Deutsche Bank: White Metals Re-Engage as Structural Tightness Reasserts

DB’s 2026 Precious Metals outlook report has been published. It is comprehensive enough to break into two parts: One for Gold and one for Silver. Here is our breakdown of the Silver work, which is impressive and very timely Gold will be out tomorrow. Incidentally, the bank does not give a price target, but they give all the data needed to imply what their actual target is. We do that for them.

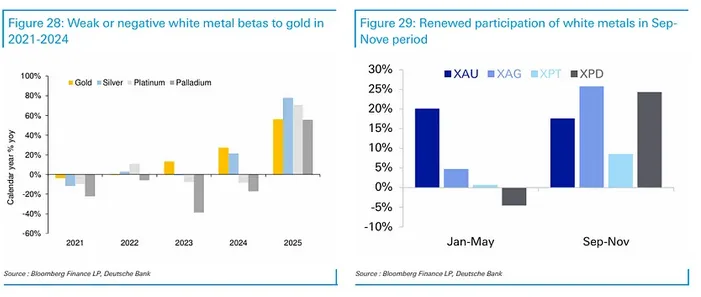

The critical regime shift identified by DB is that white metals are no longer operating purely as niche industrial commodities. Instead, constrained availability combined with financial spillover from gold’s rally allows price sensitivities to reconnect across the complex, producing synchronized directional movement rather than isolated cycles.

In other words, silver is shifting from a paper-driven follower of gold to a physically constrained companion that can episodically lead during repricing phases, implying that both silver and platinum remain materially undervalued within the current precious-metal regime.

I. White Metals Reconnect with Gold’s Price Regime

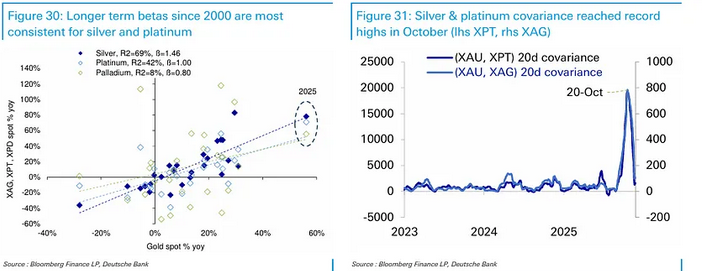

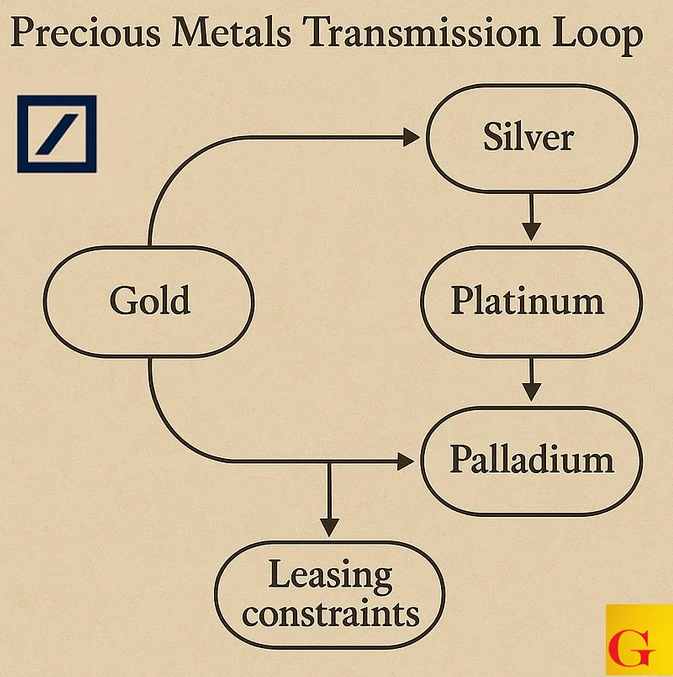

Deutsche Bank positions silver, platinum, and palladium as beneficiaries of the same structural forces driving gold higher, with tight physical balances and renewed beta relationships re-establishing price participation. The bank states that, “Positive implications for white metals: Consecutive years of undersupply enables silver, platinum and palladium to participate more fully in gold’s strength. Elevated lease rates indicate physical scarcity which affects industrial users, many of whom prefer to lease than own” .

