Cette contribution d'un invité est fournie par Vince Lanci.

“Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply.”

-BOA Metals

Silver EFPs: The Canary in the Mine

Contents

Overview: Silver Market Dynamics and Prospects

Resilience Amid Macro Headwinds

**Tariff Risks Mean Higher Price Risk

**The EFP: Canary in the Silver Mine

**India and China Premiums Persist

**Global Central Banks as Silver Buyers

Supply Constraints and Production Trends

Conclusion and Comments

Overview: Silver Market Dynamics and Prospects

On January 15th Bank of America released a special report titled Silver won’t lose its luster long-term covering Silver from the perspective of upside risk due to ongoing developments potentially coming to a head. We had already covered the Tariff and ETF risk in SILVER: Tariffs, EFPs, and Stockouts and were pleasantly surprised when a major Bullion bank took up the topic only days after our coverage.

Their report provides a comprehensive exploration of the silver market, dissecting near-term headwinds (Macro), structural fundamentals (BRICS demand), and potential shifts in demand dynamics ( Tariff/EFP risks).

This analysis underscores the metal’s resilience despite significant macroeconomic challenges, examining supply deficits, industrial demand, and the interplay of recent escalating geopolitical and regulatory factors in this regard.

Resilience Amid Macro Headwinds

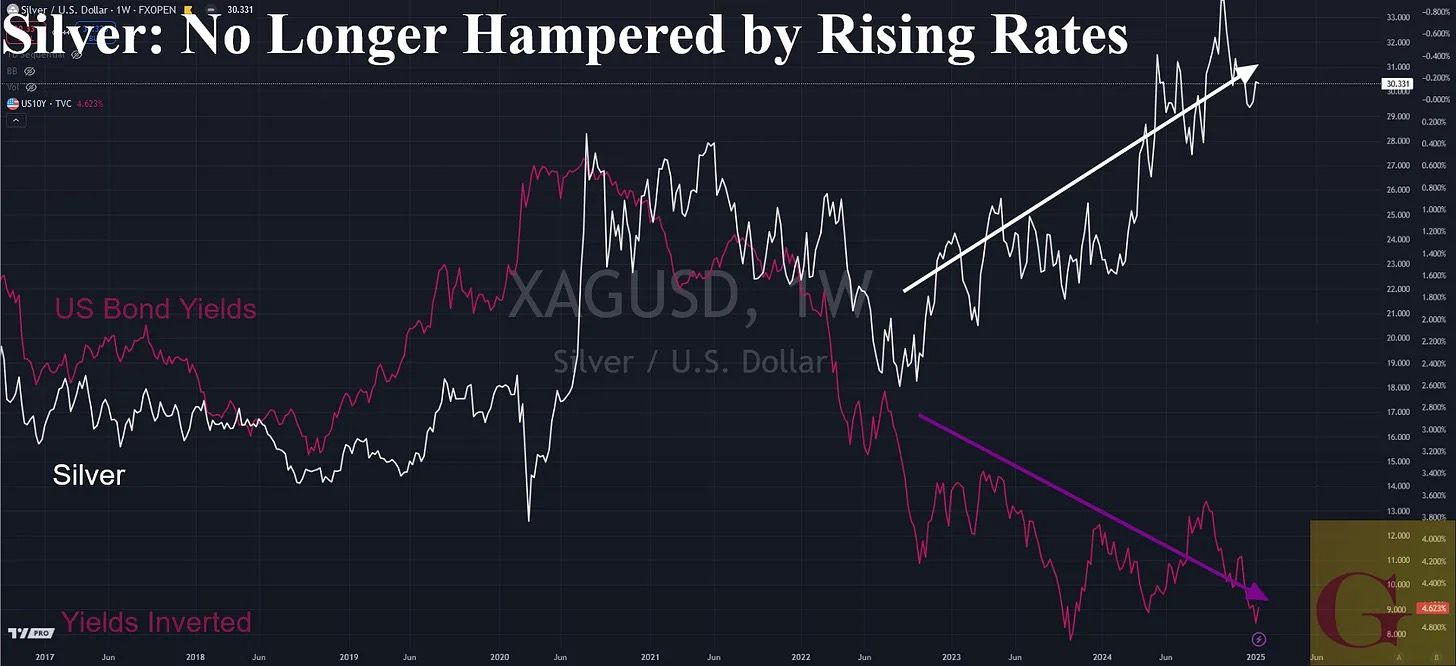

Silver prices have remained steady at approximately $30 per ounce over the past nine months, defying macroeconomic pressures such as a strong U.S. dollar, rising Bond yields and weakening industrial activity.

