Contents:

- Silver’s Rally Tests the Limits of Liquidity

- Investment Flows as the Dominant Force

- Liquidity Squeeze in London

- Risks of a Two-Sided Correction

- Gold vs. Silver: Divergent Reasons

- Bottom Line: Higher but Harder

- **GoldFix Graphic: Goldman’s view on Gold versus Silver

Silver’s Rally Tests the Limits of Liquidity

As silver surged past $50 per ounce for the first time in London trading history, Goldman Sachs Commodities Research argues that the rally, while supported by the same private investment inflows driving gold, is vulnerable to sharper swings. The report, authored by Lina Thomas and Daan Struyven1, positions silver as both a beneficiary and a victim of market exuberance. It lacks the structural bid from central banks that continues to anchor gold, leaving it exposed to liquidity shocks and investor sentiment shifts.

“The most likely path for silver prices in the medium term is to rise further since silver benefits from the same private investment flows lifting gold amid Fed cuts. However, in the near term, we see significantly more volatility and downside price risk for silver than for gold.”

Investment Flows as the Dominant Force

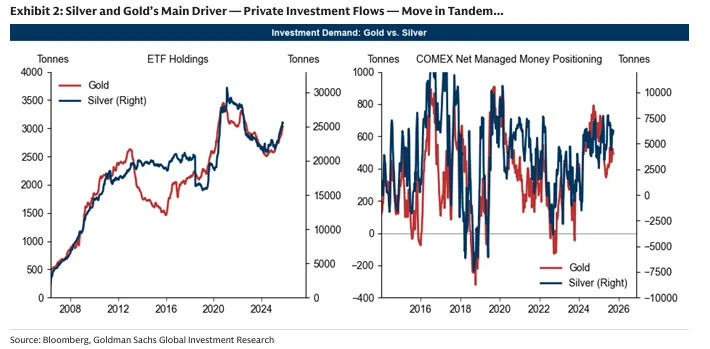

The analysis centers on the observation that private investment flows, through ETFs and speculative positioning, remain the primary driver of both metals. The bank estimates that 1,000 tonnes of silver inflows lift prices by approximately 1.6%, mirroring the proportional sensitivity seen in gold when adjusted for market size. The relationship between these flows historically held the gold-silver ratio in a 45–80 range, but the ratio widened after 2022 as central bank gold purchases decoupled the two markets.

“Gold has decoupled as central bank buying surged, lifting prices even without private investment inflows. Silver, which lacks that central bank bid, lagged.”

Now, with the Federal Reserve cutting rates and ETF inflows returning, silver is regaining lost ground. Year-to-date gains approaching 70% have narrowed the ratio back toward the upper end of its historical range, yet the underlying volatility remains elevated.

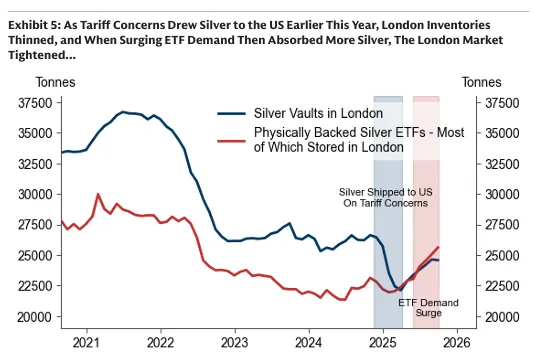

Liquidity Squeeze in London

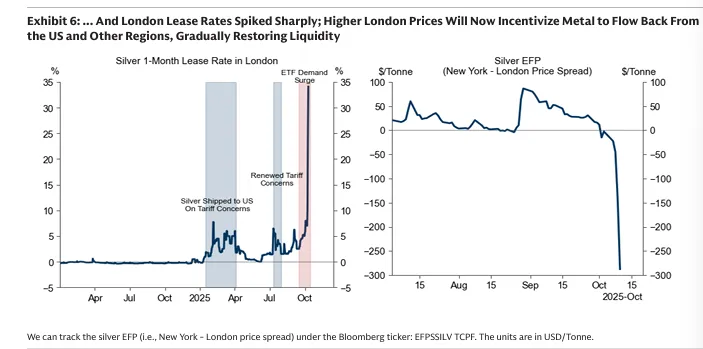

The report attributes part of the rally to a temporary liquidity squeeze in the London market. Inventories fell earlier in the year as tariff concerns drew metal to the United States, while renewed ETF demand absorbed remaining stockpiles. The ensuing tightness drove lease rates sharply higher and magnified price moves.

“A liquidity squeeze, which we expect to be temporary, amplified the recent silver rally (+35% since August 26th).”

Thomas and Struyven expect this imbalance to normalize as elevated London prices attract metal back from the U.S. and other regions. Still, silver’s smaller scale—roughly one-ninth the size of the gold market—ensures that even moderate shifts in positioning can translate into pronounced price volatility.

Risks of a Two-Sided Correction

The near-term risk lies in both demand normalization and supply restoration. If ETF inflows slow, or if metal flows back from U.S. stockpiles through an unwinding of the EFP trade (exchange-for-physical spread), the London tightness could ease rapidly. The authors note that a brief retreat in investment flows could trigger a disproportionate correction due to silver’s lack of an official-sector anchor.

“Even a brief retreat in investment flows may trigger disproportionate corrections for silver.”

Moreover, uncertainty surrounding potential Section 232 tariff investigations on critical minerals, including silver, could delay shipments and extend the squeeze. Although silver was exempted from direct tariffs earlier in 2025, its inclusion on the critical minerals list leaves the market cautious.

Gold vs. Silver: Diverging Foundations

The authors reaffirm that silver’s speculative profile contrasts with gold’s strategic one. Gold’s unique physical and institutional advantages—scarcity, density, and status within IMF reserve frameworks—make it a viable central bank asset. Silver’s industrial exposure and volatility make it unsuitable for reserve management.

A $1 billion holding in gold fits in a suitcase; the same value in silver fills a full-size freight truck.”

They dismiss the argument that rising gold prices might prompt substitution into silver, emphasizing that central banks manage value, not weight. Silver remains tethered to private investment cycles and industrial use cases such as solar manufacturing, where efficiency gains and substitution have capped its upside potential.

Bottom Line: Higher but Harder to Get There

Goldman’s outlook envisions further medium-term gains in silver as Fed easing supports investment inflows, yet with pronounced volatility. Without the stabilizing force of central bank accumulation, silver’s price path will remain dependent on the behavior of ETF investors and the restoration of London liquidity. As we ha e stated several times: The easy money has been made. Now the big money can be made, but with much higher risk

“We see significant volatility and two-sided risk, reflecting silver’s smaller and less liquid market, which makes it prone to sharp rallies and deep corrections.”

How Much Does Goldman “Hate” Silver? This much

- As always, ht ZH

↩︎