The critical regime shift identified by DB is that white metals are no longer operating purely as niche industrial commodities. Instead, constrained availability combined with financial spillover from gold’s rally allows price sensitivities to reconnect across the complex, producing synchronized directional movement rather than isolated cycles.

NOTE: The above data taken in combination with the bank’s Gold price target of $5,000, puts Silver between $68 and $73 as their 2026 target given beta and covariance analysis. We believe DB’s price target for Silver is conservatively around $71.25 if Gold trades $5,000.

II. Lease Rates as the Market’s Physical Stress Gauge

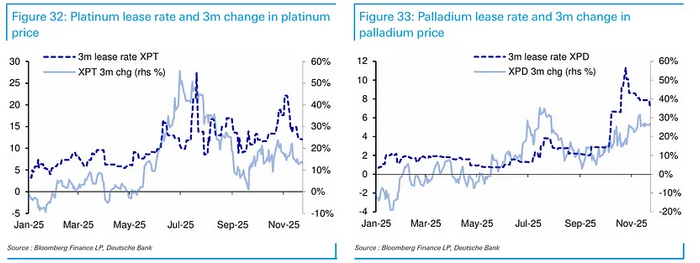

Across the white-metals spectrum, DB emphasizes the importance of rising lease rates as a direct signal of market tightness. Elevated leasing costs reflect immediate inventory scarcity rather than speculative positioning. DB notes that industrial users increasingly choose leasing over outright ownership, which signifies operational dependence on immediate supply access rather than price hedging motives.

Lease-rate elevation functions as a transmission channel linking physical deficits into price formation. Industrial leasing absorbs available warehouse metal without releasing stock back into exchange or fabrication supply, effectively tightening float and amplifying any incremental investment flow into price movements.

III. Silver: Persistent Deficits and Rising Investment Elasticity

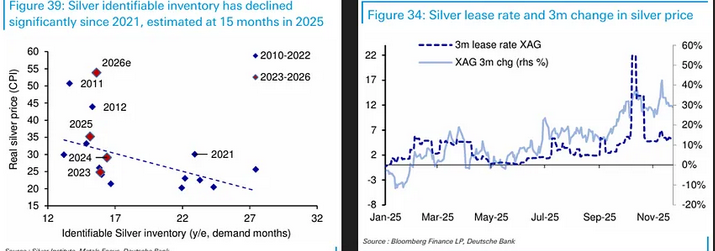

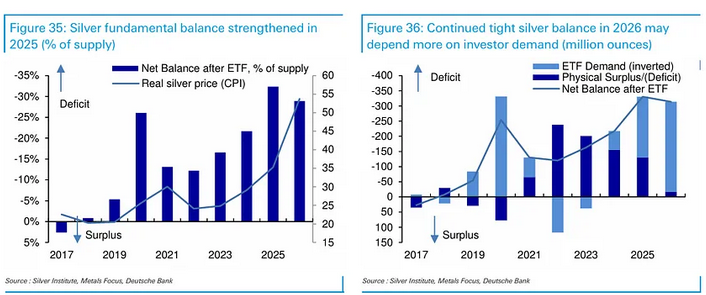

Deutsche Bank projects silver to remain in structural undersupply through the coming year, with deficits supported simultaneously by industrial fabrication demand and expanding investment participation. The bank expects “supply-demand to remain in deficit for silver…next year” .

Silver’s role differs from gold due to its dual status as a monetary adjunct and industrial input, particularly in photovoltaics, electronics, and electrification. DB highlights that investment demand is expected to grow even against tight leasing conditions. This reflects the market’s ability to absorb rising prices without choking off capital flows, an expression of renewed beta coupling to gold’s institutional breakout.

Rather than silver rallying independently, DB frames participation as a contagion effect from gold’s regime repricing, where investors seek leveraged exposure to precious-metal momentum via higher volatility white metals that remain undervalued relative to gold’s price trajectory.

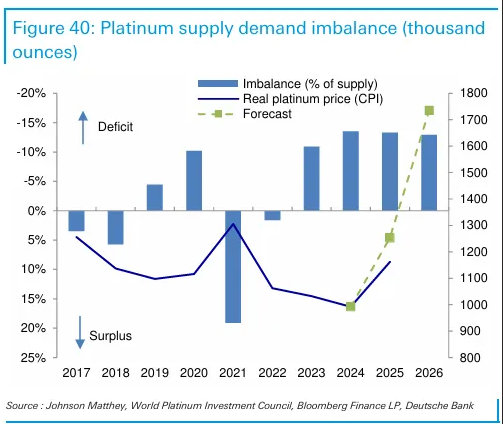

IV. Platinum: Tight Physical Markets despite Structural Demand Adjustment

Platinum’s outlook remains anchored by continued physical tightness despite lingering distortions from regulatory developments, notably China’s VAT reforms on imports. DB underscores resilience in bar-and-coin demand and constrained pipeline availability, resulting in continued supply shortfalls .