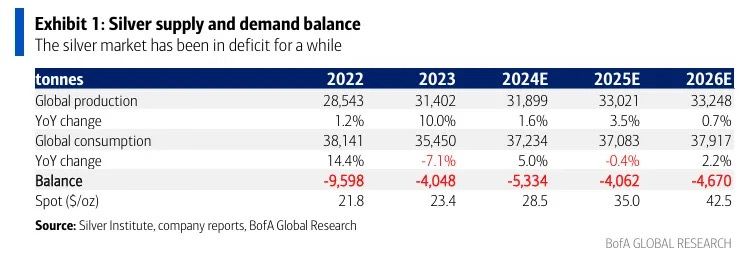

BOA attributes this stability to persistent supply deficits, exacerbated by underinvestment during prior bear markets. Global production is forecasted at 27Kt for 2024, still well below the 2016 peak by 1Kt.

This constrained supply has been exacerbated by growing industrial demand, particularly from sectors like renewable energy and electric vehicles. Solar panels and automotive technologies are increasingly reliant on silver, reinforcing its critical role in green energy transitions.

The analysis makes particular note of several interrelated items little discussed by any Bullion bank publicly before this report. First The Bank highlights potential disruptions stemming from the U.S. trade policy.

Broadly speaking, in context of the bigger supply/demand picture for Silver, two new significant developments are introduced:

The Tariff Risk to Supply and Developing Price Risk

Global Central Banks Potential as Silver Buyers

Tariff Risks Mean Higher Price Risk

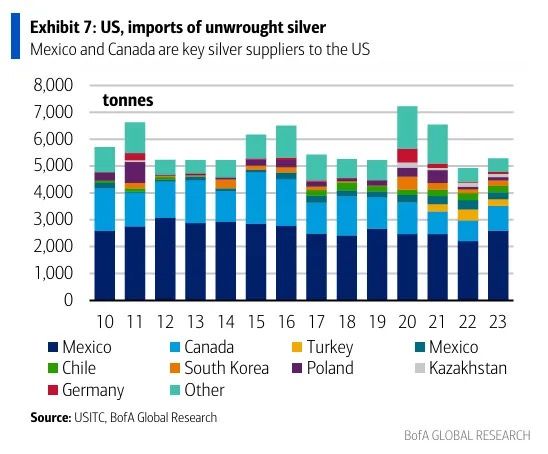

The analysis highlights potential trade disruptions arising from U.S. tariff policy. Speculation around President-elect Trump’s proposed 25% duty on Mexican and Canadian imports has already impacted global silver flows.

To that effect BOA states: “Tariffs from the next US administration might lead to dislocations in metal markets.” As key suppliers to the U.S., Mexico and Canada’s inclusion in potential tariffs would heighten on hand physical liquidity issues particularly in London as metal will alternatively be drained for US delivery or taken off the market altogether for fear of profit opportunity missed.

Essentially, if tariffs are enacted, some (much?) of the Silver promised for Comex delivery against exchange futures is ineligible for use at current prices. The result is a short-squeeze scramble of sorts as certain internationally refined metal (like Canada and Mexico) must be swapped out for non-tariffed metal. If not, a very high price may have to literally be paid.

