Update – Monday February 1st 10:13 Am.

President Trump has stated that tariffs on Mexico will be delayed for a month to allow for further negotiations. More below.

Update – Monday February 1st 3:50PM

President Trump has stated that tariffs on Canada will be delayed for a month to allow for further negotiations. More below.

Trade Wars

How Washington’s trade war chess match could reshape your precious metals playbook.

The Oval Office sent shockwaves through global markets as 25% tariffs on Canadian and Mexican imports, along with 10% tariffs on Chinese goods, and will take effect on Tuesday, February 4th 2025.

While Washington debates border policies, precious metals investors are scrambling to understand what these sweeping changes mean for their portfolios. Let’s cut through the noise and examine the real impacts on the precious metals market.

Despite the best wishes of bullion collectors, President Trump’s actions on Tariffs leave no carve outs or exception for bullion and monetary metals.

The white House released formal Fact Sheets on Tariffs, the official executive actions came out the following hours, formally enacting tariffs on Mexico, Canada and China.

What the Executive Actions State

In a sweeping series of executive orders issued February 1, 2025, the Trump administration announced new tariffs on imports from Mexico, Canada, and China. These actions, set to take effect February 4, represent one of the most significant trade policy shifts in recent years.

- Mexico: 25% tariff on all products

- Canada: 25% on most goods, 10% on energy resources

- China: 10% across the board

What’s Behind the Move?

The administration cites a “national emergency” focused on drug trafficking and border security. Each order targets specific concerns:

Mexico’s order addresses illegal immigration and drug cartel operations, with the administration claiming Mexican drug trafficking organizations are leading distributors of fentanyl and other narcotics into the U.S.

Canada faces scrutiny over fentanyl labs operating within its borders. The order notably claims that northern border drug seizures last year contained enough fentanyl to kill 9.5 million Americans.

China’s tariffs target synthetic opioid precursor chemicals, with the order alleging that Chinese companies are being subsidized to export fentanyl-related materials.

Implementation Details:

- Start date: February 4, 2025, 12:01 AM EST

- Exemption for goods in transit before February 1

- No duty drawbacks or de minimis treatment allowed

- All orders include retaliatory clauses if countries strike back

The Path Forward

Each order includes provisions for removal if countries demonstrate “adequate steps” toward enforcement cooperation. However, the broad scope and sudden implementation may spark significant international tension and potential trade disputes.

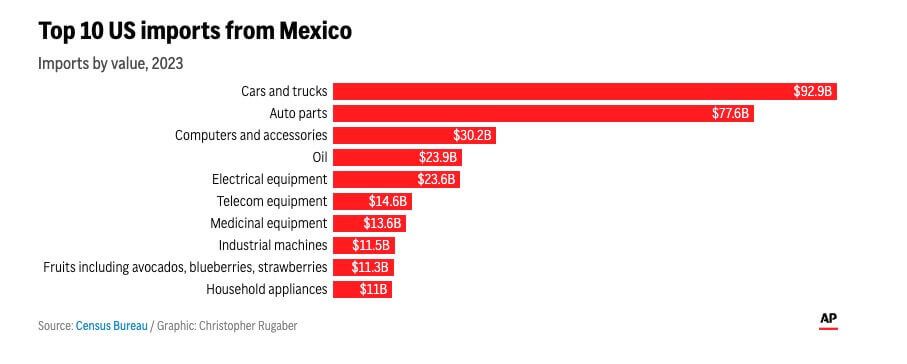

For businesses and consumers, these tariffs mean higher costs across multiple supply chains, from automotive parts to energy resources.

Are There Tariff Exceptions?

Yes, but very limited. The 50 U.S.C. 1702(b) exceptions specifically exclude four categories from these tariffs: (1) personal communications without transfer of value, (2) humanitarian donations like food, clothing, and medicine (unless they would impair handling of the emergency), (3) informational materials regardless of format (including publications, films, photos, artwork, etc.), and (4) travel-related transactions (including personal baggage, living expenses, and travel arrangements).

These carve-outs appear designed to maintain personal freedoms and humanitarian aid while targeting commercial trade. For businesses, this means educational materials, humanitarian supplies, and travel services should be exempt from the new tariffs, though they must meet the specific criteria outlined in the statute.