Industrial users again prefer leasing exposure, illustrating constrained spot access rather than surplus conditions. This underscores DB’s interpretation that platinum’s physical foundation cannot be assessed through price weakness alone. Instead, leasing spreads reveal marginal scarcity masked by subdued investment participation. As gold draws price leadership across the complex, platinum’s restrained inventory backdrop allows it to re-engage upwards when cross-metal beta relationships normalize.

VI. Cross-Metal Regime Dynamics

White metals are now operating under a shared framework:

- Gold provides the directional anchor.

- Lease markets enforce physical discipline.

- Supply constraints selectively transmit scarcity into pricing.

Silver and platinum retain deficit conditions, enabling price convexity when capital flows resume or industrial consumption tightens availability. Palladium’s equilibrium dampens upside torque but does not negate participation when macro liquidity cycles lift the broader complex.

VII. Strategic Synthesis

Deutsche Bank’s white-metals thesis reframes these markets as secondary beneficiaries of gold’s institutional repricing regime rather than isolated industrial plays. Deficits in silver and platinum serve as physical amplifiers to gold’s price signals, while lease market stress underscores real inventory scarcity rather than speculative exuberance. Palladium’s balanced conditions temper volatility but enable participation as capital seeks cross-complex exposure.

Under DB’s framework:

- Silver is positioned as the leveraged financial adjunct to gold’s rally, with structural deficits reinforcing upside elasticity.

- Platinum trades as a constrained physical market awaiting renewed investment sponsorship to express its scarcity.

- Palladium transitions into a beta-driven co-mover after exiting its historic deficit regime.

Collectively, the bank views the white metals complex as exiting fragmentation and re-entering synchronized price formation, anchored to gold’s structural repricing path, with leasing markets supplying the mechanical constraint that converts modest demand increments into disproportionate price responses.

Final Comment:

While Deutsche Bank attributes silver’s tightening chiefly to industrial demand growth and elevated leasing activity, this framework understates the deeper structural shift occurring in the metal’s price formation. Physical inventories continue migrating toward Asian fabrication and solar supply corridors, steadily shrinking the pool of deliverable metal accessible to Western trading venues. This is occurring alongside an extended contraction in COMEX open interest relative to rising spot prices, a divergence that signals diminishing influence from speculative paper demand even as physical conditions tighten. The resulting market structure increasingly favors spot-driven repricing rather than derivatives-driven price discovery.

Silver’s persistent supply deficit now intersects with collateral substitution dynamics created by gold’s sequestration into sovereign reserves and repo-eligible balance sheets. As central banks withdraw gold from elastic circulation channels, private accumulation gravitates toward accessible secondary alternatives. Unlike platinum or palladium, whose demand remains overwhelmingly industrial, silver maintains a dual monetary-industrial identity. This positions it as a practical reserve adjunct for private savers and industrial hedgers priced out of consistent gold access, reintroducing monetary sensitivity not fully captured in DB’s commodity-elasticity models.

The growing reliance on leasing further reduces spot float. Industrial users borrow metal rather than hold inventory, delaying the replenishment of deliverable stocks while satisfying near-term fabrication needs. This structure allows headline supply data to mask tightening real-world availability. As a result, apparent market balance measures increasingly diverge from effective liquidity conditions.

Under this regime, investment demand carries outsized price impact. With limited deliverable float and weakened paper participation, even modest physical inflows routed through Asian hubs or retail bar channels have the potential to propagate sharp localized price stress. Silver’s price response therefore becomes increasingly convex under sustained tightness, characterized by prolonged consolidation periods followed by abrupt repricing when physical strains overwhelm residual inventory buffers.

Consequently, DB’s assessment that silver will “participate” in gold’s advance may understate the magnitude of its potential response. Rather than functioning solely as a correlated beta follower, silver faces a structural pathway toward episodic price discontinuities fueled by inventory depletion, physical channel convergence, and the erosion of traditional derivative smoothing mechanisms.