This guest contribution is provided by Vince Lanci.

Topics:

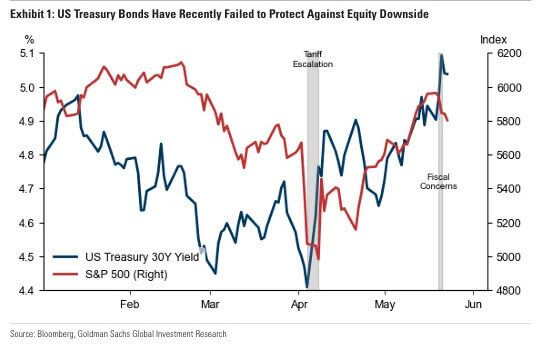

- Bonds Haven’t Worked for Years

- Bonds Failed to Hedge Two Risks

- Gold Is the Core Hedge Now

- Oil Is Still a Hedge—But Don’t Go Crazy

- The Proof: Gold is the Anchor

- Final Thought: Gold as Neutral Collateral

Goldman Says Buy Gold— “The 60/40 is Dead”

“Even a modest reallocation from Treasuries or equities into gold could trigger a steep repricing.”

-Goldman Sachs

The Precious Metals and Energy analysts at Goldman Sachs Daan Struyven, Lina Thomas, Samantha Dart have overtly taken a step to recommend replacing a portion of Bonds in the rules governing the 60/40 (Stock/Bond) portfolio mix. This is neither a short term trade idea, nor is it one of those macro “plays” the market has seen so much of these past two years. This is a call to change how pensions and the largest institutions allocate big money to hedge equity risk. As such, it is (to our eyes) the very first shot across the bow for global money managers to take heed on allocations going forward.

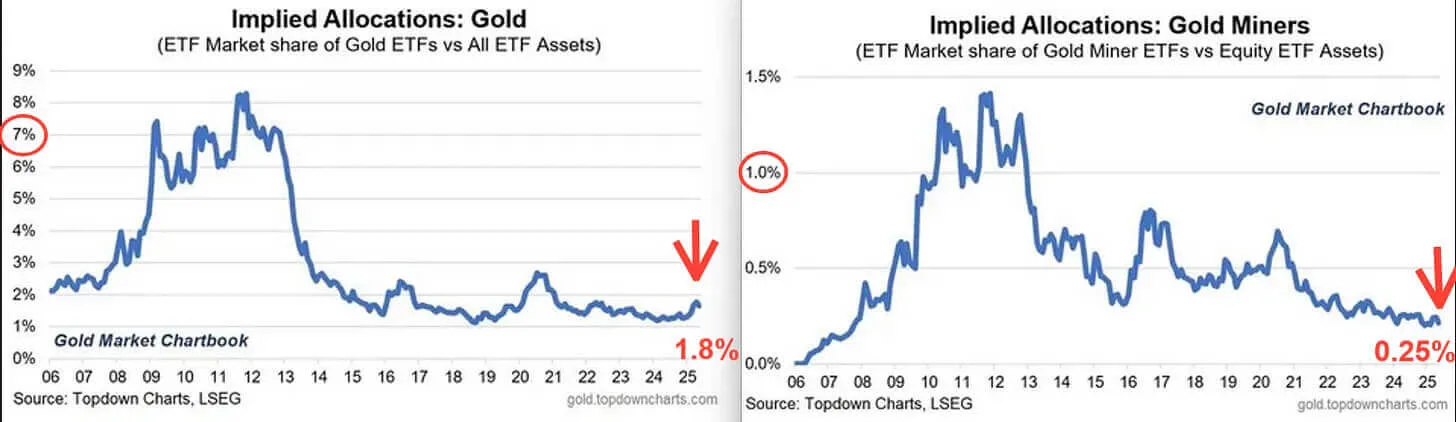

Put another way: Sovereign entities like Central Banks started replacing Bonds with Gold more aggressively when the Ukraine war started. Now, privately held institutions have begun following that lead. The charts just below serve as a reminder of how far gold has yet to go in terms of broadening reinvestment. We have much more to go in restoring Gold as a proper asset for global financial health. Gold, for all intents and purposes, is criminally underheld.

On that note, this analysis is must read for those seeking the road map laid out for pension asset allocators for the next 5 years. This could (should) be the next tailwind to underpin and drive gold relentlessly upwards to where it belongs in the pantheon of assets.

Bonds Haven’t Worked for Years

When bonds stop working, the portfolio model must change. The traditional 60/40 equity-bond allocation failed twice in recent months—once during tariff-induced recession fears, again as long-term borrowing costs surged on fiscal sustainability concerns. In both cases, U.S. Treasuries failed to offset equity drawdowns.

