“Silversqueeze” Done, Platinum-Pump Next?

Critical Observations

- Platinum & Palladium emerge as structurally underpriced due to durable automotive demand, delayed scrap supply, and persistent underinvestment in mining, with upside potential materially above consensus estimates into 2026.

- Silver bears the most contemplation here as it shifts from squeeze conditions toward inventory saturation according to Ghali, with volatility driven by liquidity distortions and prices expected to normalize into the mid-$40s. Ghali is the first we know of to take this position. It is not without merit. The shorts could wait this out. But if they are not able to wait, Ghali may be early in his call of the Silver squeeze demise. Finally, the market knows there is a Silver deficit now. It does not seem to be looking at the aforementioned PGM risk. So Ghali’s points are well taken. Platinum may be “where the puck goes to next” borrowing Wayne Gretzky’s analogy.

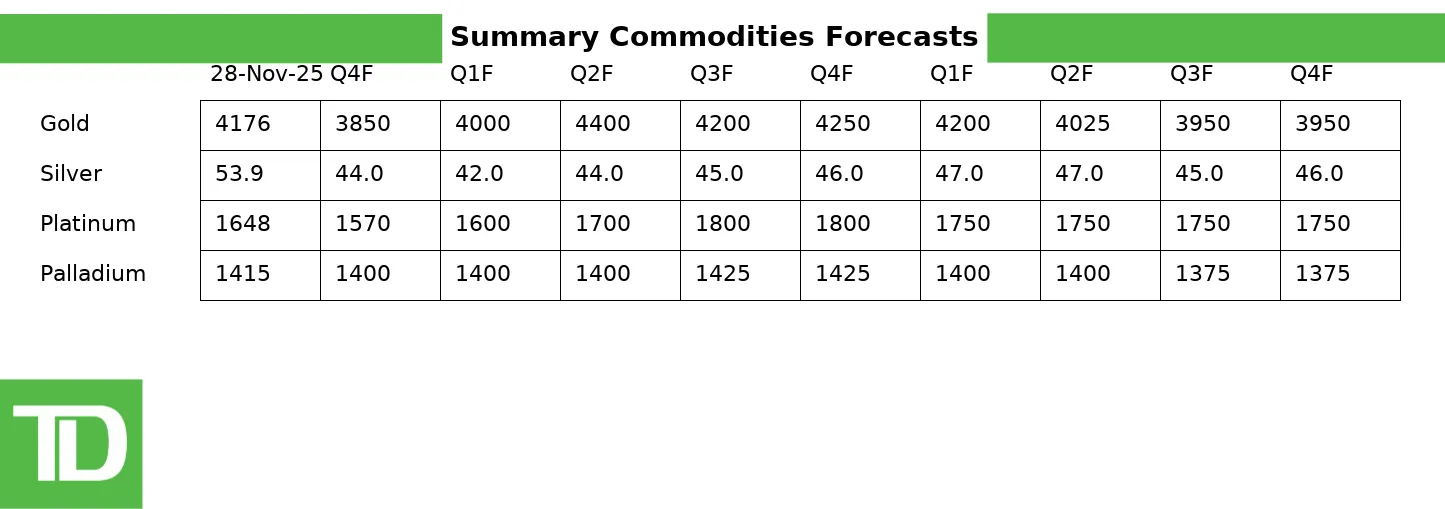

- Gold remains the primary beneficiary of monetary stress, fiscal deterioration, and institutional diversification, with a projected trading regime centered near $4,400/oz in early 2026.

Platinum & Palladium: Structural Deficits Beneath Consensus Pessimism

“Small changes in vehicle density can result in immense changes in auto sales and associated PGM demand.”

— Dan Ghali, TD Securities

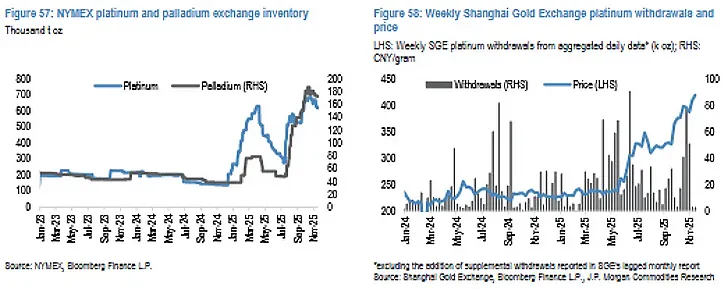

TD’s second most contrarian thesis centers on platinum and palladium. Prevailing market consensus assumes structural erosion of internal-combustion vehicle demand, affordability constraints linked to tariffs, and accelerated scrap recovery will narrow current deficits toward market balance or even surplus. TD’s proprietary modeling offers a differing outlook.