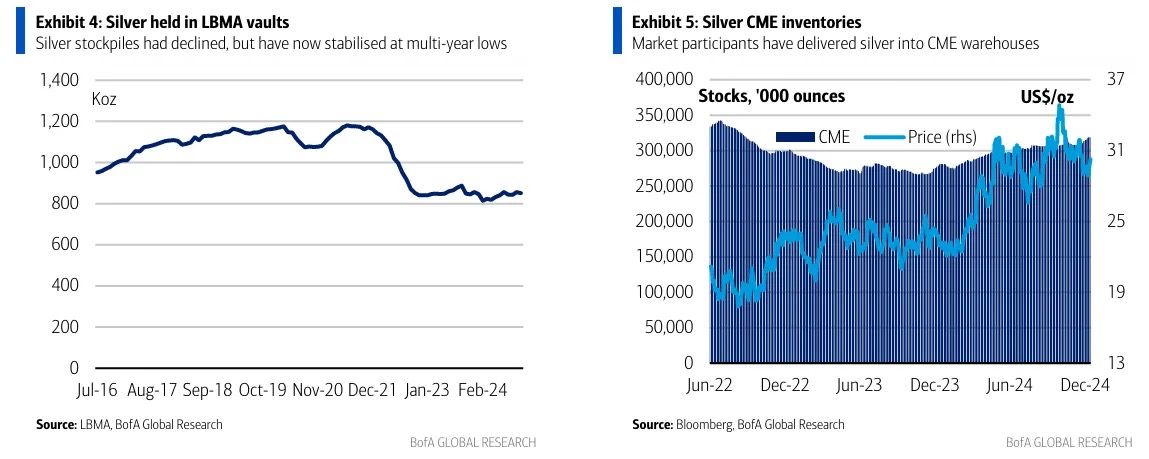

The recent torrid redirection of physical silver to the U.S. in anticipation of tariffs has further tightened supplies in London, raising more concerns.

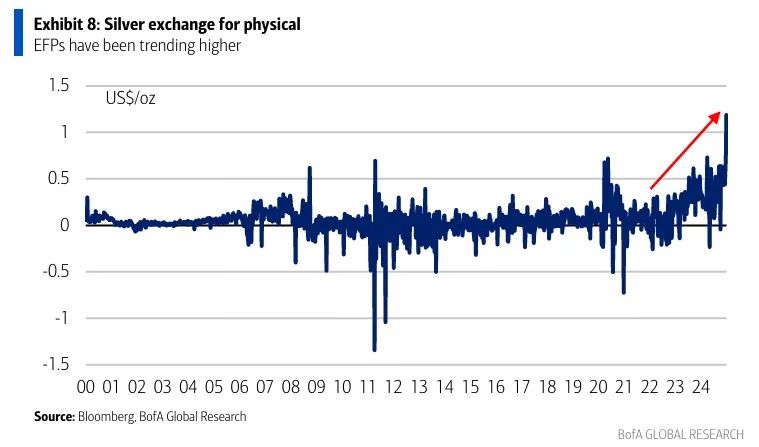

This potential tariff dislocation risk is easier to see using a well-worn tool traded by Bullion Banks since the LBMA and Comex were born called: the Exchange for Physical Spread or “EFP” for short. Far from a story or imaginary problem, the EFP is showing us the market is worried about this right now.

The EFP: Canary in the Silver Mine

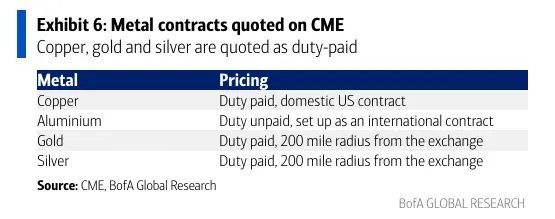

The EFP, an institutional measure of regional physical metal supply/demand balances, is directly and measurably discounting the potentiality of current Tariff developments. EFPs involve the exchange of a paper futures position (such as a CME contract), in return for physical silver in the LBMA spot market. When normally functioning, EFP pricing reflects a combination of spot silver prices and carrying costs associated with futures contracts.

Right now, the EFP is not doing that. It is currently discounting a lack of physical delivery available in the USA. Here’s how…

With CME futures currently trading in a steep contango to LBMA—where futures prices exceed spot prices by far more than normal…

Selling futures for physical positions seems like an attractive trade to take advantage of an “unnatural” differential between the cross-Atlantic venues.

But, that is potentially a big mistake. Should tariffs materialize, EFP pricing will rise further, adding to price and commensurate delivery problems.

Bank of America again:

There has been apprehension that liquidity on London’s physical market has fallen as traders have shipped silver to the US in anticipation of trade [tariff] restrictions, a dynamic worth following. Indeed, the market has periodically scrambled for physical ounces in London. Separately, exchange for physicals (EFPs) has been a popular silver trading strategy and tariffs may lead to an increase in volatility.

