Wyoming Establishes $10 Million State Gold Reserve in Historic Move

In a significant shift toward sound money principles, Wyoming has enacted legislation that requires the state to hold physical gold and silver as part of its investment portfolio. Senate File 96, also known as the Wyoming Gold Act, was sponsored by Senator Bob Ide and recently passed with strong support in both chambers of the Wyoming legislature.

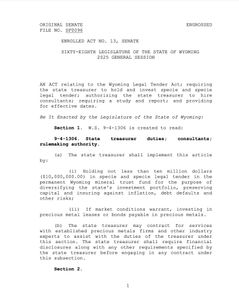

The Wyoming bill, which will be effective January 1, 2026, mandates that the state treasurer hold no less than $10 million in gold and silver specie (physical coins) and specie legal tender as part of the permanent Wyoming mineral trust fund. This move represents one of the most substantial state-level precious metals acquisitions in modern American history.

A Strategic Investment Decision

According to the legislation, the primary purposes of this gold reserve are “diversifying the state’s investment portfolio, preserving capital and insuring against inflation, debt defaults and other risks.” This strategic pivot comes at a time when many investors and governments worldwide are reconsidering traditional currency holdings amid economic uncertainties.

The bill authorizes the state treasurer to invest in precious metal leases or bonds payable in precious metals if market conditions warrant. Additionally, the treasurer may contract with established precious metals firms and industry experts to assist with implementation.

Study on Gold and Silver Payments

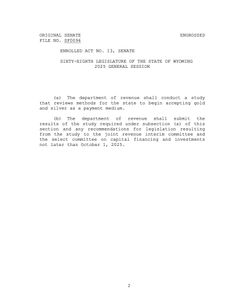

Beyond establishing a physical gold reserve, the legislation directs the Wyoming Department of Revenue to conduct a comprehensive study on methods for the state to begin accepting gold and silver as payment mediums. The department must submit its findings and any recommendations for further legislation to the joint revenue interim committee and the select committee on capital financing and investments by October 1, 2025.

This provision potentially lays groundwork for Wyoming to expand the role of precious metals in state finances beyond just holding them as assets. In committee testimony, Joe Cavatoni, of the World Gold Council, a non-profit membership organization that champions gold as a strategic asset while shaping a responsible and accessible gold supply chain, advised state legislators of the WGC’s willingness to consult with representatives of the State Treasurer’s Office and of the Department of Revenue for the creation of the study as mandated by the Wyoming Gold Act legislation at no additional cost to the State.

The Bill Became Law

On February 24, 2025, The Wyoming Gold Act became the law of the land. Senator Bob Ide, the primary sponsor of the legislation, positioned this bill as a prudent financial move for Wyoming in uncertain economic times. The state joins a growing number of jurisdictions reconsidering their approach to monetary assets and legal tender laws.

Implications for Wyoming and Beyond

The Wyoming Gold Act represents one of the most concrete steps by any U.S. state toward embracing precious metals as both an investment strategy and potential medium of exchange. Financial analysts suggest this could inspire similar legislation in other states, particularly those with conservative fiscal policies or concerns about inflation and federal monetary policy.

As implementation approaches in 2026, Wyoming’s experience will likely be closely watched by other states, economists, and precious metals advocates as a potential model for state-level monetary diversification.

The state treasurer’s office will now begin preparations for implementation, including developing procedures for securely holding physical gold and silver and potentially engaging with industry consultants as authorized by the legislation.

Part of a Growing Movement

Wyoming isn’t alone in its pursuit of sound money principles. In recent years, several states have advanced similar initiatives aimed at reducing reliance on federal fiat currency and protecting against inflation.

Tennessee led the way in 2023 by passing legislation authorizing its treasurer to purchase and directly own gold and silver bullion for state reserves.

Texas has proposed establishing gold-backed digital currencies and purchasing billions in precious metals for its state-run bullion depository. Meanwhile, Kansas has recently introduced legislation to establish a state bullion depository with gold reserves, and Idaho has considered authorizing direct state ownership of physical precious metals.

This wave of state-level gold initiatives reflects a broader movement toward financial independence and alternative monetary policies. As economic uncertainties persist, Wyoming’s bold $10 million commitment to physical gold positions it at the forefront of this growing trend, potentially inspiring similar action across other states concerned with preserving wealth and hedging against various financial risks. and investment returns, provide a stable foundation for this pioneering financial experiment.