Cette contribution d'un invité est fournie par Vince Lanci.

“Using our quarterly price changes model, we see gold prices rising to well over $3,300/oz, though we view this is a bull case given the potential for jewelry and scrap over the next 12 months. We take a more conservative base case… which suggests gold increases to $2,900-3,000/oz over the next 6-12 months.”

– Citi Metals

Bullion Bank Joins Team $3,000+

This change in risk metrics was significant as it acknowledged China/BRICS demand and set the table for price-target upgrades regardless of what the Dollar or interest rates did. And that is exactly what we got. Gold and Silver rose dissuaded neither by Dollar strength nor higher rates since those reports in August.

Citi Says More Upside is Coming

With this latest analysis, Citi joins the $3,000 club and describes more specifically the rationale for potentially even higher prices.

Here’s a breakdown of that new report:

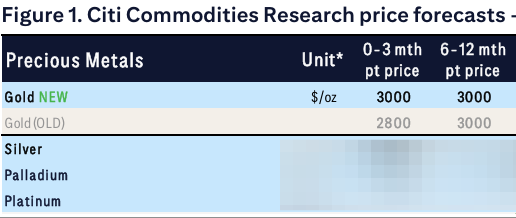

Bottom Line: Target Raised

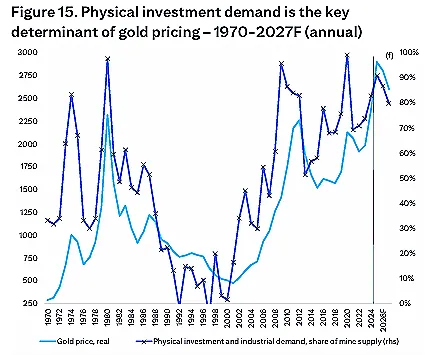

Gold’s strength has led the bank to raise its short-term target to $3,000/oz, with longer-term targets holding steady at the same level for now (see below). The reason: 95% of mine supply is expected to be absorbed by investors by late 2025, leaving little room for price declines.

There are 4 main reasons for the price target hike and their ongoing bullishness. The Bank shares some in-depth analysis drilling into the specifics of how the secular drivers of physical Gold demand are manifesting in reality. In short, they’ve done the work.

Citi’s 4 Main Reasons

1- Mine Supply is All Spoken for Now

The exact word they used was “extremely” as in: “Investment demand should underpin extremely high gold prices by historical standards.”

2- Physical Demand is Both Growing et Broadening

3- The Return of Western Investors

It is particularly notable Citi is very much in the camp an economic slowdown is coming to the US. They view this as a time when investors will put a large portion of their wealth into Gold and Silver as they extricate themselves from Tech stocks. interestingly, Michael Hartnett, the respected CIO at BofA and a Gold and Silver bull himself of late has also intimated this. More on that below.

4- Gold Tariff Calculus is Bullish

Citi does not expect gold to be included in broad tariffs during Q2 2025, given its status as a financial asset and the legal tender classification of gold coins. However, if initial tariff announcements lack explicit exemptions, U.S. premiums could spike. Current COMEX vs. LBMA spread trading suggests a ~20% probability of gold being included. Graphics illustrating their points are included.

More importantly tariffs can only drive gold prices higher because implementation of them is a road to sanctions and wealth confiscation for nations subject to them.

Tariffs are bullish for Gold because they are bearish for Trust. Citi believes tariffs, if implmented will add at least 2% to Gold prices and 5% to Silver. We and other banks believe the threat of tariffs as long as Trump is President present a real threat for sovereigns seeking to protect their wealth and avoid what happened to Russia in 2022.

Next we explore the Geopolitical and Economic drivers behind those reasons. followed by the bank’s final price determinations for 2025.