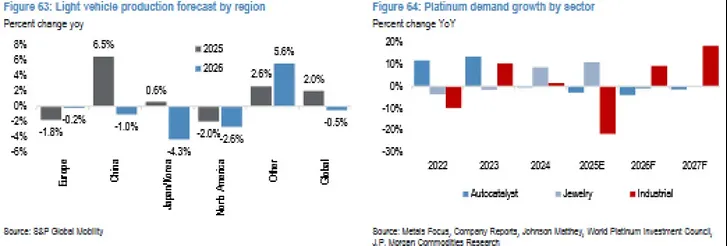

Vehicle-density surveys indicate sustained growth in North American household fleet ownership driven by de-urbanization trends. Small variations in density assumptions produce large shifts in automotive demand, with TD estimates suggesting that a two-percentage-point annual variation can swing platinum demand by over 400,000 ounces and palladium demand by approximately 1.7 million ounces.

Interestingly, JPMorgan concurs on Platinum on both squeeze risk and fundamentals, but does not think Palladium upside risk will be long-lived.

TD projects rising U.S. vehicle density and highlights persistently low dealer inventories as indicators of strengthening auto production. Global growth forecasts support continued ex-U.S. demand stability.

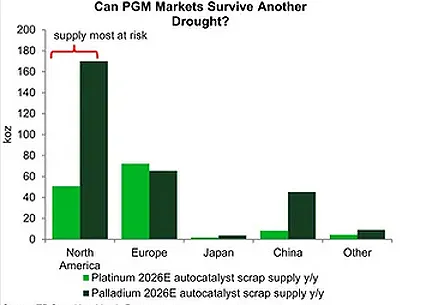

On the supply side, TD disputes prevailing scrap-boom expectations. Rather than rapid secondary-supply growth, TD expects scrap recovery to remain delayed until at least 2027. Regional scrap flows from North America are projected to remain broadly unchanged, diverging from consensus estimates for sizeable increases in platinum and palladium recycling volumes.

Combined with structural underinvestment in mine supply, this outlook supports persistent market deficits extending into the later years of the decade.

Trade policy introduces asymmetric upside risk. TD notes that Section 232 investigations could place PGMs within the tariff review framework. Even if negotiated exemptions follow, a deferred implementation window could encourage speculative stockpiling cycles similar to earlier silver dynamics. Palladium is identified as particularly underappreciated within this risk profile.

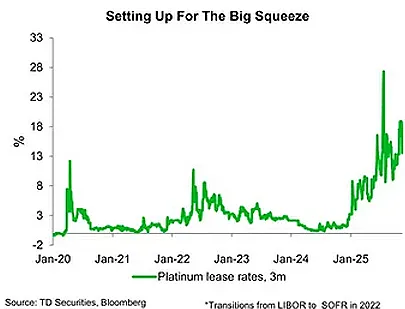

TD designates platinum and palladium as top commodity selections for 2026, with price forecasts approximately 20% above prevailing market consensus. Tighter forward curves and higher lease rates are expected to accompany structurally constrained supply conditions.

Silver: From Scarcity Premium to Inventory Overhang

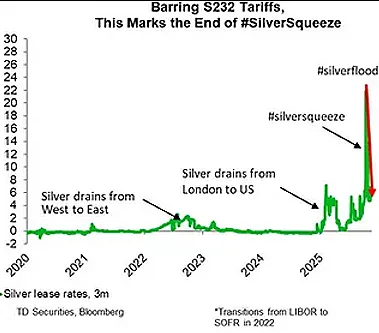

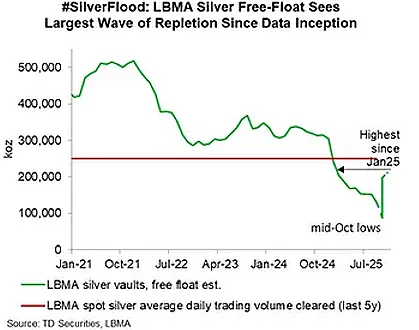

“Heading into 2026, an epic-scaled #silverflood has resulted in the single largest wave of repletion in LBMA free-floating inventories on record.”

