Precious Metals, Supply Chains, and Market Positioning

It’s been a very eventful week for markets, especially within precious metals and, within that complex, silver. As we prepare for the week ahead, it’s worth walking through what actually happened in price, and then moving directly into the drivers that matter going forward.

GoldFix is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

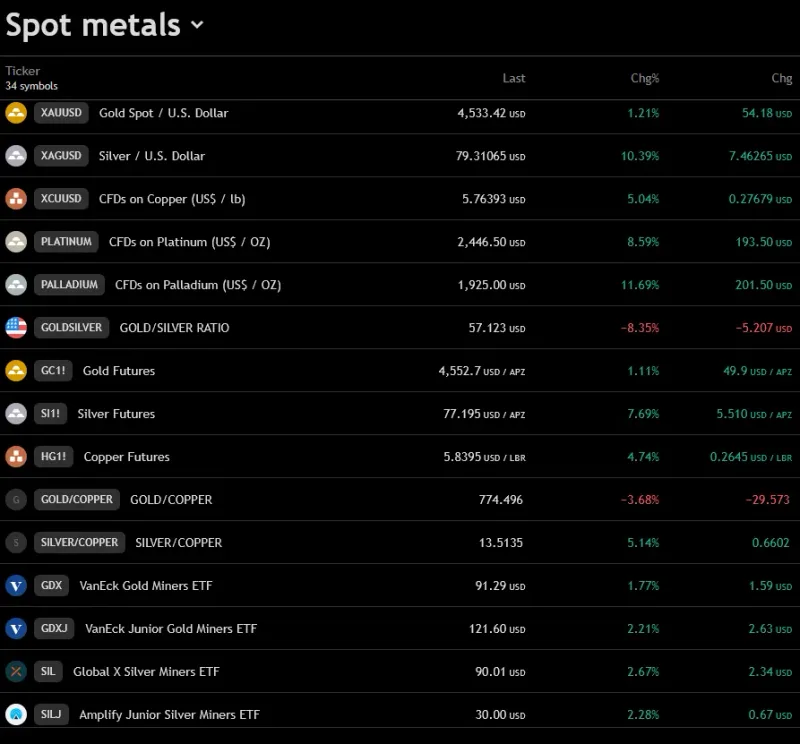

Weekly Performance: Precious Metals

On the week, spot gold rallied an impressive $193, up 4.47%, closing at $4,550. Gold opened essentially unchanged on the week, traded near but not above its recent all-time highs around $4,338, and nearly closed on both the weekly and daily highs on Friday at $4,549.96. Notably, despite this strong move, gold was the laggard within the precious metals complex.

Silver, by contrast, essentially closed on its top tick of the week. Spot silver was up $12.17, a whopping 18.1%, opening the week at $67.16. For the first half of the week, silver marched higher in a steady, methodical fashion. By midweek, however, the tone began to change. Coming back from the Christmas holiday, silver surged 10.47% on Friday alone, closing essentially at its high of the day and the week.

And even that does not tell the full story.

Asia Tells a Different Story

If you were watching silver from Asia, the price action was even more striking. After Friday’s close on the Shanghai Futures Exchange, silver had traded as high as $83, settling near $81 on a U.S. dollar equivalent basis. As of now, Shanghai futures imply silver trading at approximately $85 in U.S. dollar terms.

There are also unconfirmed reports of silver trading near $90 in Australia, though those prices have not yet been independently verified.

Platinum and the Rest of the Complex

Platinum actually topped silver for performance on the week. Platinum rallied $467, up 23.6%, opening near $1,979, never downticking during the week, and closing near the highs. The metal made a high of $2,475 and last traded around $2,446, up $193 on Friday alone.

Friday’s session was particularly notable across the complex:

- Gold up 1.19%

- Silver up 10.47%

- Platinum up 8.59%

- Palladium up 11% on the day

On the week, palladium was up 12.44%.

This was a monumental week for precious metals, and it did not happen in a vacuum.

Structural Drivers Now in Focus

Several structural factors have either become newly apparent or impossible to ignore.

First, it is now broadly understood that beginning in January 2026, China will restrict silver exports, effectively placing silver on the same footing as gold. Metal may check into China, but it will no longer freely check out.

This matters on multiple levels. China is a major silver producer, and restricting exports tightens global supply immediately. It also directly impacts London, particularly the LBMA, which continues to present itself as a global warehouse for silver despite not functioning in that role since the short squeeze crisis in October.

Importantly, China has been a lender and leaser of silver to London over the past 90 days. The decision to remove Chinese silver from export availability signals a tightening supply picture that will hit London first, and eventually the U.S. as well.

Second, the United States has formally designated silver as a critical mineral. This changes incentives. The U.S. can now discourage outward availability, permit domestic hoarding, and subsidize industries that consume silver, further tightening accessible supply.

Demand Pressures Are Rising Simultaneously

At the same time, demand is increasing across multiple fronts.

Over the last two months, there has been a substantial physical pull of silver into India and the Middle East, likely in anticipation of a forthcoming tokenized silver investment vehicle. Industrial demand is also accelerating. Electric vehicles and battery technologies are becoming more feasible, and companies such as Samsung have announced direct stakes in silver mines, effectively locking in physical supply for the next several years.

ETF demand adds another layer. Investment flows into silver ETFs pull metal into warehouses across Shanghai, India, Europe, and especially the United States, removing additional supply from circulation.

Taken together, these forces highlight a long-standing reality: global silver markets have been masking a production shortfall by drawing down inventories from every corner of the world and reallocating them. That mechanism is now breaking down.

Geopolitics and the Western Hemisphere

All of this is unfolding alongside escalating geopolitical tensions. The United States is increasing pressure on Venezuela and embargoing its oil exports, part of a broader shift toward asserting tighter control over the Western Hemisphere. North and South America are increasingly being treated as strategic supply zones under a revived, monetized version of the Monroe Doctrine.

That matters for commodities broadly and silver specifically.

What This Means for the Week Ahead

As we head into the final trading week of 2025, conditions are set for potential fireworks in silver, gold, and platinum, with silver commanding the most attention.

While equities and bonds remain on the radar, they are simply not the focal point right now. Global equity markets are in holiday-quiet mode, with U.S. exchanges closed for the weekend and major indexes lingering near record levels. Investors are digesting year-end positioning, global growth signals, oil weakness, and looking ahead to economic data and central-bank commentary in 2026.

U.S. equities ended last week near multi-year highs, with the S&P 500 approaching the 7,000 level, despite thin holiday trading.

We’ll see what the coming week brings. But in commodities, and particularly in silver, the market is no longer whispering. It is signaling loudly that structural constraints are asserting themselves.

Good Luck.