South Korea is preparing to reenter the gold market after more than a decade, signaling continued central bank interest in bullion as reserves strategy evolves.

GFN – SEOUL: Bloomberg notes in a story that the Bank of Korea is weighing plans to add to its gold reserves from a medium to long term perspective. Heung Soon Jung, director of the Reserve Investment Division, said officials will assess market conditions to determine timing and size of any purchases.

“Plans to consider additional gold purchases from a medium to long term perspective.”

The bank has not bought gold since 2013 when previous purchasing was followed by a long slump in prices. Officials now speak more openly as global central bank buying has become a larger driver of demand and a key influence on gold’s rise.

“Central bankers rarely speak in public about the gold market.”

Gold recently surged above 4,380 dollars per ounce before correcting. Prices remain up more than 50 percent this year, supported by steady official sector accumulation and growing expectations of Federal Reserve rate cuts.

Jung said any decision will reflect the evolution of international reserves plus trajectories for gold and the Korean won. Domestic critics targeted the 2011 to 2013 purchases. That experience informs the bank’s current caution.

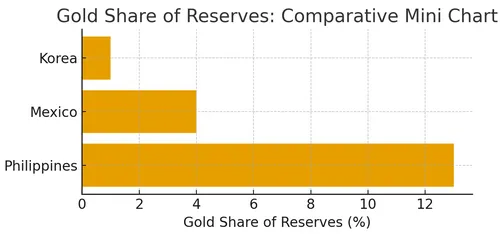

Some reserve managers are now reaching allocation thresholds that encourage rebalancing. A Philippine policymaker told Bloomberg its 13 percent gold share exceeds a preferred 8 to 12 percent range.

“We would need to see a very competitive offer in order for us to consider moving bars from London to China.”

Liquidity access influences storage decisions. Jung confirmed South Korea keeps its bullion in London. Mexico shares that preference for liquidity and services in the UK capital.