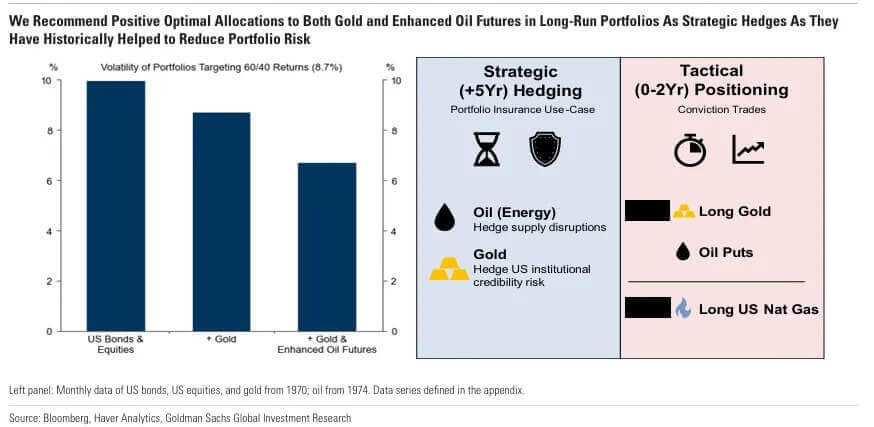

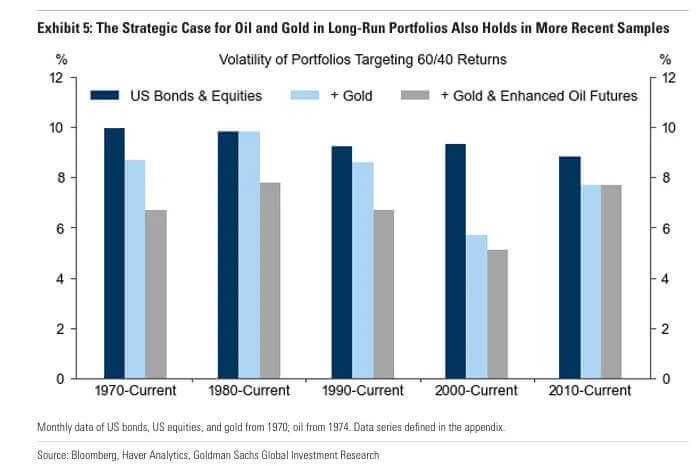

The analysts revisit a core idea: diversification must extend beyond stocks and bonds. They argue that gold and oil, properly weighted, serve as structural hedges in a world where inflation, policy error, and commodity supply risks frequently overlap. Their horizon is 5+ years.

The failure of bonds to provide protection has triggered a rethink of how real assets are integrated into portfolios. The 60/40 construct assumes that equity and bond risks are negatively correlated particularly during downturns. But in an era where inflation shocks are increasingly tied to fiscal overreach and geopolitical instability, this assumption no longer holds.

Bonds Failed to Hedge Two Risks

“Inflation shocks now come from both fiscal overreach and commodity scarcity. Real assets are no longer optional.”

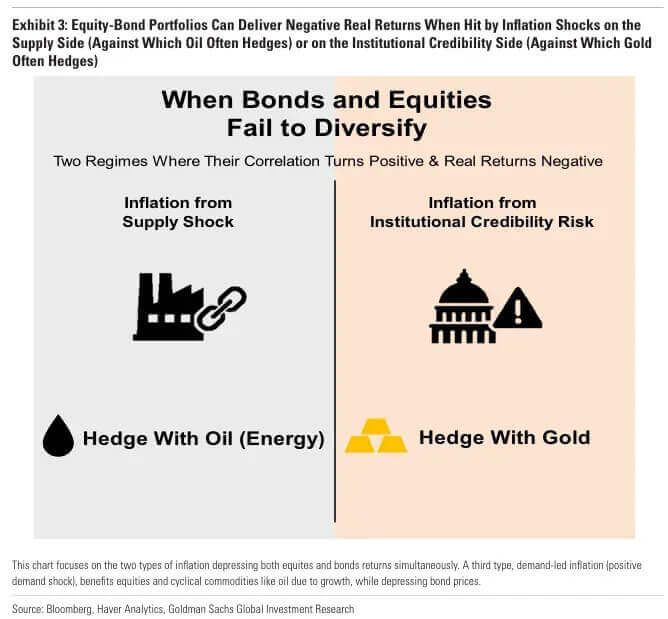

Gold and oil hedge against different shocks. Gold protects against the erosion of institutional credibility—fiscal overreach, political interference with the Fed, declining trust in sovereign bonds. Oil, by contrast, guards against inflation from supply shocks—scarcity, war, embargoes, and energy bottlenecks.

