Dieser Gastbeitrag wird von Vince Lanci zur Verfügung gestellt.

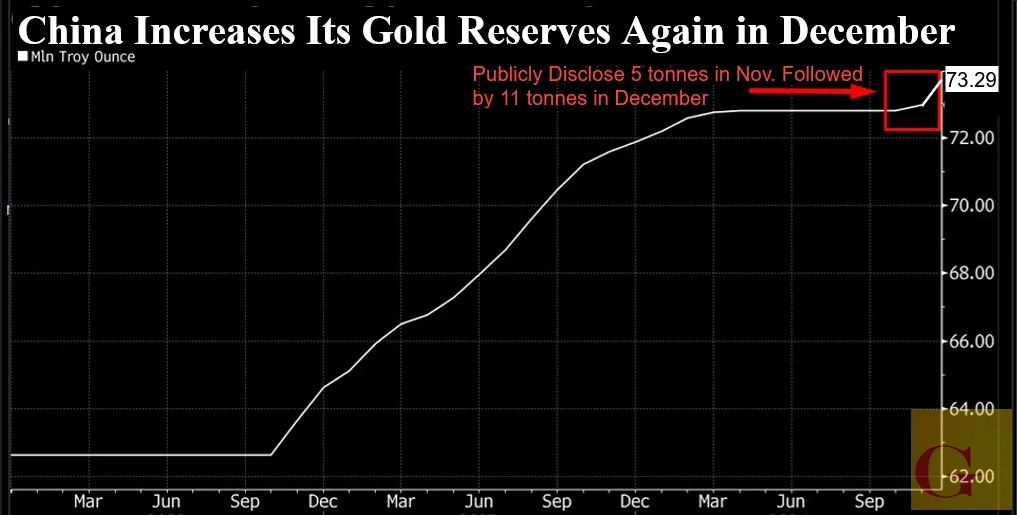

China’s Central Bank Adds Over 11 Tonnes to Gold Reserves in December

People’s Republic of China doubles its November public purchases, adds 355,265 troy ounces of Gold in December.

The People’s Bank of China (PBOC) reported an increase in its bullion reserves to 2,279.63 tonnes in December, up from 2,268.58 tonnes in November, according to data released Tuesday and according to a Bloomberg report

China’s central bank expanded its gold holdings for the second consecutive month in December, signaling their continued commitment to dedollarization despite gold prices being higher over 25% in 2024.

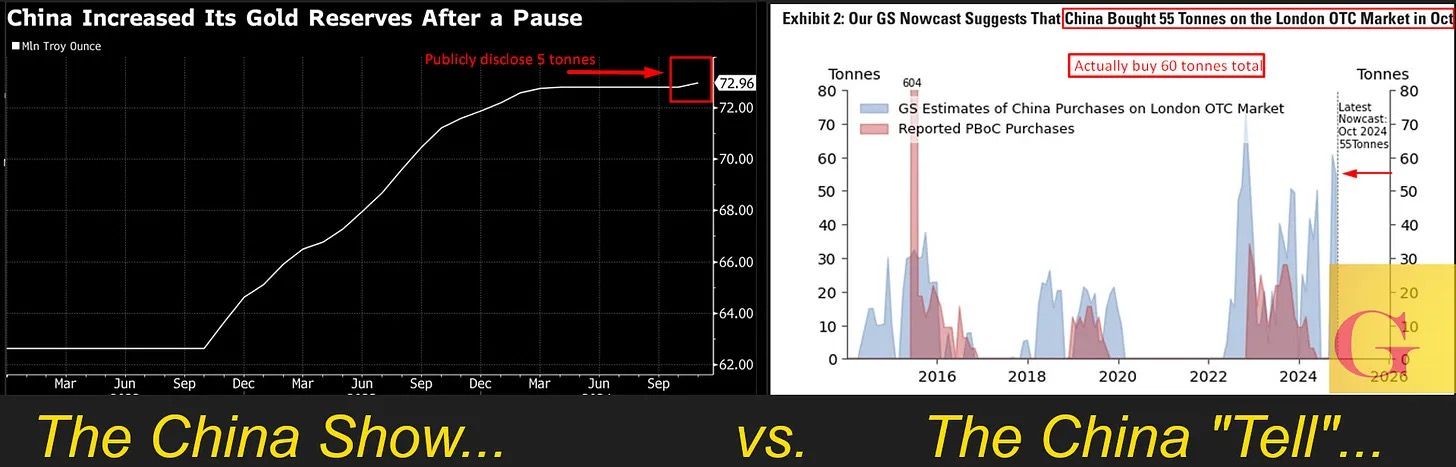

It should be noted this is gold purchased by their central bank publicly and does not include any bullion purchased by China using the LBMA physical spot market privately.

What About The LBMA Gold?

For reference, China purchased 5 tonnes in November, and according to Goldman Sachs proprietary “Nowcast” model, they purchased an additional 55 tonnes under the radar. China’s OTC purchases in November were 10x their publicly disclosed buys.

China’s November Gold Purchases…

From: Goldman Pushes Back Amidst Massive China OTC Buying.

China Buys 10x More Gold Than Publicly Stated

The bank’s October nowcast revealed 64 tonnes of central bank purchases on the London OTC market, compared to a pre-2022 monthly average of 17 tonnes. Within that analysis, China reportedly added 55 tonnes of gold, far exceeding the official figure of about 5 tonnes released by the People’s Bank of China (PBOC). This suggests China is acquiring gold at nearly 10 times the rate it publicly admits.

If that ratio holds, assume up to an additional 100 tonnes were bought via OTC.

The People’s Bank of China (PBOC) reported an increase in its Goldbarren reserves to 2,279.63 tonnes in December, up from 2,268.58 tonnes in November (a net add of 355,265.235 troy ounces), according to data released Tuesday.

This follows the PBOC’s decision to resume gold purchases in November after a six-month hiatus.

The move highlights Beijing’s ongoing strategy to diversify its reserves, even with gold trading near historic highs. In 2024, gold prices surged to record levels, fueled by U.S. monetary easing, heightened safe-haven demand, and consistent buying by central banks worldwide.

However, the rally has lost momentum since Donald Trump’s U.S. election victory strengthened the dollar. Earlier this week, Goldman Sachs revised its gold price outlook, delaying its $3,000-per-ounce forecast, citing fewer expected rate cuts by the Federal Reserve in 2025.

China’s actions underscore its broader geopolitical and economic goals, as it continues to strategically accumulate gold, balancing currency dynamics and global market shifts.

Original Title: China Increases Gold Reserves Again in December

Über den Autor

Vincent Lanci ist Rohstoffhändler, Professor für MBA Finance (adj.) und Herausgeber des GoldFix Newsletter.