Coin Drama: Libertads vs. Maples

North America’s favorite bullion beauties – Mexican Libertads and Canadian Maples – just became tariff targets. Basic math suggests a $30 silver coin could jump an additional $7.50 overnight. Reality? More complicated than a DC lobbyist’s expense report. Both mints have contingency plays and options:

- Adjusting production processes

- Exploring different distribution channels

- Utilizing existing inventory in U.S. warehouses

- Optimizing their supply chains

For instance, while RCM does mint a lot of their coins in Canada, some production can be done in the United States to mitigate tariffs.

Not Just Coins – Cast Bars Too

Here’s the kicker – 80% of U.S. silver grain used in the bullion market comes from abroad – mostly Mexico. This isn’t just about a few sovereign coins; your favorite cast bars and rounds could get caught in the crossfire as US based dealers and mints work to find alternative raw material providers.

That grain is used by mints in the US to produce thousand of different cast bar products domestically.

Domestic Silver: Why the U.S. Can’t Go It Alone

While headlines focus on international trade shifts, it’s crucial to understand America’s domestic silver landscape. Can American Mines meet our demand?

Alaska leads U.S. production with Hecla Mining’s Greens Creek and Teck Resources’ Red Dog mine combining for over 16 million ounces annually, followed by Nevada’s operations including the Rochester Mine contributing about 6.7 million ounces, and Idaho’s historic Silver Valley adding another 4.5 million ounces through the Lucky Friday and Galena mines.

Yet despite this impressive domestic production, U.S. mines only satisfy about 17% of our national silver demand.

This production gap explains why the new tariffs could have broad market implications. With 63% of U.S. silver consumption relying on imports primarily from Mexico, Canada, Peru, and Chile, and approximately 80% of silver grain used in domestic bullion products coming from international sources, the market will need time to adjust.

The remaining comes from domestic supply, recycling, and secondary markets, highlighting why existing stockpiles and secondary trading will play crucial roles in the months ahead as supply chains adapt to the new trade landscape.

To put these numbers in stark perspective, U.S. mines produce approximately 28 million ounces of silver annually, while domestic demand reaches roughly 162 million ounces. This dramatic shortfall – about 134 million ounces – underscores why international trade plays such a crucial role in America’s silver market.

In 2021, United State American Silver Eagles sold approximately 40 million 1 oz coins just by themselves.

Moves & Counter Moves

Canadian Prime Minister Justin Trudeau said Friday that Canada is ready with a respone if Trump were to move ahead with the tariffs, but he did not give details.

“We’re ready with a response, a purposeful, forceful but reasonable, immediate response,” he said. “It’s not what we want, but if he moves forward, we will also act.”

Such diplomatic language from one of the world’s largest precious metals producers suggests we could see additional market complications as countries adjust their trade policies.

The tariffs’ impact extends far beyond precious metals, with significant implications for Canadian lumber, automotive parts, and oil imports (though oil may see a reduced 10% rate).

From Mexico, the tariffs will affect a broad spectrum of imports including vehicles, automotive parts, and agricultural products – a shift that could influence consumer prices across multiple sectors, from pickup trucks to Super Bowl guacamole, as noted in the AP report.

What This Means for Investors

While the 25% tariff sounds dramatic, the actual market impact will likely be more nuanced. Smart investors should consider:

- Buy existing inventory while available

- Watch for market inefficiencies during the adjustment period

- Monitor for potential opportunities in alternative products

- Keep an eye on secondary market developments

In the bullion industry, tariffs present a unique challenge due to the traditionally razor-thin margins and intensely competitive pricing structure. However, mints and dealers have historically demonstrated remarkable adaptability, and will likely explore various strategies to maintain competitive pricing for their global customer base.

From supply chain restructuring to manufacturing relocations, the industry has multiple tools at its disposal to navigate these new trade waters.

Update Monday February 3rd 10Am

This morning, President Trump released a post stating that tariffs were going to be delayed for Mexico.

President Donald Trump has announced preliminary discussions with Mexican President Claudia Sheinbaum regarding border security and trade tariffs. According to Trump’s social media post, the proposed agreement would involve deploying 10,000 Mexican soldiers along the U.S.-Mexico border to address fentanyl trafficking and immigration concerns.

Of particular interest to bullion investors is the announcement of a one-month pause on anticipated tariffs while negotiations proceed, with high-level discussions to be led by Marco Rubio, Scott Bessent, and Howard Lutnick.