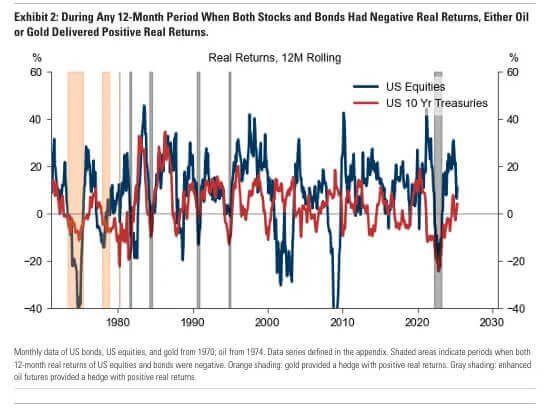

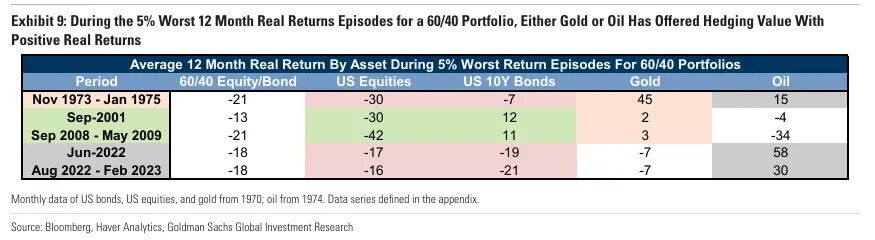

During any 12-month period where both stocks and bonds posted negative real returns, either gold or oil provided positive real returns. That’s the foundational empirical case. Portfolios need protection from dual-front inflation—and that means real assets.

History bears this thesis out. The 1970s featured runaway inflation fueled by fiscal expansion and energy disruption. The 2000s saw monetary excess and commodity spikes. And most recently, 2022 brought policy whiplash from pandemic-era stimulus, colliding with supply-side dislocations following the Ukraine war. In each instance, traditional assets failed simultaneously—while gold or oil held their ground.

Gold Is the Core Hedge Now

“Even a modest reallocation from Treasuries or equities into gold could trigger a steep repricing.”

The authors favor a long-term overweight in gold. Two reasons:

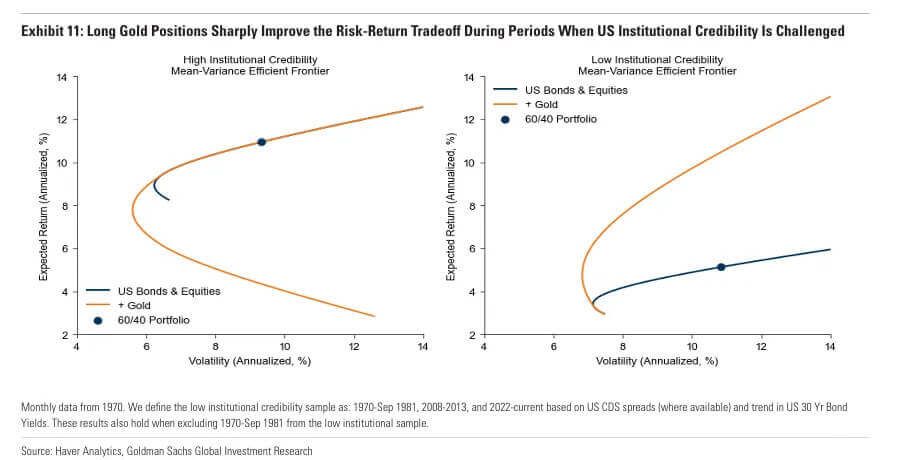

- Credibility risk is rising — U.S. debt-to-GDP is climbing, and political rhetoric is encroaching on central bank independence. When credibility erodes, both equities and bonds sell off.

- Central bank demand is structural — After Russia’s reserves were frozen, central banks—especially in emerging markets—accelerated gold purchases. Unlike FX reserves, gold held domestically cannot be seized.

The gold market is small. If even a modest reallocation occurs from Treasuries or equities, the price impact could be disproportionate. Their forecast: $3,700/oz by end-2025, $4,000/oz by mid-2026.

What distinguishes gold in this cycle is its dual role: both as an inflation hedge and as a geopolitical hedge. Gold acts as neutral collateral—trusted across sovereign divides, immune to sanctions, and beyond central bank manipulation. This makes it a preferred asset not only for private investors but for policymakers seeking insulation from dollar-based dependencies.

