Dieser Gastbeitrag wird von Vince Lanci zur Verfügung gestellt.

Gold and Silver are Moving—And It’s Not Just Tariffs

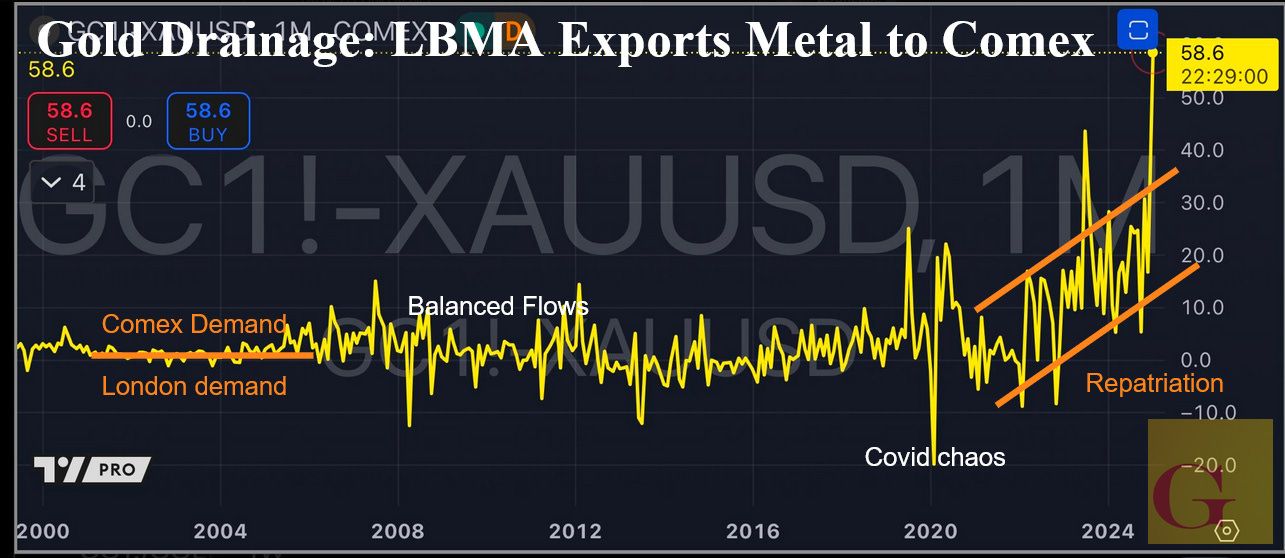

Gold and silver are being pulled into New York for reasons beyond tariffs. Days ago, we labelled the phenomenon as repatriation. A new pipeline is now draining metal from the LBMA, just as another has been pulling gold and silver toward China through Switzerland for years.

Today, ZeroHedge published a premium post on the same issue. While they avoided the word “repatriation,” they openly questioned why gold is moving to COMEX, concluding that tariffs alone don’t explain it. Their report highlighted contradictions from officials managing the narrative.

Contradictions in the Official Story

Their post starts by questioning the official story out of London

The Financial Times (FT), usually indifferent to gold flows, made an exception this time. The official explanation? Logistics. Too much gold moving too fast. Yet the same sources also cite liquidity issues, a lack of free-floating gold, and the need to borrow from central banks.

Which is it? A temporary logistical issue or a shortage of metal?

Consider this contradiction from the same FT article as noted by ZH:

“The movement of gold needed to make its way into New York, that is basically what has been driving ‘stockpiling’,” said Joe Cavatoni, market strategist at the World Gold Council. “That is leading a lot of people to say, ‘we want to get ahead of it’, and that is driving the futures market into a premium.”

At the same time, he claimed:

“We are not getting a sense from the rhetoric from the administration that it intends to go after the monetary metals.”

If tariffs aren’t the issue, what’s the rush?

Reality: Gold Has Been Moving for Quite a While

This isn’t new. The media ignored it, and bullion managers in London hoped it would go away. But it has been accelerating since August 2023, when the China premium emerged. China was first seen taking delivery of gold from the U.S. in October of that year.

In November, we reported that a U.S. bullion bank facilitated this delivery. From Exclusive: China Took Delivery of US Gold Last

Now we can say here, that two unconnected sources confirm the delivery of Gold in China from the USA. One with close Bullion bank ties stated: [T]he Chinese have definitely taken delivery of a bunch of physical New York gold in response to that arb.

Despite this, U.S. demand for gold surged, likely to at first offset the outflow to China out of NY. But now it is overtaking China exports

The bottom line: gold is being repatriated to the U.S.

The Data Confirms It

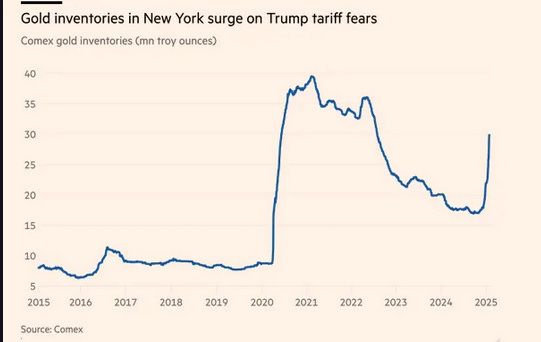

The two charts below shows this shift, reflecting COMEX demand vs. London’s physical supply. First we can see the change in metal stored using a chart provided by the FT itself.

Note the increase in vaulted bullion in New York spiked during Covid first. That was followed by an orderly drawdown. The second spike only just started in January of this year.

