The World is Running Out of Freely Available Gold

Cost Management and Logistical Streamlining?

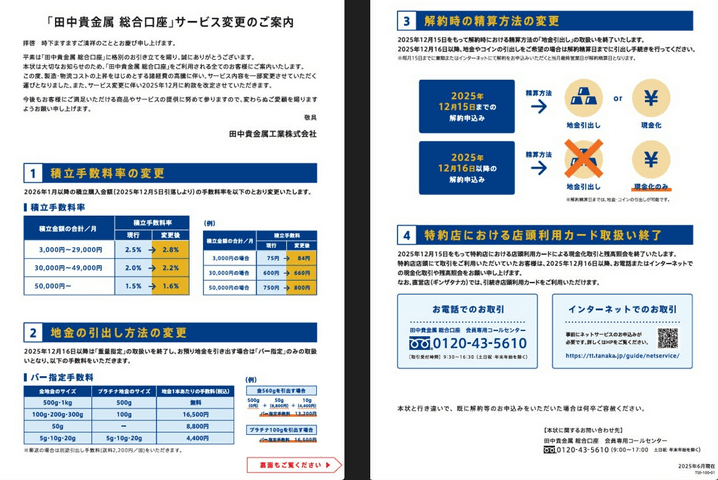

This month, Tanaka Precious Metals Co., Ltd., Japan’s number one bullion dealer and refiner1, (owner of Metalor, subsidiaries in China, and operator of Japan’s largest metals refinery) issued a notice to its clients outlining a series of changes to its “General Account” services. Chief among these was a restriction on physical gold withdrawals.

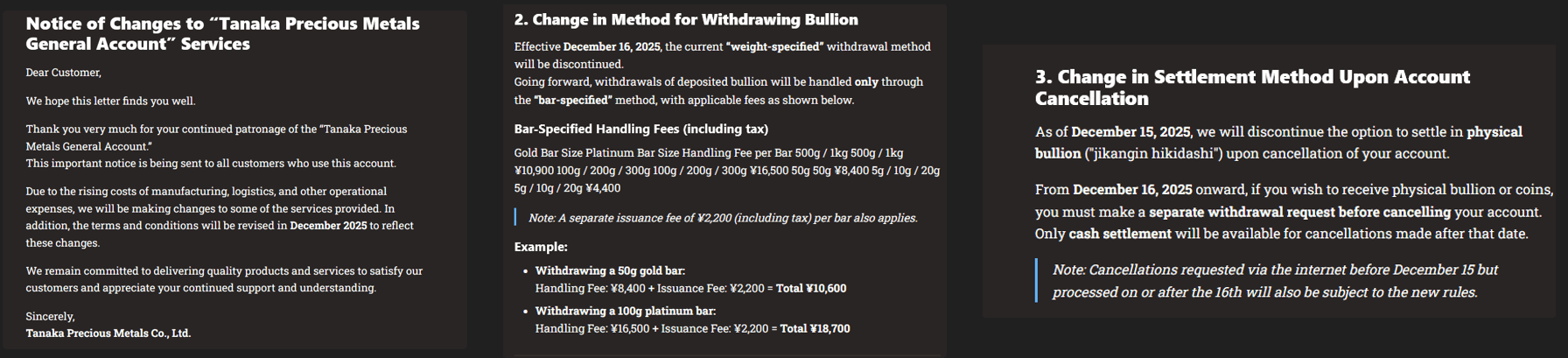

Effective December 16, 2025, customers will no longer be allowed to withdraw by weight specification. Instead, only fixed, bar-specified formats with standard handling and issuance fees will be available. Quoting from Tanaka’s notice:

Change in Method for Withdrawing Bullion: Effective December 16, 2025, Withdrawals of deposited bullion will be handled only through the “bar-specified” method,

Additionally, the company announced that account cancellations after that date would be settled in cash only—physical bullion redemption would require a separate prior step. From the firm’s notice again:

“As of December 15, 2025, we will discontinue the option to settle in physical bullion (“jikangin hikidashi”) upon cancellation of your account.” The justification offered was conventional: rising operational costs, manufacturing pressures, and the need to streamline logistics.

On its face, the rationale appears sound. Rising input costs and distribution challenges have affected industries globally. But in the case of Tanaka, the explanation may obscure a more pressing reality. Structural changes of this magnitude (eliminating investor access to flexible bar sizes and removing direct settlement in bullion) point less to margin optimization and more to constraints in physical metal availability.

Tanaka’s Notice to Clients…

The company’s new procedures are logistically neat but operationally restrictive. In context, the timing and scope of the changes suggest another motive: managing scarce collateral.

They are winding down a program in physical gold while demand for their product is going through the roof. Who does that?

