GFN – TORONTO: Canadian miner Silver Storm Mining has secured a US $7.0 million prepaid offtake financing facility with Samsung Construction and Trading and two of its subsidiaries to restart operations at its La Parrilla Silver Mine Complex in Durango, Mexico. The agreement, announced October 10, 2025, includes a two-year offtake commitment for all concentrates produced as part of the financing arrangement.

Under the terms of the financing facility, Samsung and its affiliates will provide the US $7 million in secured prepaid funding over an 18-month term to support rehabilitation and preparations for a phased restart of production at La Parrilla. The facility carries interest at 1-month SOFR + 4.75 percent, with a six-month grace period on interest and principal before equal monthly repayments begin, which may be offset by concentrate sales.

“The Agreement with Samsung represents a key step in our strategic vision of transitioning the Company into an operating entity.” Greg McKenzie, President and CEO of Silver Storm, said in the company’s release. “Samsung’s involvement as a guaranteed purchaser for the concentrates reflects the confidence of a leading industry participant in our path forward.”

Under the offtake arrangement, Samsung will receive 100 percent of the lead-silver and zinc concentrates produced at the La Parrilla complex over a two-year period, granting the trading house full offtake rights in exchange for early financing. The facility is secured by a corporate guarantee, share pledge, and first-ranking security over the mine’s assets.

The proceeds are earmarked for mill rehabilitation and upgrades, underground development, working capital and other restart activities, as part of Silver Storm’s plan to bring the previously idled asset back into production — with operations anticipated to resume in stages through the first half of 2026.

“The company has sufficient liquidity to complete the planned restart and rehabilitation activities at La Parrilla.” McKenzie added, underscoring management’s view that the financing positions the junior miner to advance construction and recommissioning work

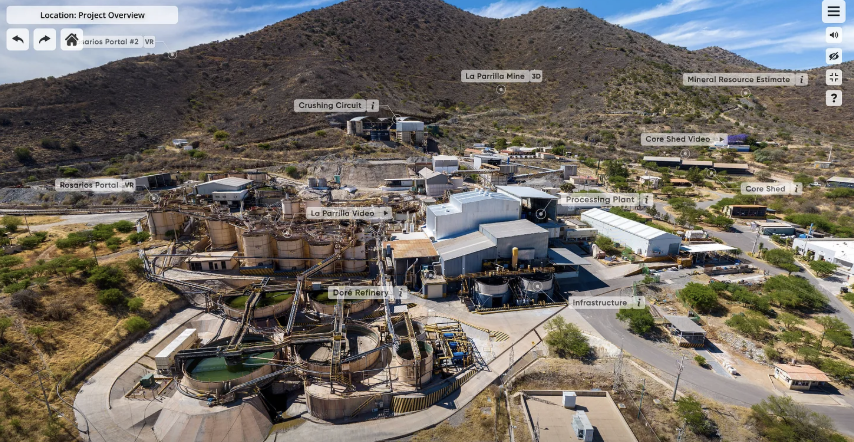

La Parrilla, a prolific past producer with a 2,000-tonne-per-day mill and multiple underground mine portals, has been inactive since 2019. The new offtake financing marks a key milestone toward unlocking the project’s near-term production potential and delivering value to shareholders.

Key Terms at a Glance

- Financing amount: US $7.0 million prepaid offtake facility (18 months).

- Offtake: 100 % of lead-silver & zinc concentrates for two years.

- Interest & repayment: SOFR + 4.75 %; six-month grace period, then monthly instalments.

- Use of proceeds: rehabilitation, upgrades, underground development, working capital

First seen and noted by Arcadia today, where Chris Marcus gives some insights into its importance; This news insight gives much credence to the silver supply scramble that is beginning to ensue