This temporary tariff suspension could have immediate implications for precious metals prices, as trade tensions between the U.S. and Mexico have historically influenced market volatility and safe-haven demand for gold and silver. Market participants should closely monitor these developing negotiations, as any resulting trade agreement could significantly impact cross-border commerce and investment strategies.

CEO of Scottsdale Mint had this to say in response:

Update Monday February 3rd 4Pm

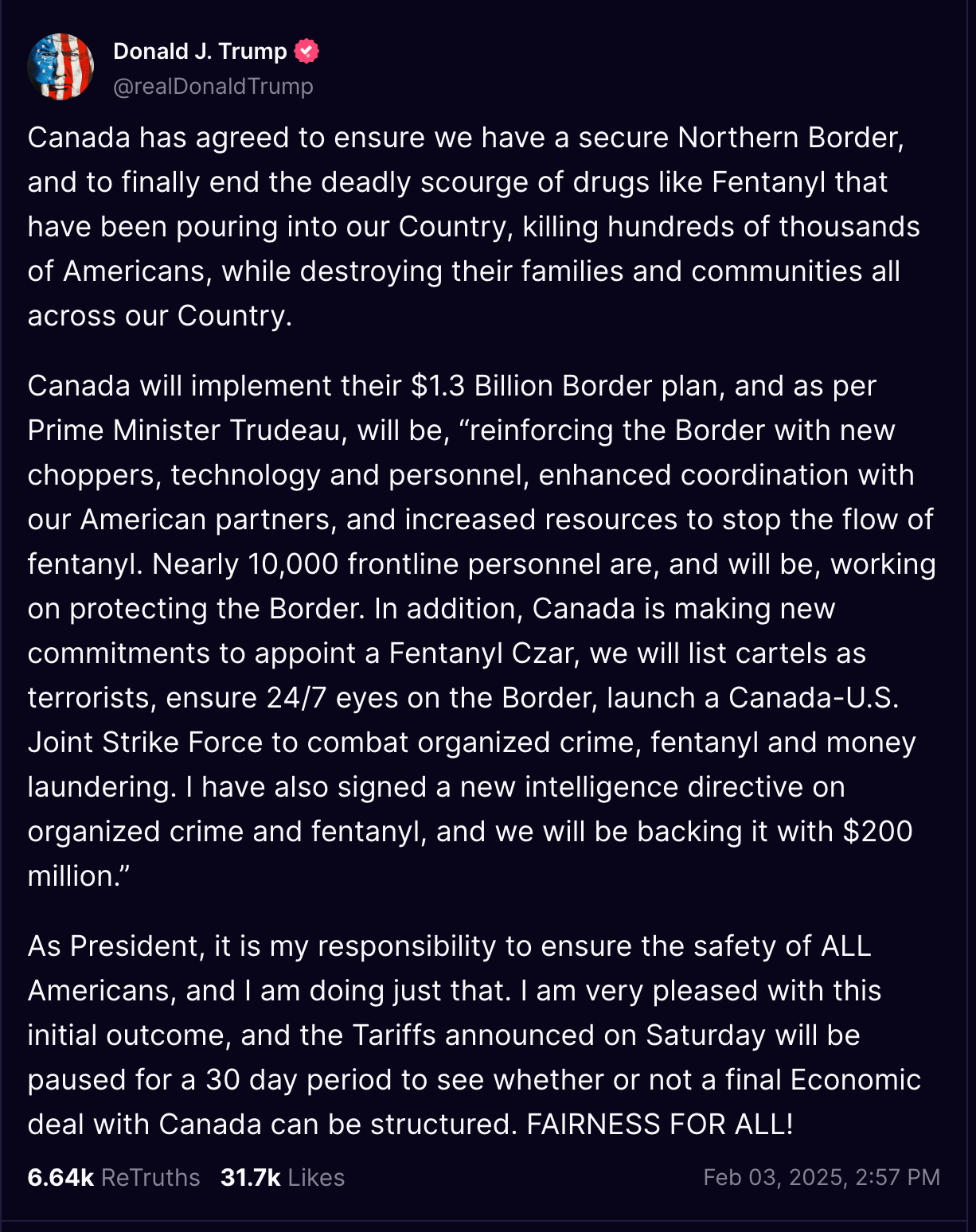

President Trump has paused implementation of tariffs on Canada following their meeting and concessions given by Canada. It will be under a 30 day review.

Scottsdale Mint will have more details about the possible impacts these actions will have in the coming days.