Put another way: The effect in extreme could be Comex prices exploding as physical players scramble to replace tariffed metal while simultaneously LBMA’s own (good delivery) physical supplies are made unavailable by savvy firms seeking to maximize profits.

Therefore, what may seem unnatural and an aberration in EFP pricing, is actually a kind of Canary in the Silver Mine warning of even more problems tied to real physical price dislocations if the Tariffs should actually come to pass.1

This covers the current supply risk and situation.

For a much more in depth examination of this particular mechanism there is a 90 minute video here, and a less intense description titled (and recommended) Silver: Tariffs, EFPs and stockouts.

Next the report updates investors on the global multipolarity of demand creating price premiums in India and China as a proxy for weakening Comex pricing power.

India and China Demand Increasingly Drives Prices

“Silver is trading at a premium in India and China, showing that supply deficits are starting to count.”- Bank of America

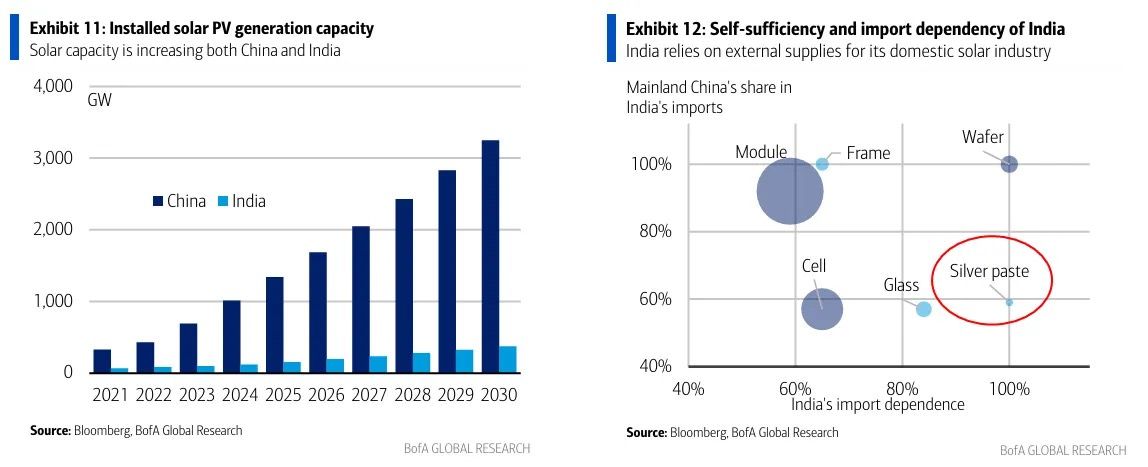

Industrial demand remains a cornerstone of silver’s appeal, with 2024 demand expected to surpass 700Moz, marking a record high. Renewable energy applications, particularly in the photovoltaic sector, and vehicle electrification are driving this growth.

Investments in electric vehicle infrastructure, including charging stations, further amplify silver’s industrial use. Regional market behavior underscores these trends.

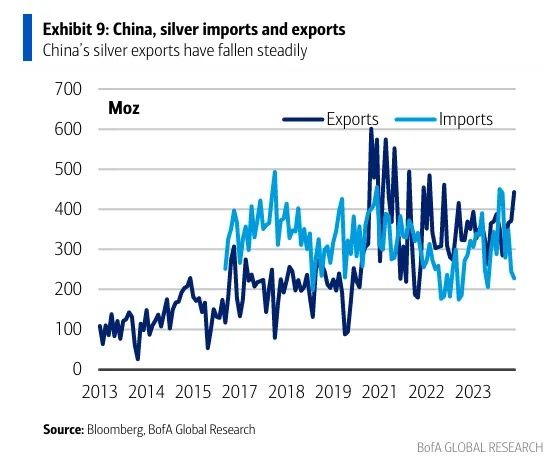

In India, silver is trading at a premium, reflecting robust demand driven by solar energy projects. Meanwhile, China’s shifting role as both an importer and exporter of silver highlights domestic market tightness. Recent data shows declining exports alongside rising imports, signifying increased local consumption.

Next BOA discusses a topic not seen elsewhere outside of conversations between hard-core Silver aficionados and those closely watching Russian policies surrounding natural resource management. Specifically, they wonder if Nation-State entities like Central Banks and Sovereign Wealth Funds are done selling silver and will they turn buyer not for monetary or for strategic metal reasons?

