This guest contribution is provided by Vince Lanci.

Silver: Bank says “There are increasing Risks of a Short-Squeeze” in London

ANZ (Australia and New Zealand Banking Group) is one of the largest financial institutions in the Asia-Pacific region, operating in 33 markets with over 180 years of history. As a major player in global financial markets with extensive operations throughout Asia, ANZ has unique insights into both Western and Eastern precious metals demand, particularly in the gold and silver markets.

ANZ Bank’s Bottom Line

- Short-term price range: USD 34-36/oz.

- Key upside drivers: Tight London liquidity, U.S. import constraints, ETF inflows.

- Key risks: Tariff-related disruptions, speculative positioning unwinds, industrial demand slowdown.

- Gold-silver ratio forecast: 84:1 to 88:1 in 2025.

Why ANZ Matters

ANZ is unique in that they have a foot in both parts of the world. Being linguistically western and geographically eastern, they can provide more timely observations on Asian gold and silver demand.

More importantly, as we shall see here, they are somewhat less constricted in their ability to make frank statements about the supply/demand situation as it pertains to LBMA without sounding like Cassandras. The shortage of silver availability is real. It is persistent and there is likely no help coming for short players without higher prices.

1- Summary/Overview: Transatlantic Dislocation

On March 18th, ANZ Bank published their periodic Precious Metals report. This particular one seemed far from routine and made a point of focusing on Silver. It specifically emphasized physical market stress, supply dislocations, and investment demand in its analysis.

In summary: The Bank argues that silver remains undervalued relative to gold, with the London market experiencing tightening liquidity and the U.S. struggling to secure adequate supply. Investment flows, trade policies, and structural deficits due to LBMA/Comex dislocations will shape silver’s price action, with ANZ raising their target to a USD 34-36/oz trading range in the short term in light of these factors.

2- Dislocations Risk LBMA Short-Squeeze Event

“Furthermore, there are increasing risks of a short-squeeze, as swap-dealer positions are net short at the highest since 2020. We believe these developments will keep silver vulnerable to a price spike” —ANZ Report

A historic supply dislocation has emerged in the London market, where silver inventories have declined sharply, leading to higher borrowing costs and reduced free-floating metal availability.

This shift has led to a tightening of available silver in the London OTC market, which serves as the benchmark for global silver pricing. Investors and refiners are struggling to source metal at previous cost levels, forcing liquidity to shift toward New York.

- LBMA silver stocks have reached a multi-year low, increasing concerns over available supply.

- The LBMA silver-to-ETF holdings ratio has fallen to 1, signaling extreme scarcity.

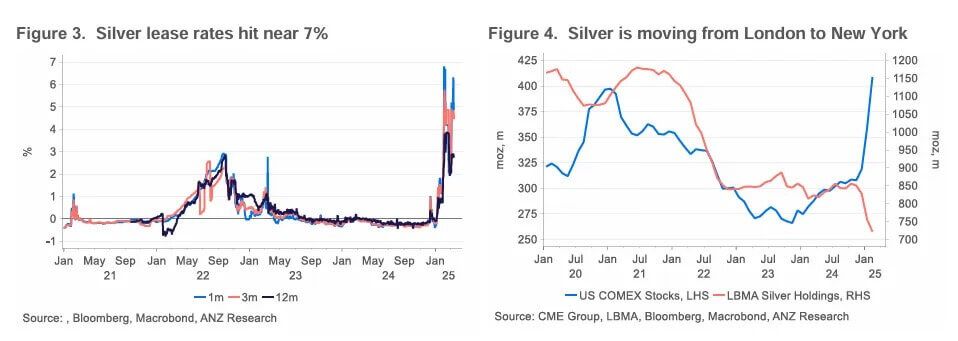

- Borrowing costs surged to 7% in January before easing to 2%, reflecting short-term panic in the lending market.

- “Low inventory levels at LBMA are raising concerns of falling ‘free-floating’ silver stocks.”

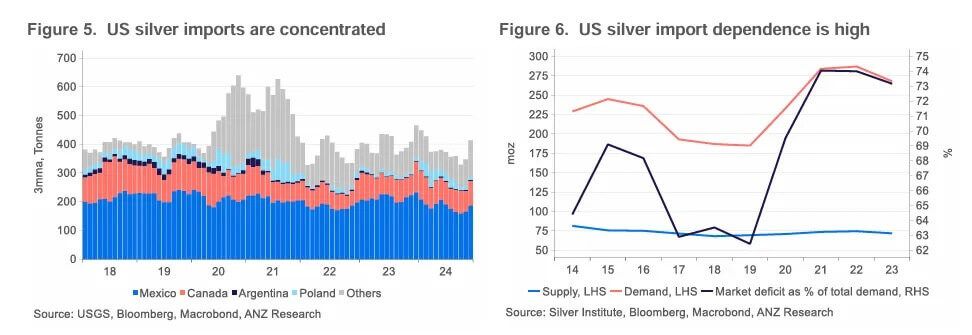

As a result, Silver holdings in London Bullion Market Association (LBMA) vaults have dropped by 128moz to 722moz since November, while Comex inventories jumped 101moz to 441moz.