Contradictory Evidence: Physical Shortages Across Asia

The plausibility of Tanaka’s stated motives begins to unravel when viewed alongside developments elsewhere in Asia. South Korea offers the most direct precedent. In February 2025, the Korea Minting and Security Printing Corporation (KOMSCO) suspended gold bar sales to commercial banks, citing insufficient inventory.

This disruption was not confined to 1-gram novelty bars; it extended to 10g, 100g, and 1kg denominations—the same range Tanaka now forces customers to pre-select in advance. Retail investors in Korea turned to silver, only to encounter secondary shortages there as well. Local outlets confirmed a halt in distribution of bullion across major cities, and government-linked suppliers admitted that demand had overwhelmed their replenishment capacity.

Meanwhile, China’s demand expansion continues to reshape the region’s bullion flow. Through the Shanghai Gold Exchange International Board (SGEI), the country has facilitated the onboarding of foreign participants in gold purchases. Importantly, the SGEI format supports large-denomination bars, such as the 300kg bars reportedly in high demand among institutional buyers. This demand does not show up in typical consumer jewelry metrics.

Instead, it depletes dealer inventories in discreet, opaque batches. This is the China way; one they’ve been doing for years when it comes to Silver and gold in LATAM as well. Buy as close to the source as you can to minimize surface price disruption.

This is why we think the largest player in Japan’s industry isn’t out of gold; its just spoken for by a powerful entity. This is a good way to nationalize some gold supply without nationalizing industry.

The consequence for neighboring markets like Japan is obvious: fewer bars available for flexible, small-lot investor withdrawals. Tellingly, Tanaka’s revised policy no longer allows for fractional withdrawals or flexible conversion from accumulated accounts to spot metal. It imposes form, size, and fee discipline.

Elsewhere, symptoms of physical tightness continue to emerge. On the LBMA, reports of “paper gold” saturation persist, traders rolling contracts forward rather than taking delivery, with minimal available liquidity in the spot physical window. Rehypothecation, a once-ignored mechanism, is now a constraint. Asian central banks continue to absorb tonnage in stealth, and institutional investors in the West find themselves shut out of delivery slots as refiners struggle to source new material.

To add fuel to the fire, the advent of tokenized gold in stablecoin form discussed here recently is also taking available gold off the market for sale in older style investment products. once taken for granted supply chains of Gold bullion for sourcing are being redirected to higher paying newer products.

The directional flow of gold has shifted: from West to East and due to technology, and physicality needed, from unallocated ledger entries to vault delivery receipts. In such an environment, Tanaka’s cost isn’t strategic optimization at all.

Collateral Crisis: You Don’t Close Shop in a Bull Market

Tanaka may indeed be managing higher costs, but those costs increasingly stem from scarcity in sourcing, not distribution. When refiners or wholesalers face tightening supply, the cost of restocking rises disproportionately. That logistical burden is not simply about transportation or fabrication; it reflects competition for the underlying commodity. In this framework, bar-specific restrictions and cash-only cancellations serve a clear purpose: preserve structured inventory for traceable delivery, and eliminate opportunistic liquidation by small holders.

Tanaka Notice Translated...

Physical gold is no longer some abstract commodity governed by correlations in some neo-keynesian economists mind, it is real collateral. And like all collateral, its availability is hierarchical. Central banks get priority. Large bars get filled first. Flexible investor programs (the type Tanaka ran for years) are the first to be curtailed when pressure mounts. The new policy does not eliminate delivery, but it does condition it: to fixed sizes, fixed costs, and separate timelines. This allows the firm to manage vault inventory as a depleting reserve, not a warehouse.

Seen this way, the service changes are a proxy signal. One of Asia’s top dealers has publicly acknowledged logistical strain, but the structure of the changes reveals the real driver: disappearing float. The very gold that once underpinned investor convenience is being reclassified as strategic stock.

Conclusion: Shrinking Supply

Tanaka’s policy revision should not be dismissed as routine operational tightening. In a year marked by Asian physical shortages, rising central bank demand, and visible drawdowns in bar inventories across Korea, Japan, and China, the firm’s move to restrict gold withdrawal flexibility signals deeper market stress. Officially, the change is about cost and logistics. Unofficially, it reflects a world in which gold is harder to source, slower to deliver, and more valuable as unredeemed collateral than as retail product.

They are winding down a program in physical gold while demand for their product is going through the roof. Who does that? Nobody. Especially not the biggest player in Japan’s retail Gold market. We think an entity with sovereign ties is securing above ground inventory. Authoritarian governments like China or Mali can confiscate or nationalize supply; But Democracies like the US and Japan simply quietly acquire behind the scenes, and nobody is the wiser.

Investors should take note. Where bullion was once abundant and distribution policy transparent, it is now gated by denomination and discretion. This is not the behavior of a market in balance. It is the quiet repositioning of gold as a control point. Tanaka’s new rules are a local event manifesting the global shortage. Who has access to physical Gold is changing

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.