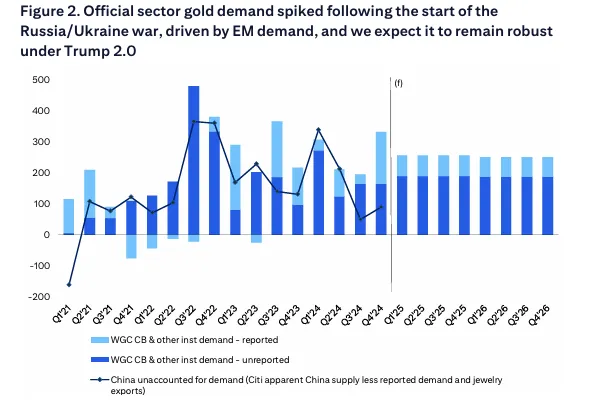

Trump 2.0 Accelerates et Broadens Dedollarization

Drilling down into Citi’s work points to sustained central bank and institutional gold demand over the next 2–3 years, keeping prices elevated. Trump’s policies are expected to reinforce reserve diversification trends among emerging market (EM) central banks. Trade tensions and a strengthening U.S. dollar further incentivize EM central banks to increase gold holdings as currency support.

The first major wave of dedolllarization began following the Russia-Ukraine war start. China, India, and Turkey led initial purchases, with smaller EM nations also reporting sizable buy-ins. By 2H’24, multiple CEEMEA nations, including Poland, expanded reserves, with Poland on track to reach 20% gold holdings. While some nations, such as Azerbaijan and Uzbekistan, have reached their reserve allocation targets others including Serbia, have recently increased gold buying, citing diversification needs.

In summary, Dedollarization is both accelerating and broadening under Trump.

Investor Demand Will Surge on Geopol Risk et Recession Fears

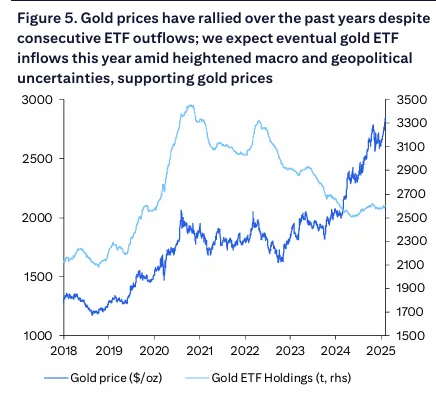

Gold prices have rallied over the past years despite consecutive ETF outflows; we expect eventual gold ETF inflows this year amid heightened macro and geopolitical uncertainties, supporting gold prices.

On the domestic front economically speaking, they also note Gold prices tend to rise both going into and coming out of US downturns historically, as illustrated by broad measures of US unemployment.

According to the bank, U.S. labor market data reflect continued weakness despite a brief post-election rebound. Citi’s Economics department anticipates further deterioration in the Job market through spring, leading to higher unemployment and heightened equity selloff risk.

These factors correlate strongly with increased household fear, stock selling, and precautionary savings converging on rising gold demand through ETFs and physical investment channels.

Price Target Breakdown: $3,000 with Good Chances of $3,400

Our forecasts for investment and industrial demand as a share of mine supply, point to $3,400/oz prices by 4Q’25, while we take a more conservative base case which suggests gold increases to $2,900-3,000/oz over the next 6-12 months.

Currently physical demand is closing in on 95% ( as mentioned near top) of freshly mined supply. This is well above the bank’s minimum of 70% to drive prices further upwards.

Addendum: What’s New Here?

Mining supply is getting scooped up at the source now

Jewelry, relied upon as scrap, is slowly getting absorbed by ETF buying now

Physical demand is not only increasing, it is broadening

Trump 2.0 has made more nations aware of tariffs and sanctions, serving to broaden global demand in general as confiscation risk spreads

EM nations buying Gold are benefiting greatly from it as a hedge for their own currencies weakening against the strong USD. This benefit will spread as a strategy worldwide.

We think this is the precursor to a soft Gold Peg throughout the BRICS as China depegs from the USD and pegs to Gold. This stabilizes FX in the region as they get off Dollars.

More pointedly and speculatively, we also think this is why the US isn’t pushing back on higher Gold prices like it has in the past. As long as Oil is cheap, Gold is Golden.

Over all, given the physical demand and renewed tariff risk, to say nothing of the repatriating of Gold and Silver state-side, $3400 does not seem that difficult.

A propos de l'auteur

Vincent Lanci est négociant en matières premières, professeur de MBA Finance (adj.) et éditeur de la revue GoldFix bulletin d'information.