Global Central Banks as Silver Buyers

“Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply.”

Central banks have historically favored gold over silver for reserves due to silver’s higher volatility, oxidation concerns, and higher storage costs. Storing $1 billion in silver costs approximately $3.4 million annually compared to $680,000 for gold, further reducing silver’s appeal as a reserve asset.

However, Russia’s potential diversification into silver signals a noteworthy shift. Even small reserve allocations—such as 1% of global foreign exchange reserves—could significantly impact the silver market, equating to five years of current supply. While the report assigns a low probability to widespread adoption of silver as a reserve asset, the implications of even minor shifts are profound.

The full quote to this effect:

While we assign a low probability to wider official purchases, small shifts in central bank FX reserves could make a difference to the white metal: at current spot prices, the silver market is valued at around $30BN versus total foreign exchange reserves of $15TN. Shifting just 1% of global reserve assets into silver would be equivalent to 5 years’ worth of silver supply.

Supply Constraints and Production Trends

Global mine supply is projected to grow modestly by 1% year-on-year to 837Moz in 2024. However, this remains below the 2016 peak due to lingering impacts of capex cuts. Growth is expected to be driven by increased production in Mexico, Chile, and the U.S., with Mexico alone adding 10Moz through operational improvements at key mines.

Conclusion and Comments

In short order:

The Tariff situation: is known and as a result, there will be dislocation if it happens, but there will also be workarounds in play. Everything Trump does is part of a carrot-stick approach. The problem is part of a much bigger issue however, and while we think any spike will be short-lived, it would only mask the bigger problem of a fragmented world fighting over a smaller available pile of natural resources.

Central Banks as Buyer: in the West, almost never happen. In the East, very possible. In the West, we suspect secretly stockpiles are being secured again. In the East, we think sovereign wealth funds are seriously looking at the market for a strategic acquisition.

About Russia: Everyone in global power knows how important silver ultimately is to military, economic, and technological applications. Labeling it as such publicly however, only makes it hoarded more by investors. They do not want that. Meanwhile, Russia is now countering the demonization of Silver much in the same way they and China have pushed back against Gold as a stupid pet-rock.

Silver as perceived by the Banks and Governments: is a very important metal. It’s available newly-mined supply is becoming more expensive to get to. But, its not a big problem because Silver is not destroyed. Therefore, Silver, as long as it is not promoted or elevated in the public eye, will eventually be influenced to go the way of Copper. The decades of success with this approach will only beget more of it. The success of this ongoing mindset is precisely why Silver has these (short-lived) but explosive moments where the world gets a peak at its true value. These events we feel will happen more frequently going forward.

The Bullion Banks look at silver like this (we feel):

‘As long as we can delay or defer delivery to physical buyers, eventually the investing public will sell cyclically or we will have time to acquire scrap as we have been from heap leaching and concentrate sifting since the Kodak days. And as time goes on, substitutes and new tech will rescue us. Time is always on our side as long as we can keep playing the paper game. ‘

The above we feel is the arrogance that is going to kill that approach given the changing world and Banking’s diminishing centralized power within it. For now, they are more worried about Gold which is easier to source and CBs are buying hand over fist. 2

End Analysis

Notes

For a much more in depth examination of this particular mechanism there is a 90 minute video here: and a less intense description titled Silver: Tariffs, EFPs and stockouts

One final comment. Assume Trump does follow through on the strongest tariffs possible, do not underestimate the banks’ collective ability to get a carve-out for their own compliance. For example: Basel 3 was designed in 2009 post the GFC. it was shelved during Grexit in the 2011 price spikes. Then upon finally being soft launched in 2021, the Banks again got grandfathered in another year to get their own books in order which took over 18 months to do

The point is: if Silver rockets it will be because the banks got their positions in order and decided to destroy someone else. We have seen this before. We ahve also seen smaller banks get run over by bigger banks in Silver… That is ultimately why there are so few Bullion banks left

This actually makes us looking to buy even more in anticipation of almost no real selling hitting Silver for years and a slower, less volatile climb assured. They cannot stop price, only slow it down.

A propos de l'auteur

Vincent Lanci est négociant en matières premières, professeur de MBA Finance (adj.) et éditeur de la revue GoldFix bulletin d'information.