“Long Gold Positions Sharply Improve the Risk-Return Tradeoff During Periods When US Institutional Credibility Is Challenged”

Furthermore, the report notes that global ETF holdings of gold remain tiny relative to the size of equity and bond markets. This means gold remains under-owned. Any structural shift—driven by fiscal deterioration or central bank diversification—could trigger a steep repricing.

Oil Is Still a Hedge—But Don’t Go Crazy

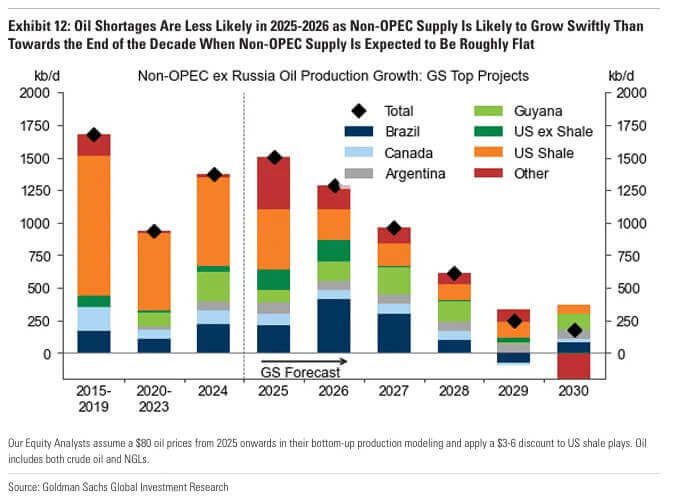

Oil’s volatility is high, but its role in risk management is still relevant. Goldman recommends underweighting oil in long-term portfolios—not excluding it.

“Oil’s role is not as a return asset—but as insurance against supply disruption.”

- Short-term: OPEC+ cooperation, spare capacity, and strong non-OPEC supply through 2026 reduce the probability of near-term shocks.

- Long-term: Post-2028, declining supply growth may reignite inflation risks. Hence, a reduced but positive allocation remains prudent.

The idea is not to treat oil as a return asset, but as a hedge against supply disruption. While near-term fundamentals suggest softness, the market has repeatedly demonstrated its vulnerability to geopolitical shocks. The Arab embargo, the Gulf Wars, and Russia’s weaponization of energy all show how quickly oil can become the epicenter of financial stress.

The Proof: Gold is the Anchor

“During any 12-month period where both stocks and bonds posted negative real returns, either gold or oil provided positive real returns.”

Gold and oil improve portfolio construction for:

- Mean-variance optimizers – Seeking lower volatility for a target return

- Tail-risk hedgers – Seeking smaller drawdowns in the worst months

Adding both assets steepens the efficient frontier and compresses losses in left-tail scenarios. For example, in five historical downturns, gold or oil (or both) delivered positive returns while stocks and bonds declined. This includes the Nixon shock, the Arab embargo, 2008, and 2022.

This holds true across different sample sets—even excluding the 1970s. The strategic utility of gold and oil persists because the shocks they hedge recur across history. Inflation may vary in form—demand-led, supply-driven, or policy-induced—but its effects on risk assets are consistent.

Tactical Recommendations (0–2 years)

- Long gold – Central bank buying and credibility hedging

- Buy oil puts or put spreads – Hedge recession risk while monetizing oversupply

- Long natural gas (April 2026) – Play on U.S. LNG export surge

These tactical views reflect near-term conditions: elevated U.S. fiscal risk, strong global oil supply, and a structural tailwind for U.S. LNG exports. In particular, using put spreads on oil allows investors to hedge energy risk without taking a speculative long position, consistent with a defensive posture.

Strategic Allocations (5+ years)

- Overweight gold – Anchor against fiscal/monetary credibility shocks

- Underweight but long oil – Insurance against unpredictable future supply disruptions

Strategic allocations are built to persist through cycles. They reflect systemic vulnerabilities in the global financial architecture. Gold is the anchor; oil is the hedge. Both are needed, but gold is foundational.

Final Thought: Gold as Neutral Collateral

“This is not a tactical trade. It’s a structural rebalance.”

This is not a tactical trade idea. It’s a structural rebalance. The legacy 60/40 is dead. Gold now plays the role of neutral collateral—trusted when institutions are not. Oil hedges the second front—energy-driven inflation. Together, they offer what bonds can no longer guarantee: protection.

Investors are no longer asking whether to own gold and oil. The question now is how much, and for how long. The answer, increasingly, is more—and for the foreseeable future.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.