The squeeze potential is further exacerbated by swap dealers holding their largest net short position since 2020, creating a heightened risk of a short squeeze.

That metal is heading westward. The US is pulling in any and all available LBMA metal, shoring up its own structural deficit likely to be exacerbated by Mexico and Canada tariffs.

3- US Shortfall – A Structural Dependence on Imports

“US domestic silver production meets less than 30% of the country’s total demand. US importers will struggle to adjust” —ANZ

The U.S. faces a growing supply challenge, as domestic silver production covers less than 30% of demand. Mine output has been in steady decline, with production falling from 38moz in 2014 to 32moz in 2023.

With scrap supply shrinking by 1% over the past decade, alternative domestic sources cannot offset import dependence. The U.S. relies on Mexico and Canada for over 70% of its silver imports, but proposed tariffs threaten to disrupt these flows, increasing import costs and squeezing availability.

If a 25% tariff is imposed on Mexican and Canadian silver, the U.S. will struggle to replace these sources with Peru and Chile.

Scrap supply is not expected to expand meaningfully, as secondary silver requires higher price incentives to drive refiners to melt holdings.

Industrial demand, which accounts for 47% of total U.S. silver consumption, remains strong despite economic concerns.

“We believe this will keep the effective import cost high in the foreseeable future.”

On the demand side, industry and investor are the major sources of silver demand in the US, contributing more than 90% of the total demand (270moz). The bank expects the US supply-demand gap to remain as high as 190moz, almost 20% of global supply. Strong demand from sectors such as 5G, artificial intelligence, electric vehicles, and photovoltaics will remain supportive. Investment demand will benefit from tighter fundamentals and easing monetary policy.

4- Market Stress – Tariffs and the COMEX-London Spread

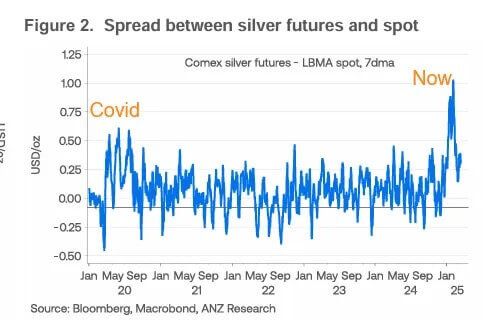

Investors, anticipating import restrictions and higher costs, have front-loaded silver purchases in the U.S., increasing demand for physical supply and widening the COMEX-London arbitrage.

“Threats of import tariffs creating a supply dislocation. Investors, keen to dodge impending tariffs, have been front-loading purchases of the metal in the US.”

- The spread between COMEX futures and London spot widened to USD 1/oz in January.

- This far exceeds the COVID-19 spread peak of USD 0.5/oz and dwarfs the historical average of USD 0.25/oz.

5- Structural Market Deficit — Persistent Tightness

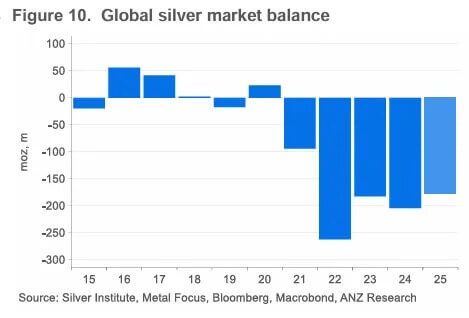

“The market deficit for silver is likely to continue for the fifth consecutive year.”

Despite an expected 2% increase in global silver mine production to 844moz in 2025, supply remains structurally tight, largely because primary silver mines continue to decline in importance.

Over 70% of silver is mined as a by-product of other metals, meaning even high silver prices won’t necessarily spur new mine supply.

Scrap supply will grow 6% in 2025, but this still leaves the market undersupplied by 180moz, down only marginally from the 200moz deficit in 2024.

Long-term investment in silver mining remains weak, limiting supply growth beyond 2027.

Finally, very little growth in global mine output is expected over the coming years, leaving mine supply estimated to peak at 856moz in 2027, according to Metal Focus.

6- The Catalyst for Silver’s Future Performance

“Investment demand will be crucial to see silver prices catching up with gold’s recent run”

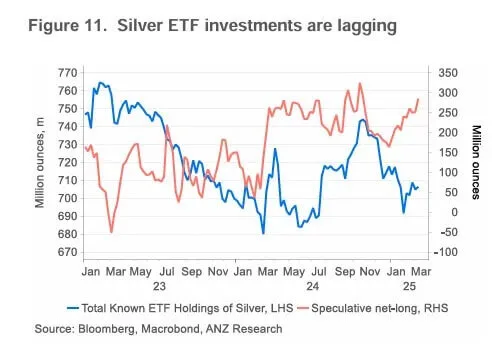

Investment demand will determine whether silver can close its valuation gap with gold. ETF holdings, which have declined for two years, are expected to recover as investors seek undervalued assets.

