings: expected to rise as the Federal Reserve cuts its funds rate by 100 basis points around mid-2026, adding roughly 5 percentage points.

- Speculative positioning: projected to normalize gradually, subtracting about 1 percentage point.

“We still expect central-bank buying to average 80/70 tonnes in 2025/2026 … and ETF holdings to rise as the Fed cuts the funds rate by 100 bp mid-2026.”

Also Note they focus mostly on those three cohorts above as higher conviction buyers in general, but this is a new level of commitment it seems

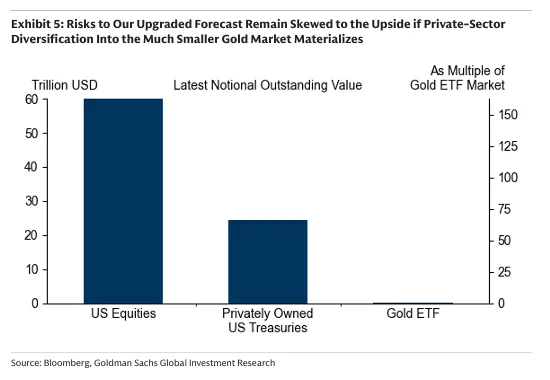

With Risks Tilted Higher

While the numerical forecast is fixed at $4,900, the tone of the analysis remains bullish.

Thomas and Struyven write that the balance of risk “is still skewed to the upside” because private-sector diversification could amplify ETF inflows beyond what rate models predict.

The small relative size of the gold market magnifies any incremental capital flow from institutions rebalancing toward hard assets.

“Private-sector diversification into the relatively small gold market may boost ETF holdings above our rates-implied estimate.”

Goldman Sachs maintains its view of structurally higher official-sector accumulation and renewed Western investment demand as durable features of the current cycle.

Even if (Western!) speculative flows remain muted, the confluence of central-bank and ETF demand provides a firm foundation for a multi-year advance toward the revised $4,900 target.

In the firm’s model, any incremental private capital inflow would compound the effect of falling real rates, reinforcing gold’s position as a preferred store of value across both institutional and sovereign portfolios .

Further Translation: Gold buying is positively sensitive to both lower rates accompanying expectations of a Fed cut (greed) and higher rates accompanied by concerns over debt, stock values, or geopolitics (fear).

It is also more likely to be bought on a weaker dollar, and sold less on a stronger dollar as its beta resets and flips. This is Anti-Goldilocks behavior, our way of describing secular change out of the Goldilocks era post Covid.