THE 60-TON REVELATION

China has been covertly amassing gold since May 2024, with September data revealing Beijing imported 69 tons (2,218,076.65 troy ounces, valued at $5.87 billion at $2,645/oz). This matches UK export data of approximately 60 tons to China, with the 9-ton difference potentially attributed to Swiss exports.

THE LONDON CONNECTION

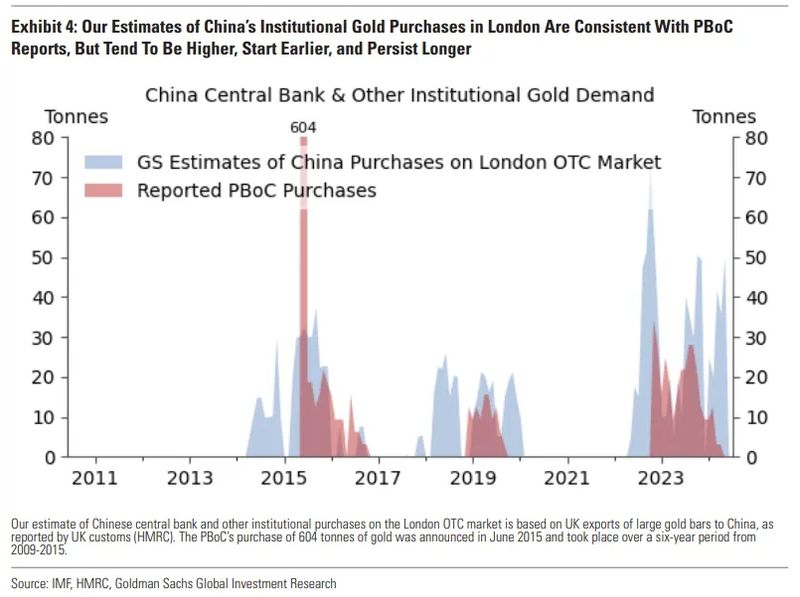

The People’s Bank of China (PBoC) operates through sophisticated channels, notably the London Bullion Market via bullion banks. A key indicator: while the Chinese private sector prefers 1 kg bars, these imports are in 400-ounce London bars—a signature of central bank acquisition. The process bypasses the Shanghai Gold Exchange (SGE), where all private gold transactions typically must occur.

This pattern emerged strongly after the Ukraine conflict, with evidence showing imports continue even when SGE trades at a discount—a clear signal of central bank rather than private sector buying. The PBoC typically takes up to a year to publicly report acquisitions and keeps about 65% of purchases hidden.

HIDDEN IN PLAIN SIGHT

Further evidence of this covert strategy appears in the divergence between World Gold Council estimates of central bank purchases and official IMF reports. This discrepancy has widened significantly since early 2022, when Western nations froze Russian dollar assets, prompting increased gold acquisition by Eastern central banks.

The People’s Liberation Army conducts independent purchases, creating a dual-track acquisition strategy that further obscures the total volume of China’s gold accumulation. Meanwhile, other BRICS nations, particularly Saudi Arabia, are employing similar tactics, though at smaller scales.

GLOBAL MARKET IMPACT

Goldman Sachs notes this systematic accumulation has fundamentally altered gold markets. With Western institutional investors also increasing gold holdings through ETFs and direct purchases, the market faces unprecedented pressure from both hemispheres. This “perfect storm” for gold prices shows no signs of abating, driven by ongoing geopolitical tensions, fiscal deficits, and a broader strategic realignment in global financial power.

Image Source: vblgoldfix

The pattern suggests a long-term strategy to rebalance global debt levels and power distribution, with gold serving as a key mechanism in this transition.

News Sources:

VBL

Money Metals