However the chart below reveals something even more strange. New York demand for London metal has been increasing since August of 2023 despite the increase in metal only visibly manifesting in 2025.

The same exact pattern can be easily seen in Silver as well. Bank of America just last week raised the point that Silver may become monetized again by Central Banks and Sovereign wealth funds which we covered exclusively for Scottsdale Mint just last week.

From Silver EFPs: The Canary in the Mine

[S]mall shifts in central bank FX reserves could make a difference to the white metal: at current spot prices, the silver market is valued at around $30BN versus total foreign exchange reserves of $15TN. Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply.

Therefore both Comex precious metals have been going in one door and out the other since August 2023. But now, for some unspoken reason, the US has stopped making deliveries. The fresh incoming Gold and Silver are staying in NY. Why?

The Media’s Narrative

The FT and others frame this new drainage event as a tariff-driven shift which provides a convenient scapegoat:

“Trump’s tariffs are why gold is leaving London.”

In reality, the volume of gold leaving the LBMA far exceeds what tariffs alone would explain. The U.S. is pulling gold back, just as China has been.

Where the Gold Is Really Going

Zero Hedge highlights here what we’ve also been saying: London’s gold pool is drying up. The media ignores the bigger picture—gold has been flowing out of London to China at a far greater scale than to the U.S.

Since late 2024, central banks have ramped up gold purchases, pushing prices to $2,800 per ounce. The biggest buyer? China.

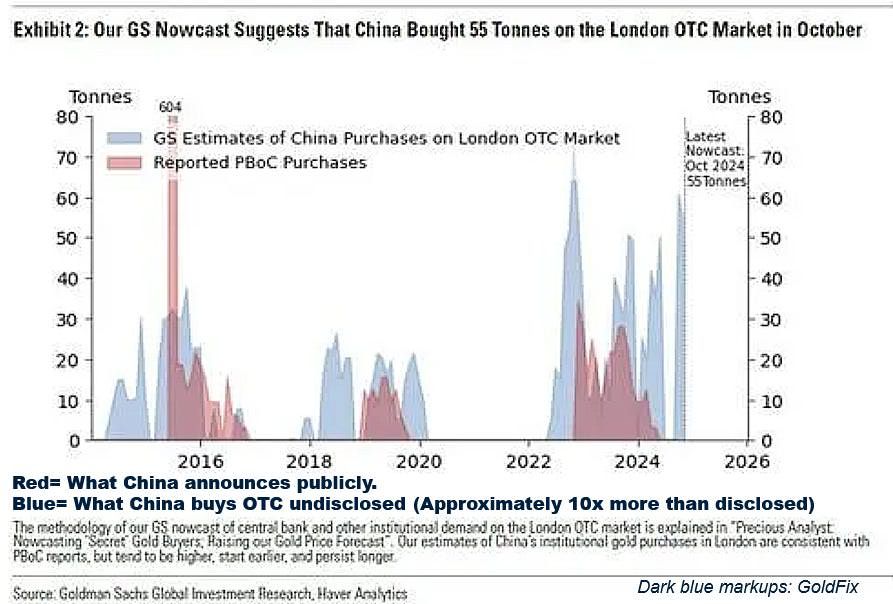

Gold has been leaving London for both the U.S. and China for some time now. The China-tell is in this Goldman Sachs’ analysis, which shows China’s real demand far exceeds official numbers.

London’s role as the world’s gold hub is fading. The LBMA has operated on the assumption that gold can always be leased. That model is breaking down. Basel III, de-globalization, and central bank accumulation are reshaping the market. Nations are preparing to use their Gold and Silver in Trade once again.

Global Stackers: Repatriating Gold and Silver

The repatriation trend started in 2016 with Germany finally getting its gold back 3 years after asking for it, then the trend moved to China, India, and now the U.S. Everyone wants their gold back.

The LBMA is losing relevance as a centralized depository. Gold is going regional. The global order is shifting. And the East-West divide is now final, with assets being divided.

Why? Because in a world where gold is tier-one capital, owning it outright matters. Stackers are indeed ascendant.

London’s Gold Pool is Running Dry

The rapid outflow of gold has raised alarms. Critics of the LBMA—long suspicious of double claims and commingled metal—are seeing their concerns validated.

We’re not saying London doesn’t have the gold. But the freely available supply looks much smaller than assumed.

We once said that Fort Knox, were it opened, might have nothing but Moths and half-eaten IOUS in it. It’s quite possible those IOUs and the moths eating them are being exported to London right now in exchange for the real thing.

Why is The Old System is Breaking Down?

In an era of Basel III, de-globalization, and rising demand for gold as money, the model of leasing and rehypothecation no longer holds.

The gold is leaving. The world is taking it home.

And the U.S. is no exception.

Fort Knox jokes aside, the acceleration of this trend suggests something bigger is at play. The U.S. wants its gold back—just like everyone else.

Final Thought

The question as raised by ZeroHedge is: What has spooked the world’s savviest investors to suddenly park as much as gold in vaults some 100 feet below Manhattan all of a sudden?

The answer offered is: Just as Gold and Silver were were expatriated stateside during Covid it is again being bought. The price of gold futures in the US remaining much higher than in London just might have little to do with Trump tariffs and more to do with the US needing its metal supply chain reshored

In a word, Repatriation is part of the implied answer. Repatriation to what ends is the final question we all hope to have the answer to soon.

Über den Autor

Vincent Lanci ist Rohstoffhändler, Professor für MBA Finance (adj.) und Herausgeber des GoldFix Newsletter.