— Dan Ghali, TD Securities

TD assesses that silver’s market structure has shifted materially over the past year. What began as a developing physical squeeze has transitioned into the largest inventory replenishment event observed in modern precious-metals trading. More than 212 million ounces of silver are now estimated to be freely available within LBMA vaults, effectively reversing over a year of cumulative drawdowns. At prevailing price levels, supply from private-vault liquidation and scrap recovery has returned to the market.

Despite this replenishment, prices have remained near historical highs. TD attributes this resilience to distorted liquidity conditions rather than renewed physical tightening. Spot trading volumes have declined by roughly 65% from recent peaks, leaving prices increasingly sensitive to derivatives-related volatility and gamma-hedging flows. Volatility curves have inverted, with ETF implied volatility pricing above futures-market volatility, a movement TD interprets as rising speculative participation exceeding traditional basis-trade activity.

Options markets reinforce this dynamic. Elevated call skews on popular silver ETFs resemble conditions that prevailed during the 2022 retail squeeze episode, which preceded a notable price decline. Shanghai exchange tightness, often framed as evidence of ongoing scarcity, is characterized as a function of flow dislocation rather than a reflection of global supply shortage. Arbitrage windows remain closed, and TD expects existing incentives to encourage a gradual reappearance of inventory on Chinese exchanges.

The firm concludes that the primary silver-squeeze phase has ended. A renewed imbalance would require either meaningful erosion of above-ground inventories in Shanghai and New York or implementation of export controls that inhibit physical rebalancing, including Section 232 tariffs. Absent these catalysts, the replenished liquidity environment in London presents downside correction risk relative to late-2025 highs.

Industrial demand trends further weigh on silver’s outlook. TD identifies weakness across solar fabrication, jewelry, silverware production, and physical investment demand. Relative to gold, silver’s role as a debasement hedge remains weaker, limiting its defensive function during periods of monetary stress.

TD’s forward projections anticipate price normalization into the mid-$40s as elevated inventories and softer industrial demand reassert influence over market valuations.

Gold: Monetary Drift Becomes Monetary Bid

“The Fed-driven carry cost reductions, along with an expected yield curve steepening and potential concerns surrounding Fed independence, prompt us to say that the yellow metal will reach a new quarterly record of $4,400/oz in the first six months of 2026.”

— Dan Ghali, TD Securities

TD’s gold outlook is rooted in both the erosion of monetary credibility across advanced economies and the evolving policy environment. Rate cuts, yield curve steepening, and political pressure on the Federal Reserve are treated as reinforcing forces compressing real rates and weakening confidence in inflation discipline. TD emphasizes the growing uncertainty surrounding whether the Federal Reserve will remain able or willing to defend the 2% inflation mandate amid surging public debt and rising political constraints.

The macro environment is described as one in which dollar debasement, de-dollarization, and de-globalization trends continue to mature. These dynamics are expected to reinforce central bank gold purchases while encouraging asset allocators to reconsider classic portfolio frameworks. TD references a move away from the traditional 60/40 structure toward asset mixes incorporating as much as 25% commodity exposure, a shift that structurally increases demand for gold alongside falling policy rates.

Short-term volatility remains possible. The firm acknowledges potential headwinds including intermittent dollar strength, fluctuations in the pace of rate cuts, changes to VAT treatment for Chinese gold purchases, and periodic technical overbought conditions. TD does not view these factors as sufficient to disrupt the broader bullish trajectory. The firm expects gold prices to advance once easing becomes firmly established within the context of weakening growth, persistent inflation overshoots, and a more politically dovish Federal Reserve composition.

TD’s regime view establishes a new secular trading corridor for gold between $3,500 and $4,400 per ounce. Sustained pricing below the lower bound would require renewed strength in U.S. risk assets, renewed confidence in labor-market resilience, and the abandonment of rate-cut expectations. Such outcomes would also require a reversal of debasement and monetization narratives. TD’s base case assumes none of these conditions emerge. Instead, the firm anticipates continued labor-market softening, fragile equity markets, ongoing monetary easing, and inflation persisting above target.

Fiscal deterioration compounds the outlook. Rising U.S. debt trajectories, exposure to revenue rebates should certain tariffs be invalidated, and competition for capital from expanding European sovereign issuance constrain Washington’s ability to manage long-end yields without aggressive liquidity operations reminiscent of past balance-sheet interventions. TD views such measures as functionally analogous to renewed quantitative easing, further strengthening the monetary case for gold.

Across central banks, ETFs, and speculative trading flows, TD expects demand convergence to intensify. Their formal projection targets an average quarterly gold price of $4,400 per ounce in the first half of 2026, with intermittent upside excursions above that level.