- Net-long speculative positions have surged by 96moz to 285moz, showing growing investor confidence in silver.

- ETF inflows, expected to rise by 40-45moz, would return holdings to early 2024 levels (745moz).

- Retail silver investment remains weak, but bar and coin sales could recover in 2025 as price stability improves.

Although geopolitical tension will remain as a driver of the gold price, the bank sees silver starting to find its value relative to gold. Silver will likely soon start getting support from monetary easing and supportive fundamentals.

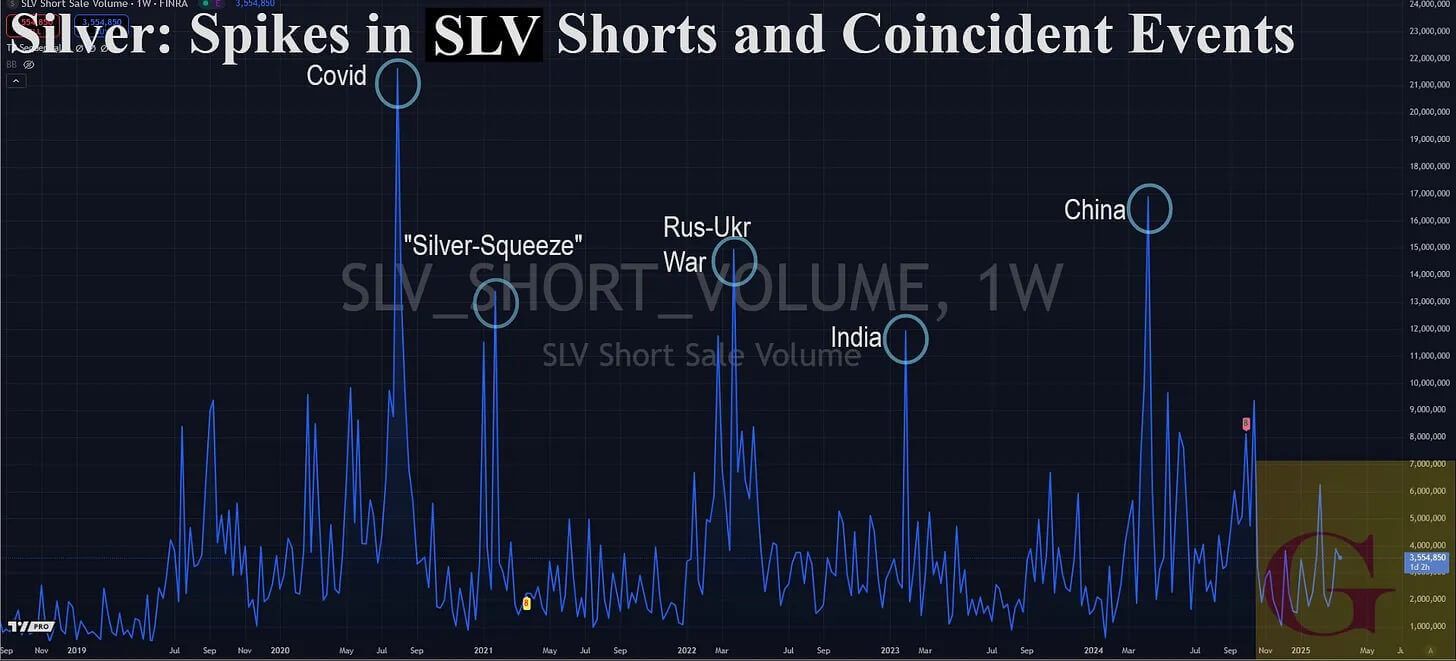

7- Preview: A Word on ETF Use and Abuse

One thing of note not covered in this report and well-worth mentioning is the overlap of industrial demand with investment demand as it relates to LBMA behavior. The ratio of LBMA silver stocks to silver-backed ETF holdings has fallen to a historical low of 1. This is in no small part because the LBMA banks are leasing any investment Silver they can get their hands on from others to satisfy US industrial demand.

Frankly, that is a big deal. It speaks to double-counting and the fractional reserve banking model failing in practice for Silver.

If demand increases for physical ETFs, then their increased bullion demand will push London and any other overly-leveraged short that much closer to a crisis.

Bullion banks know this. It has been observed here since 2011 when JPM’s Blythe Masters had her way with Silver. We intend to cover the phenomenon depicted below in a subsequent report. For now, here’s a “teaser” of sorts.

This isn’t even the good part… Wait until you see the current PSLV chart. More next week.

Stay tuned.

About the Author

Vincent Lanci is a commodity trader, Professor of MBA Finance (adj.) , and publisher of the GoldFix newsletter.