本篇特邀稿件由 Vince Lanci 提供。

Gundlach: Gold to $4,000

Jeffrey Gundlach, CEO and CIO of DoubleLine, reiterated his bullish outlook on gold, predicting it will reach $4,000.

Jeffrey Gundlach is the founder, CEO, and Chief Investment Officer of DoubleLine Capital, an investment management firm he established in 2009 that currently manages over $150 billion in assets. Known as the “Bond King,” Gundlach has built a reputation as one of the most influential fixed-income investors and macroeconomic forecasters in the financial world.

His firm primarily focuses on fixed-income investments, including government bonds, mortgage-backed securities, and corporate debt, rather than direct investments in precious metals.

While DoubleLine doesn’t specifically focus on gold as an investment vehicle, Gundlach frequently comments on gold markets as part of his broader macroeconomic analysis, often using gold price movements as indicators of inflation expectations, currency devaluation concerns, and systemic risk in the global financial system.

The Gold Bull Market Continues

On a recent investor call—held in Europe before gold futures crossed the $3,000 mark Thursday—Gundlach reaffirmed his long-standing bullish stance.

- “Gold continues its bull market that we’ve been talking about for a couple of years, ever since it was down to $1,800,” he said.

- He expects gold to reach $4,000, though he is uncertain about the timeline. “I feel like that’s the measured move anticipated by the long consolidation at around $1,800,” he added.

On Central Bank Demand and Gold’s Role

Gundlach highlighted aggressive central bank purchases of gold, noting the trend is unlikely to reverse.

- “Purchases have increased at a very sharp, steep trajectory. And I don’t expect this to stop.”

- He sees gold’s appeal as a store of value outside the traditional financial system, which he describes as being in a “state of flux.”

On European Equities and the Dollar’s Decline

Gundlach is not surprised by the recent outperformance of European stocks as the U.S. dollar trends lower.

- DoubleLine began investing in Europe around 2021. “It was painful for a couple of years from 2021 to 2023, but now it’s got a lot of momentum,” he said.

- He views the shift as part of a broader market rotation away from U.S. dominance.

Regarding Tech Vulnerability and Fiscal Policy

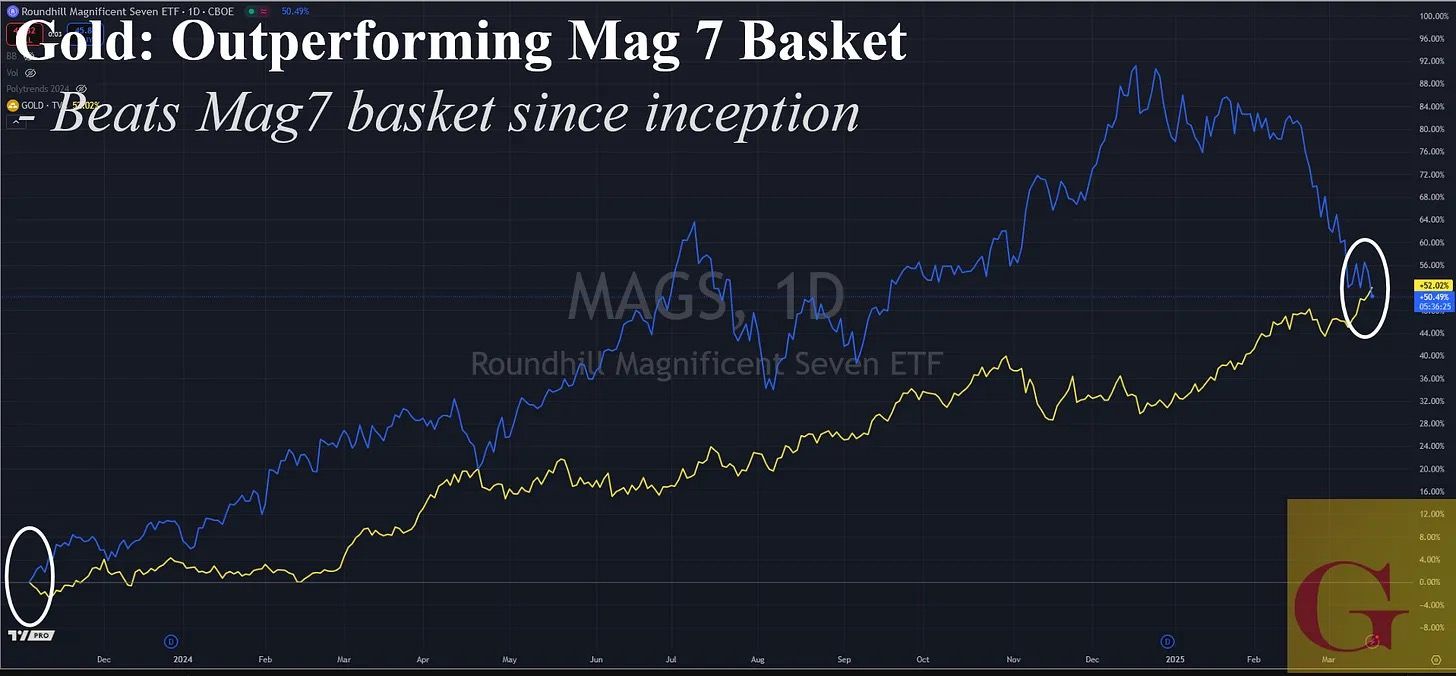

Gundlach addressed the changing perception of major U.S. tech stocks, particularly the “Magnificent Seven.”

- “They were viewed as invulnerable, but now it’s clear they are not. Every sector is always vulnerable, and we’re starting to obviously see that.”

He also supports Elon Musk-led government spending cuts.

- “I’m quite in favor of that happening because it’s the only way we can try to get our fiscal house in order.”

Recession Risk and Fed Policy

Gundlach assigns a 60% probability of a U.S. recession this year—well above Wall Street consensus.

- He described the bond market’s reaction to Federal Reserve policy as volatile.

- “It’s been a roller-coaster ride—pricing in anywhere from one to eight cuts, then back to one, and now moving toward more cuts again. This continues to gyrate.”

Bottom Line: Gundlach remains firm in his gold outlook, sees market rotations accelerating, and expects economic uncertainty to persist.

关于作者

文森特-朗西 他是商品交易员、MBA 金融学教授(副教授),也是 GoldFix 通讯。